Get the free Verification of Pension/Rollover - marist

Show details

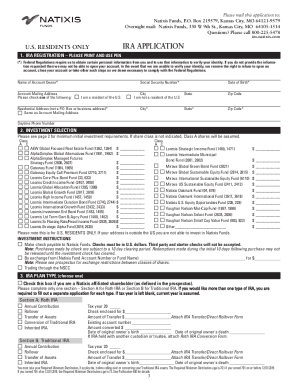

This form is used by Marist College's Office of Financial Aid to clarify discrepancies regarding the income reported on the Federal Income Tax Return related to pensions or rollovers for students

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of pensionrollover

Edit your verification of pensionrollover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of pensionrollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification of pensionrollover online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit verification of pensionrollover. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification of pensionrollover

How to fill out Verification of Pension/Rollover

01

Obtain the Verification of Pension/Rollover form from your pension plan administrator or financial institution.

02

Read the instructions provided with the form carefully to understand the information required.

03

Fill out your personal details, including your name, address, Social Security number, and any other identifying information requested.

04

Indicate the type of pension plan or account you are rolling over by selecting the appropriate options on the form.

05

Provide the financial institution's name and account information where the funds will be rolled over.

06

If required, include the amount or percentage of your pension that you wish to rollover.

07

Sign and date the form to confirm that the information you provided is accurate.

08

Submit the completed form to your pension plan administrator or financial institution as per their submission guidelines.

Who needs Verification of Pension/Rollover?

01

Individuals who are planning to retire and want to initiate a pension payout.

02

Those who are changing jobs and wish to roll over their pension funds into a new retirement account.

03

Participants in a pension plan who want to transfer their funds to an Individual Retirement Account (IRA) or another qualified plan.

04

Beneficiaries receiving funds from a deceased person's pension plan.

Fill

form

: Try Risk Free

People Also Ask about

What is a letter of determination for 401k rollover?

An IRS determination letter expresses an opinion on the qualified status of the plan document. This document is required to be generated from the old provider of the 401(k) you wish to roll over, and is needed to complete the rollover.

How do I get a letter of determination?

You must submit an application with the IRS to receive a letter of determination. The application is Form 1023. It select cases, small nonprofits can apply with Form 1023-EZ.

How do I prove an indirect rollover?

If you've done an indirect rollover, your custodian will send you a form 1099-R documenting the amount that was distributed from your retirement plan. Any deviation from this amount will be a taxable event.

What is a determination letter from an insurance company?

Employers get to deduct their contributions on the company's federal tax return and may even qualify for tax credits. A letter of determination shows that a plan meets all the requirements of the Employee Retirement Income Security Act of 1974 (ERISA) and qualifies for special tax treatment.

What are the rules for pension distribution rollover?

60-day rollover: You receive a check from your pension. You have 60 days to deposit the money into an IRA to avoid taxes. If your pension withholds taxes, you must use other funds to roll the full distribution amount into your IRA.

How do I prove a rollover to the IRS?

These procedures are generally sufficient: employee certification of the source of the funds. verification of the payment source (on the incoming rollover check or wire transfer) as the participant's IRA or former plan.

What is a letter of determination for rollover?

An IRS determination letter expresses an opinion on the qualified status of the plan document. This document is required to be generated from the old provider of the 401(k) you wish to roll over, and is needed to complete the rollover.

What is the purpose of the determination letter?

A determination letter is a document that outlines an American organisation's tax-exempt status. It is an important document issued by the Inland Revenue Service (IRS) that should be obtained by non-profits and other charitable organisations to prove their tax exemption status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verification of Pension/Rollover?

Verification of Pension/Rollover is a process through which an individual confirms the details of their pension plans or rollover accounts, ensuring that the information is accurate and compliant with regulatory requirements.

Who is required to file Verification of Pension/Rollover?

Individuals who are rolling over their pension funds from one account to another or those who are receiving pension benefits are typically required to file Verification of Pension/Rollover.

How to fill out Verification of Pension/Rollover?

To fill out the Verification of Pension/Rollover, individuals must provide their personal information, including the name of the pension plan, account numbers, and the amount being rolled over, as well as any necessary signatures to authorize the transaction.

What is the purpose of Verification of Pension/Rollover?

The purpose of Verification of Pension/Rollover is to ensure that the transfer of funds is executed correctly, to confirm that the individual’s accounts are properly aligned with their financial goals, and to maintain compliance with tax regulations.

What information must be reported on Verification of Pension/Rollover?

The information that must be reported includes the account holder's personal details, the pension plan name, the rollover amount, the receiving account information, and any necessary certifications or signatures.

Fill out your verification of pensionrollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Pensionrollover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.