Get the free Form 527

Show details

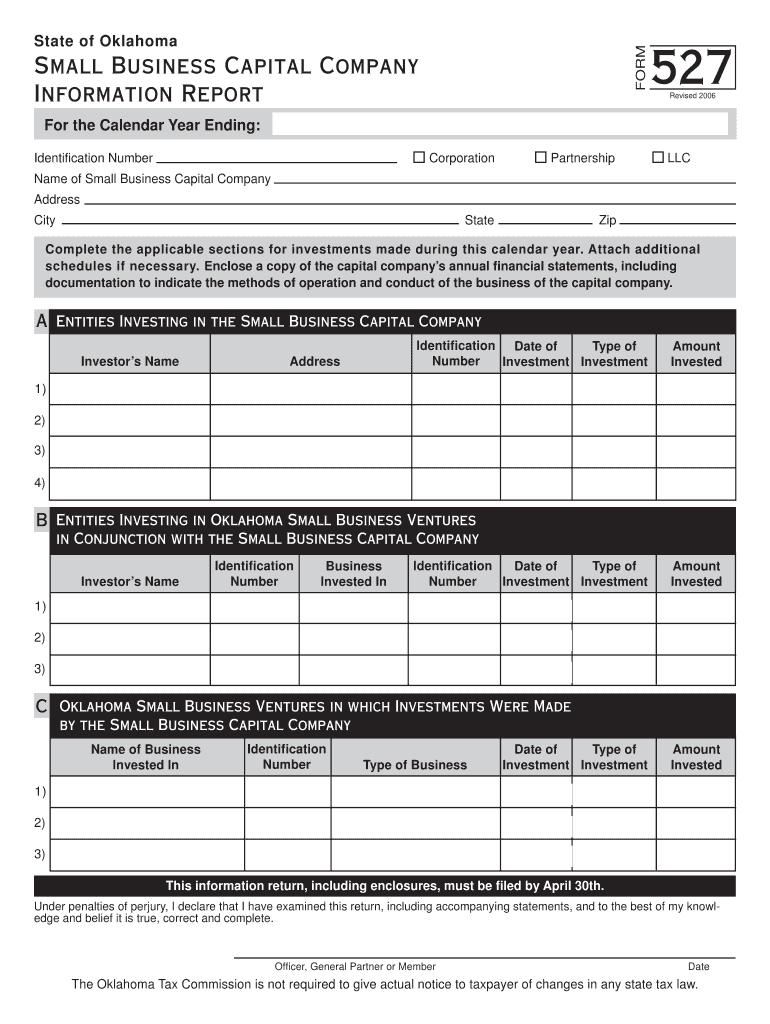

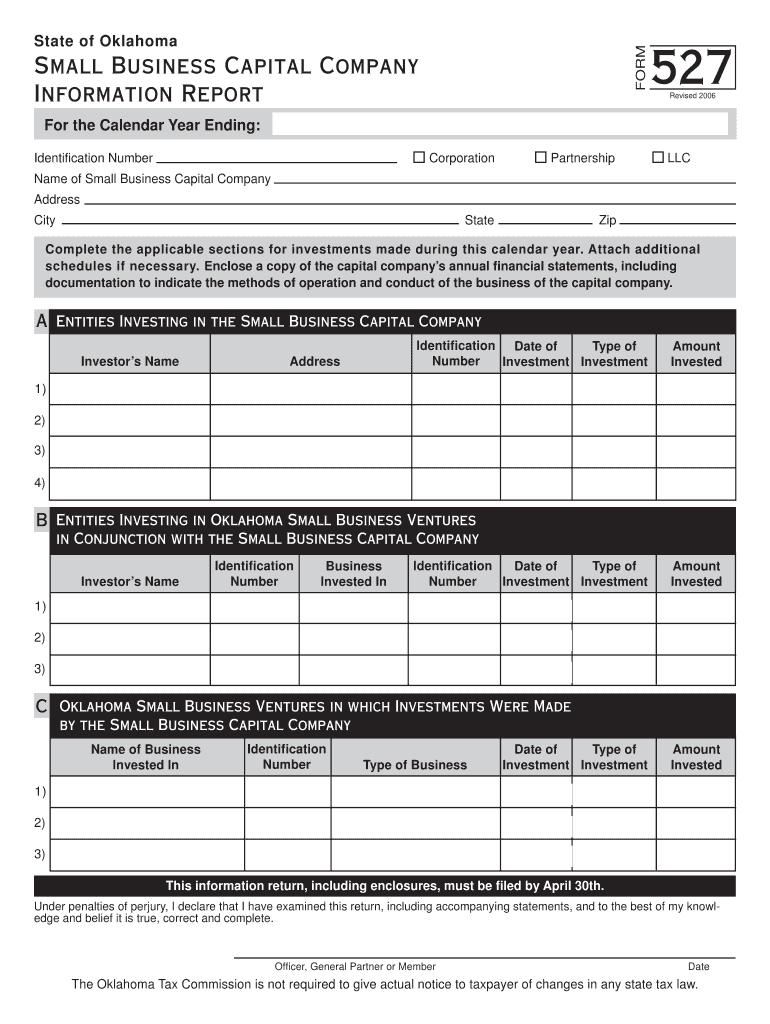

Este informe debe ser presentado por cada Small Business Capital Company para detallar las inversiones realizadas durante el año calendario. Incluye requisitos de presentación, información sobre

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 527

Edit your form 527 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 527 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 527 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 527. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 527

How to fill out Form 527

01

Obtain Form 527 from the designated government website or local office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Begin with section 1, providing your personal information such as name and address.

04

Continue to section 2, listing any relevant affiliation or position related to the purpose of Form 527.

05

Complete section 3 by detailing the financial activities or contributions as required by the form.

06

Review the form for any missing information or errors.

07

Sign and date the form at the designated section.

08

Submit the completed form as directed, whether electronically or by mail.

Who needs Form 527?

01

Individuals or organizations involved in political fundraising or expenditures.

02

Candidates running for office who need to report financial contributions.

03

Political parties or political committees that engage in advocacy or campaign activities.

Fill

form

: Try Risk Free

People Also Ask about

What happens when you fully depreciate a rental property?

Depreciation deductions allow property owners to recover the cost of their property over time. For owners of residential rental property, the cost is typically recovered after 27.5 years.

Do you have to pay back depreciation on rental property?

Many real estate investors wonder whether they have to pay back depreciation deductions if they decide to sell their rental properties. The short answer is that depreciation on a rental property doesn't need to be paid back in a literal sense.

Do you have to pay back property depreciation?

However, when the time comes to sell, the IRS requires real estate investors to recapture any depreciation expense taken and pay tax. Fortunately, there are ways an investor may be able to defer or even completely eliminate paying depreciation recapture tax.

How do you avoid depreciation recapture on rental property?

If it's important to you to avoid the depreciation recapture tax, there are several strategies you may want to adopt. Take advantage of IRS Section 121 exclusion. Conduct a 1031 exchange. Pass on the property to your heirs. Sell the property at a loss.

How many days can you use a rental property for personal use?

ing to IRS rules, personal use should not exceed 14 days or 10% of the number of days the property is rented at a fair rental price, whichever is greater. Exceeding this limit impacts the rental property's tax deductions, as it alters the balance between rental and personal use.

What is the downside of depreciation rental property?

Other landlords worry that claiming depreciation could result in lower income from their property, reducing their cash flow. However, depreciation isn't an actual cash expense; it's simply a tax deduction. In other words, depreciation may lower your taxable income, but it doesn't affect your cash flow.

What is a 527 form?

SECTION 527 POLITICAL ORGANIZATIONS – TAX FILING REQUIREMENTS. Political organizations that have tax-exempt status under section 527 of the Internal Revenue Code must file some or all of four forms as a condition of tax-exempt status.

How do I report conversion of rental property to personal use in the IRS?

The Form 4797 is Disposition of Business Property, which includes the conversion to personal use. (It closes out the Schedule E for reporting). When you sell the property, you will have to account for the depreciation to determine the gain or loss (essentially it is suspended).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 527?

Form 527 is a financial disclosure form required by certain state authorities in the United States to report the campaign finance activities of candidates and political committees.

Who is required to file Form 527?

Candidates for public office, political committees, and organizations that engage in political advocacy and spend money on campaign-related activities are typically required to file Form 527.

How to fill out Form 527?

To fill out Form 527, individuals or committees must provide information about their identity, the sources of their funding, expenditure details, and the purpose of their activities, ensuring compliance with relevant campaign finance laws.

What is the purpose of Form 527?

The purpose of Form 527 is to enhance transparency in campaign financing by ensuring that stakeholders, including voters, can access information regarding the funding and expenditure of political campaigns.

What information must be reported on Form 527?

Information that must be reported on Form 527 includes the name and address of the filer, details of contributions received and expenditures made, and the identification of donors who contributed above a certain threshold.

Fill out your form 527 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 527 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.