Get the free Loan Discharge Affirmation Form - ohio

Show details

A form for students who have had federal student loans discharged due to total and permanent disability, providing options for requesting or declining federal loan consideration for future academic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan discharge affirmation form

Edit your loan discharge affirmation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan discharge affirmation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

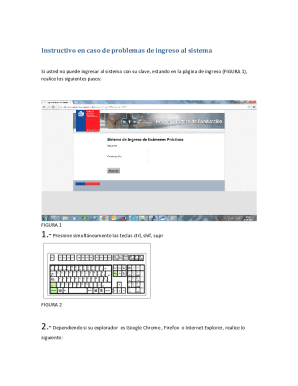

Editing loan discharge affirmation form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan discharge affirmation form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan discharge affirmation form

How to fill out Loan Discharge Affirmation Form

01

Obtain the Loan Discharge Affirmation Form from the lender or relevant authority.

02

Enter your personal information at the top of the form, including full name, address, and loan account number.

03

Review the instructions provided on the form carefully to ensure understanding.

04

Complete all sections of the form as required, providing accurate and truthful information.

05

If applicable, gather any necessary supporting documents to attach with the form.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form and any supporting documents to the lender or the designated office.

Who needs Loan Discharge Affirmation Form?

01

Borrowers who have completed their loan obligations and are seeking to formally discharge their loan.

02

Individuals needing proof of loan discharge for personal records or financial planning.

03

People who have experienced a significant change in their financial situation and need a loan discharge.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for loan discharge?

Your loan can be discharged only under specific circumstances, such as school closure, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or because of total and permanent disability, bankruptcy, identity theft, or death.

Is there a form for student loan forgiveness?

If you're working toward Public Service Loan Forgiveness (PSLF), complete and submit the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & Application (PSLF) form annually or when you change employers. If you've made 120 qualifying payments, fill out and submit this same form.

How do I apply for a loan discharge for a school closure?

If you meet the eligibility requirements for a discharge of loans you obtained to attend a school that closed, your loan holder will automatically send you an application you can submit to your loan servicer. Or, you can contact your loan servicer directly about the application process for getting your loan discharged.

How does loan discharge work?

When you have your federal student loans discharged, it means: you no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and.

Who qualifies for loan discharge?

Your loan can be discharged only under specific circumstances, such as school closure, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or because of total and permanent disability, bankruptcy, identity theft, or death.

How long does it take to get student loans discharged?

Borrowers who have reached 20 or 25 years (240 or 300 months) worth of eligible payments for IDR forgiveness will see their loans forgiven as they reach these milestones. ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

What happens to my student loan if the Department of Education shuts down?

Student loans will continue to exist, but oversight of them may shift to the Department of the Treasury or Small Business Administration. Students should still file the Free Application for Federal Student Aid (FAFSA) as soon as possible to help find financial aid, including Pell Grants and other funding.

Will discharged student loans be removed from a credit report?

you no longer have further obligation to repay the loan, you will receive a reimbursement of payments made voluntarily or through forced collection, and. the discharge will be reported to credit bureaus to delete any adverse credit history associated with the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan Discharge Affirmation Form?

The Loan Discharge Affirmation Form is a document used to affirm that a borrower has met the necessary requirements to discharge or cancel a loan, typically in the context of student loans or similar financial products.

Who is required to file Loan Discharge Affirmation Form?

Borrowers who are seeking to discharge their loans due to qualifying circumstances, such as total and permanent disability or school closure, are required to file the Loan Discharge Affirmation Form.

How to fill out Loan Discharge Affirmation Form?

To fill out the Loan Discharge Affirmation Form, borrowers must provide personal information such as their name, contact details, loan information, and details related to the discharge request, while also signing and dating the form.

What is the purpose of Loan Discharge Affirmation Form?

The purpose of the Loan Discharge Affirmation Form is to formally document the borrower's affirmation of their eligibility for loan discharge and to initiate the review process by the lending institution.

What information must be reported on Loan Discharge Affirmation Form?

The information that must be reported on the Loan Discharge Affirmation Form includes the borrower's personal details, loan account numbers, the reason for discharge, and any supporting documentation as required by the lender.

Fill out your loan discharge affirmation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Discharge Affirmation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.