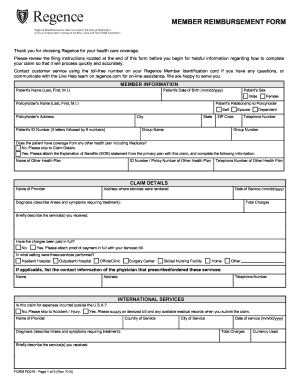

Regence PD019 2012 free printable template

Get, Create, Make and Sign Regence PD019

Editing Regence PD019 online

Uncompromising security for your PDF editing and eSignature needs

Regence PD019 Form Versions

How to fill out Regence PD019

How to fill out Regence PD019

Who needs Regence PD019?

Instructions and Help about Regence PD019

Hi I'm here to help you learn about your high deductible health plan over the next few minutes you'll discover what it is and how it works with a high deductible health plan you often pay a lower premium in return for having a higher deductible the term deductible simply means the amount you need to pay out of your own pocket for medical expenses before your insurance kicks in just so you know most medical services like doctor visits MRIs and most prescriptions count towards your deductible another thing to keep in mind you pay nothing for preventive care like annual checkups okay let me give you an example say you go for a job, and you trip it happens but this time you break an ankle an ambulance ride surgery and some physical therapy later you're feeling better, but you now have a ten thousand dollar hospital bill let's say your deductible is two thousand dollars that means you have to pay two thousand dollars out of your own pocket before your insurance coverage kicks in health plan coverage varies so be sure to check with your employer about your specific coverage now I know $2,000 is still a lot of money the good news is having a financial account can help you pay for medical costs like this your high deductible health plan comes with a health savings account known as an HSA is an account that you can contribute to and withdraw money from tax-free it can help you pay your deductible co-payments and other qualified medical expenses like eyeglasses and dental work you can even take money out to pay for non-medical expenses but if you're under 65 you have to pay taxes and a penalty with an HSA you and your employer can contribute tax-free how much you can contribute is set by the IRS and may change from year to year all that money including what your employer gives you is yours even if you switch jobs and if your new employer doesn't offer an HSA you can still keep your account and use it to pay for qualified expenses, but you won't be able to put any more money into it don't worry if you have money left over at the end of the year it rolls over year after well you get the picture and because your contributions are tax-free you enjoy tax savings so let's say this is your paycheck every month without an HSA your entire paycheck is taxed and $1,000 goes to the government but here's what's great about an HSA, so you take $200 from each paycheck and put it into an HSA only thirty-eight hundred dollars is taxed and nine hundred fifty dollars goes to the government for a tax savings of $50 each month that's six hundred dollars a year you save in taxes, and you also put twenty-four hundred dollars into your HSA that you can use for medical expenses like that two thousand dollar deductible better, yet you can even invest that money grow it tax-free and use it for retirement you must meet certain guidelines to qualify for an HSA please check with your employer let's recap you often pay a lower premium with a high deductible health plan you have to pay...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Regence PD019 directly from Gmail?

Where do I find Regence PD019?

How do I edit Regence PD019 on an iOS device?

What is Regence PD019?

Who is required to file Regence PD019?

How to fill out Regence PD019?

What is the purpose of Regence PD019?

What information must be reported on Regence PD019?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.