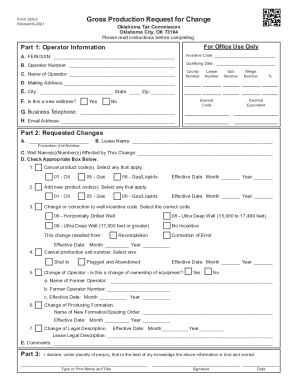

OK OTC 320-C 2011 free printable template

Get, Create, Make and Sign oklamhoma 320 c 2011

How to edit oklamhoma 320 c 2011 online

Uncompromising security for your PDF editing and eSignature needs

OK OTC 320-C Form Versions

How to fill out oklamhoma 320 c 2011

How to fill out OK OTC 320-C

Who needs OK OTC 320-C?

Instructions and Help about oklamhoma 320 c 2011

Video demonstration of how to change the labels on your link see pricing gun first you need to open the label roll cover and then remove or loosen the baseplate by pulling down the gun and using these latches here take your new roll of labels and I always remove the outer layer just to get rid of any sticky backing paper or sellotape or whatever and then get a length of the labels and straighten them out like so and what you're aiming to do is drop the labels straight through, so they come out the bottom end of the gun, so it's just straight through no fancy feeding or anything once you've got them in place securely you can close that over, so they don't go flying out when you turn it upside down, and then you need to pull the portion of the labels out close the baseplate and then basically the labels feed onto the cork you can keep the press on the label to find the label good handle on that the labels are eventually taken up, and then they'll start issuing from the underside just tear off any excess from the bottom ideally what you want to do is get rid of all forms that still got labels on the back start using there we go we've got the last ones with some labels on tear it off and the girl is now all ready to use water links pricing guns labels and heat rollers please visit shop stuff Del co dot UK' thanks for watching

People Also Ask about

What are the residency requirements for tax purposes in Oklahoma?

How many months do you have to live in Oklahoma to be a resident?

Who pays Oklahoma gross production tax?

What qualifies as residency in Oklahoma?

Who is required to file Oklahoma tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my oklamhoma 320 c 2011 directly from Gmail?

Can I create an electronic signature for the oklamhoma 320 c 2011 in Chrome?

Can I edit oklamhoma 320 c 2011 on an iOS device?

What is OK OTC 320-C?

Who is required to file OK OTC 320-C?

How to fill out OK OTC 320-C?

What is the purpose of OK OTC 320-C?

What information must be reported on OK OTC 320-C?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.