Get the free 2011-2012 Special Circumstance Financial Aid Form - moval

Show details

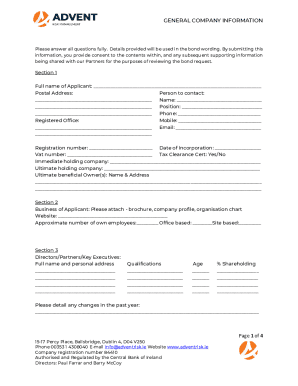

This document is used by students at Missouri Valley College to report changes in their financial situation affecting their financial aid eligibility, specifically regarding income for the academic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2011-2012 special circumstance financial

Edit your 2011-2012 special circumstance financial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2011-2012 special circumstance financial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2011-2012 special circumstance financial online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2011-2012 special circumstance financial. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2011-2012 special circumstance financial

How to fill out 2011-2012 Special Circumstance Financial Aid Form

01

Obtain the 2011-2012 Special Circumstance Financial Aid Form from your school's financial aid office or their website.

02

Read the instructions carefully to understand what information is required.

03

Fill out your personal information, including your name, student ID, and contact information.

04

Document your special circumstance in detail, including any changes in income or family situation that have occurred since you filed your FAFSA.

05

Provide any required supporting documentation, such as tax returns, layoff notices, or medical bills.

06

Review the completed form for accuracy and completeness.

07

Submit the form to your financial aid office, either in person or via the method they specify (mail, fax, online submission).

Who needs 2011-2012 Special Circumstance Financial Aid Form?

01

Students who have experienced a significant change in financial circumstances that were not reflected on their FAFSA, such as job loss, reduction in income, or unexpected medical expenses.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a special circumstances letter for financial aid?

Start with a summary of your special circumstances and their impact on your available income for college. Provide detailed financials and numbers, quantifying the impact of expenses or economic changes on your ability to pay for college. When possible, include explanations of why these expenses are necessary.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

What qualifies as a special circumstance for FAFSA?

Medical, dental, or nursing home expenses not covered by insurance; Child or dependent care expenses; Severe disability of the student or other member of the student's household; and. Other changes or adjustments that impact the student's costs or ability to pay for college.

What is the most common mistake made on the FAFSA?

Some of the most common FAFSA errors are: Leaving blank fields: Too many blanks may cause miscalculations and an application rejection. Enter a '0' or 'not applicable' instead of leaving a blank. Using commas or decimal points in numeric fields: Always round to the nearest dollar.

What not to put on FAFSA?

Assets that are not counted by FAFSA when determining your SAI include: 401(k) and Roth and traditional IRA accounts (though withdrawals from Roth IRA accounts will be counted as untaxed income) Cash values of whole life insurance policies and qualified annuities. SIMPLE, KEOGH, and pension plans. Annuities.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

What will disqualify you from FAFSA?

These include failing to fill out the Free Application for Federal Student Aid (FAFSA), not having a high school diploma (or something equivalent to one), and having previously defaulted on a federal student loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2011-2012 Special Circumstance Financial Aid Form?

The 2011-2012 Special Circumstance Financial Aid Form is a document used by students to report financial situations that may affect their eligibility for financial aid, allowing them to request adjustments to their FAFSA information.

Who is required to file 2011-2012 Special Circumstance Financial Aid Form?

Students who have experienced significant changes in their financial situation since the time they submitted their FAFSA, such as job loss, divorce, or unexpected medical expenses, are required to file the 2011-2012 Special Circumstance Financial Aid Form.

How to fill out 2011-2012 Special Circumstance Financial Aid Form?

To fill out the form, students should gather necessary documentation of their special circumstances, accurately complete all sections of the form, and submit it to their school's financial aid office along with any required supporting documentation.

What is the purpose of 2011-2012 Special Circumstance Financial Aid Form?

The purpose of the 2011-2012 Special Circumstance Financial Aid Form is to provide financial aid administrators with information about unusual circumstances affecting a student's financial situation that are not reflected in the FAFSA, enabling them to make informed decisions about aid eligibility.

What information must be reported on 2011-2012 Special Circumstance Financial Aid Form?

The form requires reporting information such as changes in income, unexpected expenses, changes in household size, and other relevant financial details that may impact the student's eligibility for financial aid.

Fill out your 2011-2012 special circumstance financial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2011-2012 Special Circumstance Financial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.