Get the free CASB DS-2 - mtu

Show details

This Disclosure Statement outlines the cost accounting practices of educational institutions, detailing how costs are recorded, allocated, and managed in compliance with federal regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign casb ds-2 - mtu

Edit your casb ds-2 - mtu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your casb ds-2 - mtu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit casb ds-2 - mtu online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit casb ds-2 - mtu. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out casb ds-2 - mtu

How to fill out CASB DS-2

01

Obtain the CASB DS-2 form from the official website or relevant agency.

02

Read the instructions carefully before starting to fill out the form.

03

Fill in your personal information, including your full name, address, and contact details.

04

Provide information about your immigration status or any relevant legal status.

05

Include details regarding the specific employee or purpose for which you are applying.

06

Review all the provided information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed form according to the instructions provided.

Who needs CASB DS-2?

01

Individuals applying for certain immigration benefits.

02

Employers sponsoring foreign workers.

03

Organizations seeking to comply with the requirements of immigration authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is a cost accounting standards board CASB disclosure statement?

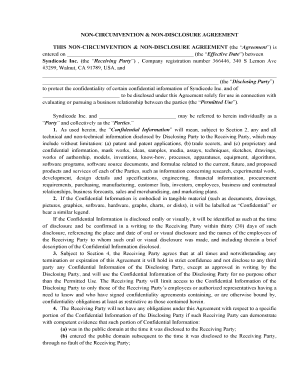

A CASB Disclosure Statement is a form whereby a US Government Contractor discloses its cost accounting practices, for which it is required to demonstrate CAS compliance for the life of its active CAS (Cost Accounting Standards) covered awards.

What is CASB cost accounting standards?

The cost accounting standards (CAS) consist of nineteen standards promulgated by the Cost Accounting Standards Board (CASB) designed to ensure uniformity and consistency in the measurement, assignment and allocation of costs to contracts with the United States Government.

What are the CASB cost accounting standards?

The cost accounting standards (CAS) consist of nineteen standards promulgated by the Cost Accounting Standards Board (CASB) designed to ensure uniformity and consistency in the measurement, assignment and allocation of costs to contracts with the United States Government.

What is a CASB disclosure statement?

The Cost Accounting Standards Board Disclosure Statement (CASB DS-1) is the form required by Public Law 100-679 for contractors and subcontractors. Its purpose is to provide consistency in reporting of costs. All new contractors are required to submit a CASB DS-1 before a contract of $50 million or more is awarded.

What are the cost accounting standards?

Cost Accounting Standards (popularly known as CAS) are a set of 19 standards and rules promulgated by the United States Government for use in determining costs on negotiated procurements.

What is a disclosure statement in government contracting?

A Disclosure Statement is a written description of a contractor's cost accounting practices and procedures. (A blue print if you will.)

What is cost accounting standards 408?

Cost Accounting Standard (CAS) 408 was put in place to provide consistency in the measurement and allocation of vacation, sick leave, holiday, and other compensated personal absences. Today, many contractors refer to all paid time off as “PTO.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CASB DS-2?

CASB DS-2 is a form used by governmental and regulatory bodies for the purpose of data reporting related to financial transactions and compliance.

Who is required to file CASB DS-2?

Organizations and entities conducting specific financial activities or transactions that fall under regulatory oversight are required to file CASB DS-2.

How to fill out CASB DS-2?

To fill out CASB DS-2, individuals should follow the guidelines provided by the regulatory body, including accurately entering financial data, compliance information, and signing the form as necessary.

What is the purpose of CASB DS-2?

The purpose of CASB DS-2 is to facilitate transparency and compliance in financial reporting, ensuring that relevant data is collected for regulatory review.

What information must be reported on CASB DS-2?

The information that must be reported on CASB DS-2 includes details about financial transactions, entity identification, compliance metrics, and any required disclosures as stipulated by regulations.

Fill out your casb ds-2 - mtu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Casb Ds-2 - Mtu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.