Get the free 2009-2010 Rental Property Supplement - muhlenberg

Show details

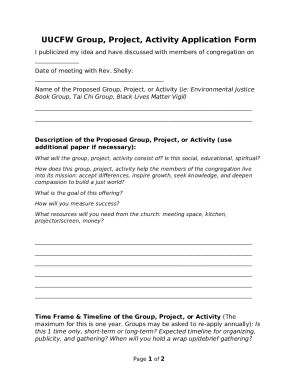

This form is required for parents to report rental property information for financial aid purposes, including details about the property and ownership.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009-2010 rental property supplement

Edit your 2009-2010 rental property supplement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009-2010 rental property supplement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

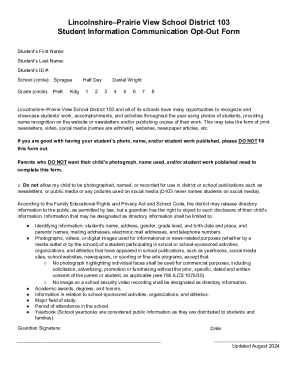

How to edit 2009-2010 rental property supplement online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2009-2010 rental property supplement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

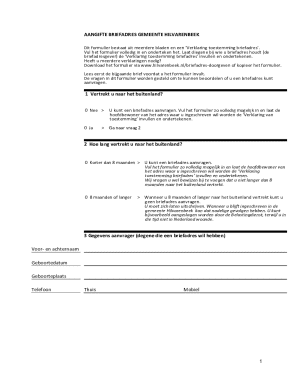

How to fill out 2009-2010 rental property supplement

How to fill out 2009-2010 Rental Property Supplement

01

Obtain a copy of the 2009-2010 Rental Property Supplement form.

02

Fill out personal information including your name, address, and contact details.

03

List each rental property you own separately.

04

For each property, report the income earned over the rental period.

05

Deduct allowable expenses such as repairs, maintenance, and property management fees.

06

Calculate the net income for each property by subtracting total expenses from total income.

07

Complete any additional sections as required by the form.

08

Review all entries for accuracy before submitting the form.

09

Sign and date the form as required.

Who needs 2009-2010 Rental Property Supplement?

01

Property owners who earn income from rental properties during the 2009-2010 tax year.

02

Individuals who are preparing their taxes and need to report rental income.

03

Landlords who wish to claim deductions on expenses related to their rental properties.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between 27.5 and 39 years depreciation?

What is the difference between 27.5 years and 39.0 years for rental property depreciation? 27.5 years is used primarily for residential properties whereas 39.0 years is used for commercial properties including nonresidential properties.

What is the 27.5 year depreciation rule?

Depreciation of rental property starts when the property is placed in service and ends when either you have deducted your entire "cost basis" in the property or you remove the property from service. For residential rental property, it typically takes 27.5 years to fully recover your cost basis.

Why can't I deduct my rental property losses?

Without passive income, your rental losses become suspended losses you can't deduct until you have sufficient passive income in a future year or sell the property to an unrelated party. You may not be able to deduct such losses for years. In short, your rental losses will be useless without offsetting passive income.

Is 27.5 or 39 years depreciation?

Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Commercial property can be depreciated over a 39-year straight line, while residential property can be depreciated over a 27.5-year straight line. This information is outlined in the U.S. Tax Code.

Can I write off my phone bill for rental property?

Internet and cell phone plans If you use your personal internet and cell phone for your rental business, you can typically deduct the business portion. It may be challenging to separate personal and business usage, but the key is to be reasonable and consistent and keep records.

What improvements to rental property must be capitalized?

Capital Improvements additions, such as a deck, pool, additional room, etc. renovating an entire room (for example, kitchen) installing central air conditioning, a new plumbing system, etc. replacing 30% or more of a building component (for example, roof, windows, floors, electrical system, HVAC, etc.)

What is 39 year depreciable property?

Class life is the number of years over which an asset can be depreciated. The tax law has defined a specific class life for each type of asset. Real Property is 39 year property, office furniture is 7 year property and autos and trucks are 5 year property. See Publication 946, How to Depreciate Property.

Is a short-term rental depreciated over 39 years?

However, if your short-term rental operates more like a hotel or motel — where average guest stays are fewer than 30 days — it may be classified as nonresidential or commercial property. In this case, the IRS requires you to depreciate the property over 39 years, reducing your annual depreciation deductions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009-2010 Rental Property Supplement?

The 2009-2010 Rental Property Supplement is a tax form used by property owners to report income and expenses related to rental properties for the tax years 2009 and 2010.

Who is required to file 2009-2010 Rental Property Supplement?

Any property owner who receives rental income and wishes to report it for the tax years 2009 and 2010 is required to file the 2009-2010 Rental Property Supplement.

How to fill out 2009-2010 Rental Property Supplement?

To fill out the 2009-2010 Rental Property Supplement, property owners should gather relevant financial documents, report rental income, itemize expenses such as repairs, depreciation, and utilities, and ensure all information is accurately entered onto the form.

What is the purpose of 2009-2010 Rental Property Supplement?

The purpose of the 2009-2010 Rental Property Supplement is to ensure that property owners accurately report their rental income and related expenses for tax calculation, compliance, and proper assessment of tax liability.

What information must be reported on 2009-2010 Rental Property Supplement?

The information that must be reported on the 2009-2010 Rental Property Supplement includes total rental income received, expenses incurred (such as repairs, maintenance, property management fees), and any relevant deductions for depreciation or other costs.

Fill out your 2009-2010 rental property supplement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009-2010 Rental Property Supplement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.