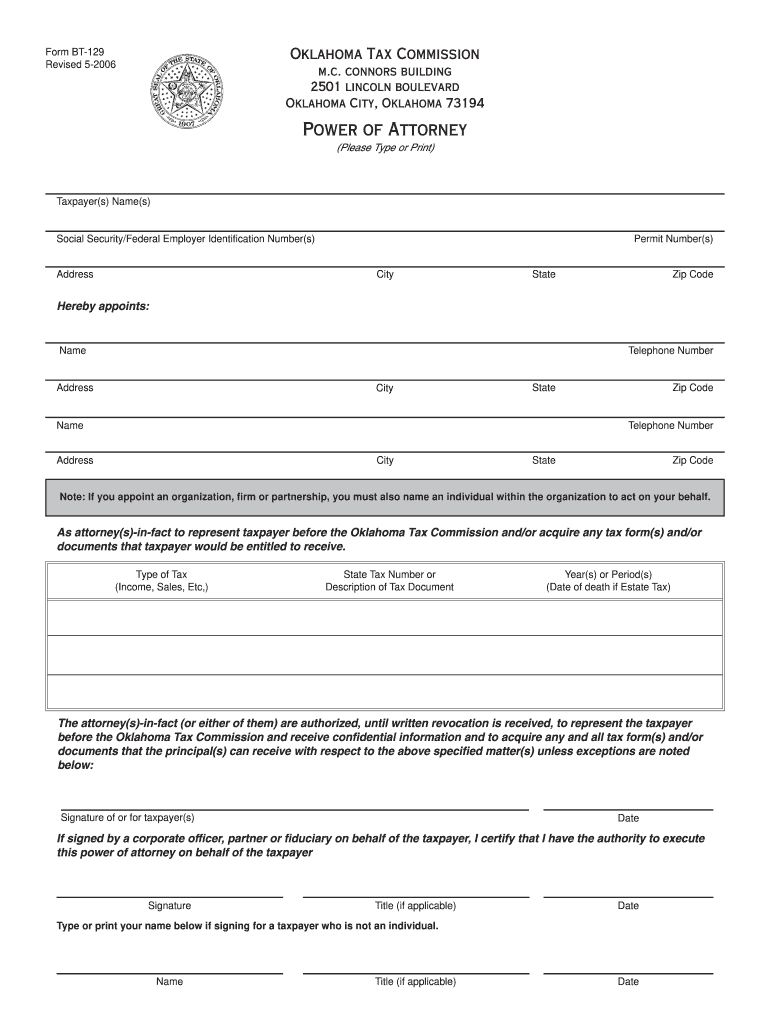

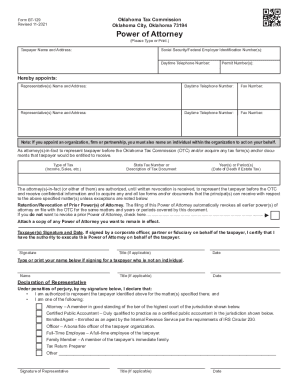

OK BT-129 2006 free printable template

Get, Create, Make and Sign OK BT-129

How to edit OK BT-129 online

Uncompromising security for your PDF editing and eSignature needs

OK BT-129 Form Versions

How to fill out OK BT-129

How to fill out OK BT-129

Who needs OK BT-129?

Instructions and Help about OK BT-129

Law.com legal forms guide form BTW 190 Oklahoma annual business activity tax return any corporation limited liability company or partnership or business trust doing business in the state of Oklahoma must complete and file a form BTW 190 this is also the case for any entity doing business in the state for a year or longer this document can be obtained for the website of the Oklahoma tax commission step one at the top of the form enter your federal employer identification number business name and address if you begin doing business in the state in the year for which you are filing check the box where indicated step to enter your NAILS code if you are filing on a consolidated or combined net revenue basis write the number of entities for which you will be filing step 3 check the box next to the type of entity for which you are filing step 4 part one requires you to document your revenue corporations which operate in multiple states should first complete part three on the second page before completing this section corporations which are only based in Oklahoma should skip part three steps 5 parts 2 requires you to calculate your tax owed including any penalty and interest if filing late step 6 enter the name of the taxpayer and the federal identification number at the top of pages 2 3 and 4 steps 7 parts 4 requires you to document income excluded from part 1 including interest dividends and deductions real estate rentals mineral rights net capital gains and compensation step 8 parts five and six are only for those filing on a consolidated or combined basis if so provide the name social security number home address title and daytime phone number for the responsible party for each entity in part 5 compute the consolidated or combined net revenue in part 6 as instructed step 9 a responsible party should sign and date the first page and provide their title to watch more videos please make sure to visit laws calm

People Also Ask about

How do I get a tax exempt card in Oklahoma?

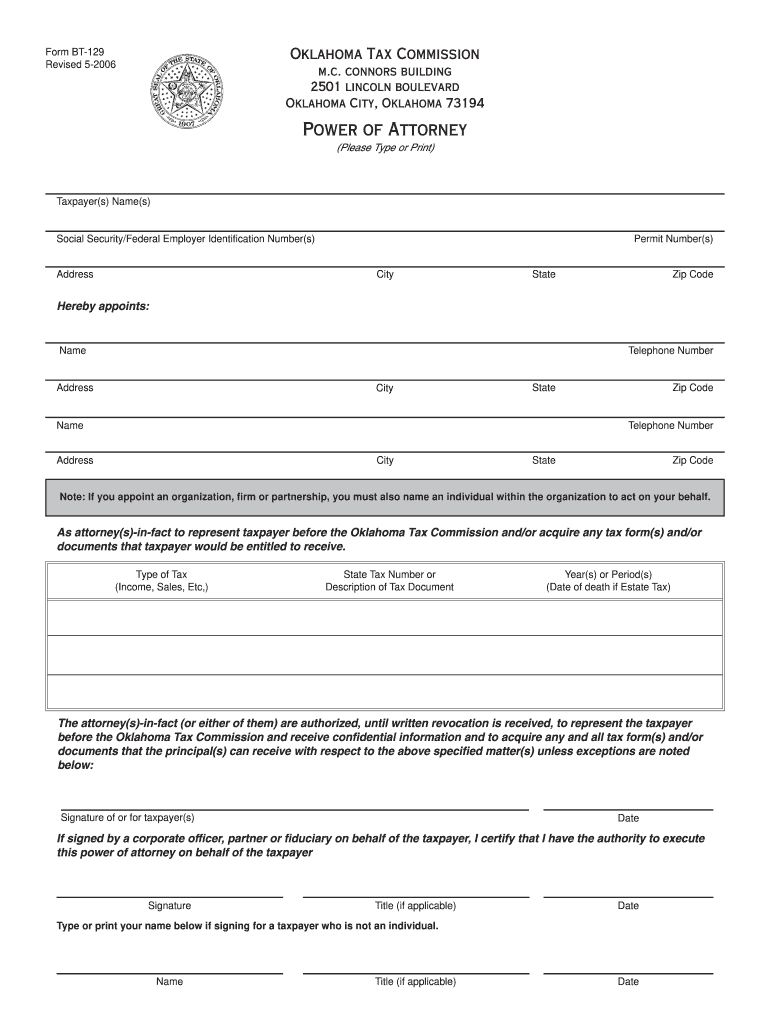

What is Oklahoma tax power of attorney form BT 129?

Is a durable power of attorney effective immediately in Oklahoma?

Does Oklahoma recognize durable power of attorney?

Does a power of attorney have to be filed with the court in Oklahoma?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OK BT-129 online?

How do I fill out OK BT-129 using my mobile device?

How do I edit OK BT-129 on an iOS device?

What is OK BT-129?

Who is required to file OK BT-129?

How to fill out OK BT-129?

What is the purpose of OK BT-129?

What information must be reported on OK BT-129?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.