Get the free Ministerial Deduction Application - onu

Show details

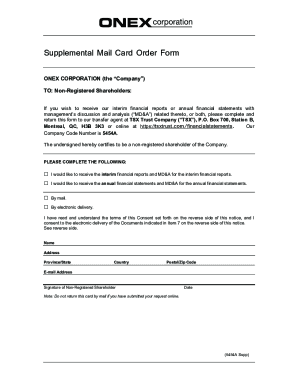

Application form for unmarried legally dependent children of United Methodist ordained elders for tuition and general fee deductions at Ohio Northern University.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ministerial deduction application

Edit your ministerial deduction application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ministerial deduction application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ministerial deduction application online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ministerial deduction application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ministerial deduction application

How to fill out Ministerial Deduction Application

01

Gather all necessary documents related to your tax situation.

02

Obtain the Ministerial Deduction Application form from the relevant authority or website.

03

Fill out your personal information, including name, address, and contact details.

04

Provide your ministerial credentials or proof of your ministerial status.

05

Detail your income sources and any deductions you are eligible for.

06

Include any additional documentation that supports your application.

07

Review the completed application for accuracy and completeness.

08

Submit the application to the appropriate tax office, either electronically or by mail.

Who needs Ministerial Deduction Application?

01

Ministers or clergy members who are classified as a minister for tax purposes.

02

Individuals working in religious organizations who receive income that qualifies for ministerial deductions.

03

Those seeking tax relief based on their ministerial duties and services.

Fill

form

: Try Risk Free

People Also Ask about

Is clergy housing allowance worth it?

A housing allowance one of the best benefits for clergy and pastors. The benefit is two-fold: 1) the income is excluded from gross income for income tax purposes and 2) the allowance is used to cover housing-related expenses. Once the housing allowance is set, it's time to track expenses in the new calendar year.

Is church tithing 100% tax deductible?

The total of your church cash donations plus all other charitable contributions you make during the year typically cannot exceed 60 percent of your adjusted gross income (AGI). If it does, then you cannot deduct 100 percent of your donations in the current tax year.

What is tax deductible for ministers?

A licensed, commissioned, or ordained minister who performs ministerial services as an employee may be able to exclude from gross income the fair rental value of a home provided as part of compensation (a parsonage) or a housing allowance provided as compensation if it is used to rent or otherwise provide a home.

What can ministers write off on taxes?

Tax Deductions for Clergy Parsonage Allowance: Communication Expenses: Auto Travel: Out-of-Town Travel: Continuing Education: Equipment Purchases:

Do I need to file form 4361 every year?

You must file Form 4361 by the due date of your tax return for the second tax year in which you earned at least $400 of self-employment earnings as a minister. Once you claim the exemption, you cannot revoke the election.

What taxes are pastors exempt from?

Clergy, minister, or missionary wages reported on Form W-2 are subject to self-employment taxes, but no Social Security and Medicare taxes are withheld.

What is the difference between form 4361 and 4029?

To sum it up, Form 4361 is specific to ministers and similar roles aiming for a self-employment tax exemption. In contrast, Form 4029 caters to religious group members seeking a broader exemption from Social Security and Medicare taxes.

Are there tax advantages to being a minister?

Ministers are treated as a hybrid of a self-employed worker and a traditional employee for tax purposes. In most cases, the church is a tax-exempt entity. That means the church, which is the minister's employer, does not withhold income tax from the minister's wages.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Ministerial Deduction Application?

The Ministerial Deduction Application is a form used by religious leaders and ministers to claim a deduction for certain expenses related to their ministry work.

Who is required to file Ministerial Deduction Application?

Individuals who serve in a ministerial capacity and wish to claim deductions for eligible expenses associated with their ministry are required to file the Ministerial Deduction Application.

How to fill out Ministerial Deduction Application?

To fill out the Ministerial Deduction Application, gather all relevant financial documents, accurately report eligible expenses, provide required personal information, and submit it according to the specified guidelines.

What is the purpose of Ministerial Deduction Application?

The purpose of the Ministerial Deduction Application is to allow ministers to report and receive tax deductions for qualified expenses incurred in the course of their ministry work.

What information must be reported on Ministerial Deduction Application?

The Ministerial Deduction Application must report personal details, the nature of ministry work, detailed descriptions of eligible expenses, and any other required financial information specific to the individual’s ministry.

Fill out your ministerial deduction application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ministerial Deduction Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.