Get the free Annual Giving in Perpetuity - millersville

Show details

This document outlines the process for making annual gifts to support students and programs at Millersville University and explains how these gifts can become permanent through estate planning and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual giving in perpetuity

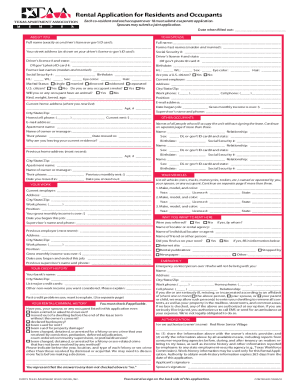

Edit your annual giving in perpetuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual giving in perpetuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual giving in perpetuity online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual giving in perpetuity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

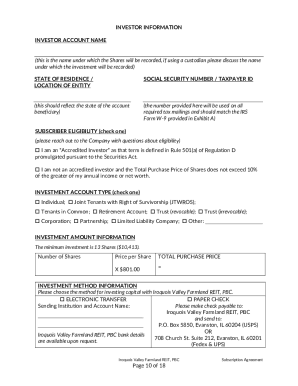

How to fill out annual giving in perpetuity

How to fill out Annual Giving in Perpetuity

01

Identify the purpose of the Annual Giving in Perpetuity.

02

Gather necessary financial information and projections.

03

Determine the annual gift amount to be contributed perpetually.

04

Decide on a reliable investment strategy for the funds allocated.

05

Fill out the necessary forms accurately, ensuring all information is complete.

06

Submit the completed forms to the relevant organization or financial institution.

Who needs Annual Giving in Perpetuity?

01

Nonprofit organizations seeking a sustainable revenue source.

02

Donors looking to make a lasting impact through their contributions.

03

Financial advisors assisting clients with philanthropic plans.

04

Individuals or families wishing to establish a legacy of giving.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a perpetuity payment?

A perpetuity is a type of annuity where there is no end to the payments. It may have fixed or growing payments depending on its nature. For example, a rental property will give you a fixed amount every month. Meanwhile, a government bond will result in an increasing amount after each period as time goes on.

What is a perpetual gift?

The Perpetual gift emphasizes the notion of a constant and renewing relationship between the Holy Spirit and the faithful, supporting the Church's mission and growth throughout time. Synonyms: Everlasting gift, Eternal gift, Infinite gift, Continuous offering.

What does it mean to continue in perpetuity?

Perpetuity means everlasting, an indefinitely long duration. A foundation's decision toward perpetuity may be driven by the donor's intent or family legacy. Perpetuity can provide long-term, sustained giving to important issues and opportunities for increased impact.

What is annual perpetuity?

A perpetuity is a type of annuity that lasts forever. The stream of cash flows does not have an end date. In finance, a perpetuity calculation is used to determine the present value of a company's cash flows when discounted back at a certain rate.

What is perpetual giving?

Perpetual Giving is an initiative of the philanthropic arm of Perpetual Guardian. Our aim is to encourage more people to think about leaving charitable gifts when writing a Will, so that over time we can make legacy giving a social norm. By working together, we can change the shape of charity giving forever.

What is a gift in perpetuity?

An endowed gift is money given by a donor that is to be invested in perpetuity, with the distributions available to spend on activities consistent with donor intent. An expendable gift is money given by a donor that is to be entirely spent on activities consistent with donor intent.

What is a gift after death called?

gift causa mortis. Gifts causa mortis is a Latin phrase used to refer to gifts made in contemplation of death which differ from gifts made inter vivos .

What does donated in perpetuity mean?

Many donors concerned with preserving their intent choose to give while living or sunset, but it is still possible to operate your foundation in perpetuity — with no end date in mind — and protect donor intent. In fact, perpetuity carries some advantages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Giving in Perpetuity?

Annual Giving in Perpetuity refers to a continuous commitment to give a specified amount of money each year, indefinitely, to support a particular cause or organization.

Who is required to file Annual Giving in Perpetuity?

Typically, organizations or individuals who have committed to ongoing charitable donations, especially in the context of tax-exempt status or benefits, are required to file Annual Giving in Perpetuity.

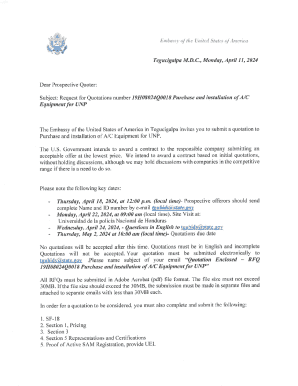

How to fill out Annual Giving in Perpetuity?

To fill out Annual Giving in Perpetuity, you need to provide the necessary financial information, including the donor's details, the amount pledged, the beneficiary organization, and the duration of the commitment, clearly indicating that it is intended to be perpetual.

What is the purpose of Annual Giving in Perpetuity?

The purpose of Annual Giving in Perpetuity is to ensure sustained financial support for an organization or cause, allowing for long-term planning and stability in funding.

What information must be reported on Annual Giving in Perpetuity?

Information that must be reported includes the donor's name, the donation amount, the beneficiary organization, the terms of the gift, and any relevant tax identification numbers.

Fill out your annual giving in perpetuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Giving In Perpetuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.