Get the free Senior Parent Quarterly Income Report - dss cahwnet

Show details

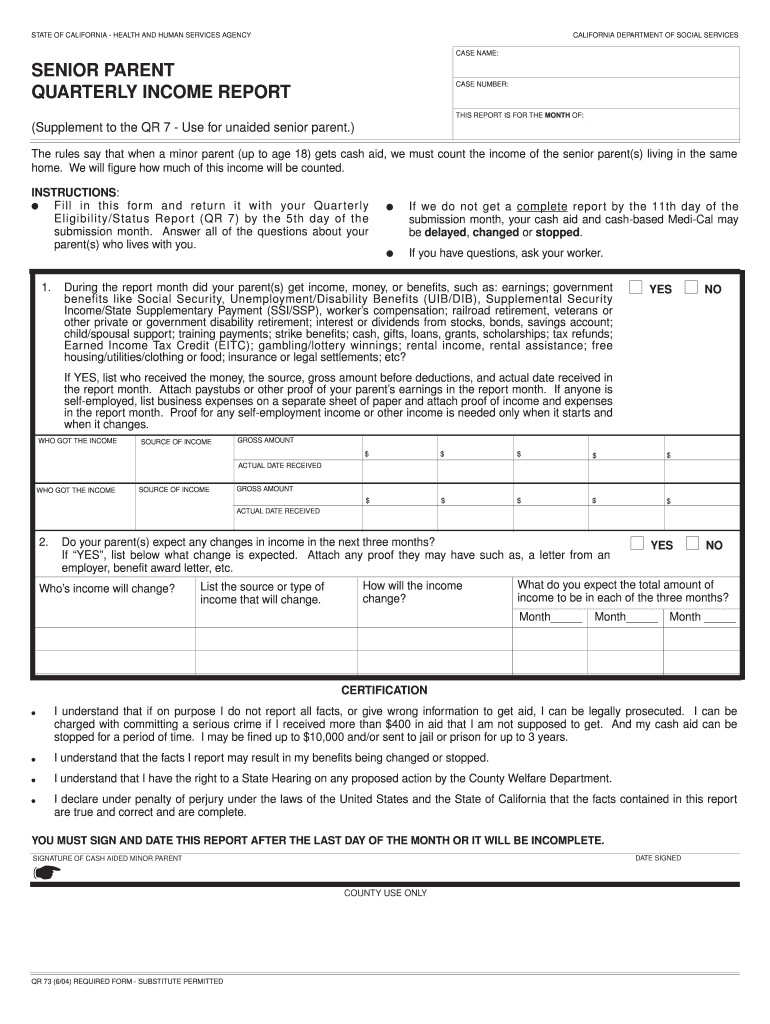

This report is required for minor parents receiving cash aid to report income from senior parents living in the same household. It includes detailed instructions on reporting sources of income, expected

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign senior parent quarterly income

Edit your senior parent quarterly income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your senior parent quarterly income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit senior parent quarterly income online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit senior parent quarterly income. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out senior parent quarterly income

How to fill out Senior Parent Quarterly Income Report

01

Gather all necessary financial documents including income statements, tax returns, and any other relevant financial information.

02

Start with personal information, enter the senior parent's name, address, and contact information.

03

List each source of income, detailing the monthly amount for pensions, Social Security, investments, etc.

04

Provide documentation for each source of income, ensuring that totals are accurate and can be verified.

05

Fill out any additional sections related to expenses, if required, detailing consistent monthly expenses.

06

Review the entire report for accuracy and completeness before submission.

07

Sign and date the report to certify that all information is true and correct.

Who needs Senior Parent Quarterly Income Report?

01

Senior parents who wish to receive assistance or benefits based on their income.

02

Organizations or agencies providing support services to low-income seniors.

03

Government programs that require income verification for eligibility.

Fill

form

: Try Risk Free

People Also Ask about

How much of Social Security is taxable after age 70?

If your combined income is less than $32,000, none of your Social Security benefits are taxable. If your combined income is between $32,000 and $44,000, up to 50% of your benefits may be subject to tax. If your combined income exceeds $44,000, up to 85% of your benefits may be taxable.

Do seniors over 70 need to do federal tax returns every year?

In reality, Social Security is taxed at any age if your income exceeds a certain level. Essentially, if your taxable income is greater than the Standard Deduction for your filing status, you'll typically have to file a tax return.

Is there a tax credit for taking care of elderly parents?

For the 2024 tax year, the Child and Dependent Care Credit provides a credit of up to $3, 000 in caregiving costs for one person, or up to $6, 000 for two people. The Credit for Other Dependents provides a credit of up to $500 per dependent. If you and your loved one are eligible, you can claim both credits.

Do seniors over 70 need to do federal tax returns every year?

In reality, Social Security is taxed at any age if your income exceeds a certain level. Essentially, if your taxable income is greater than the Standard Deduction for your filing status, you'll typically have to file a tax return.

How much can a 70 year old earn without paying taxes?

Taxes aren't determined by age, so you will never age out of paying taxes. People who are 65 or older at the end of 2025 have to file a return for that tax year (which is due in 2026) if their gross income is $16,550 or higher. If you're married filing jointly and both 65 or older, that amount is $32,300.

How much can a 70 year old earn without affecting Social Security?

Starting with the month you reach full retirement age, there is no limit on how much you can earn and still receive your benefits. You work and earn $32,320 ($8,920 more than the $23,400 limit) during the year.

What is the maximum income without paying taxes?

If you were under 65 at the end of 2024 If your filing status is:File a tax return if your gross income is: Single $14,600 or more Head of household $21,900 or more Married filing jointly $29,200 or more (both spouses under 65) $30,750 or more (one spouse under 65) Married filing separately $5 or more1 more row • Jan 28, 2025

What is the standard tax deduction for seniors over 65?

For single filers and heads of households age 65 and over, the additional standard deduction increases slightly — from $1,950 in 2024 (returns you'll file soon in early 2025) to $2,000 in 2025 (returns you'll file in early 2026).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Senior Parent Quarterly Income Report?

The Senior Parent Quarterly Income Report is a financial document that provides a summary of the income earned by senior parents during a specific quarter. It is often required for social service programs or financial aid assessments.

Who is required to file Senior Parent Quarterly Income Report?

Individuals identified as senior parents, typically those receiving assistance or benefits related to dependent care or senior services, are required to file the report.

How to fill out Senior Parent Quarterly Income Report?

To fill out the Senior Parent Quarterly Income Report, gather income documentation for the reporting quarter, complete all required fields on the form, ensure accuracy of the reported figures, and submit it to the designated authority or agency by the deadline.

What is the purpose of Senior Parent Quarterly Income Report?

The purpose of the Senior Parent Quarterly Income Report is to provide authorities with an updated view of a senior parent's financial status, which helps in determining eligibility for various programs, services, or financial assistance.

What information must be reported on Senior Parent Quarterly Income Report?

The information that must be reported includes total income for the quarter, sources of income (such as wages, pensions, or benefits), any changes in financial circumstances, and relevant personal information of the filer.

Fill out your senior parent quarterly income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Senior Parent Quarterly Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.