Get the free Request for Deferment of Repayment - Federal Perkins Loan Program - ohsu

Show details

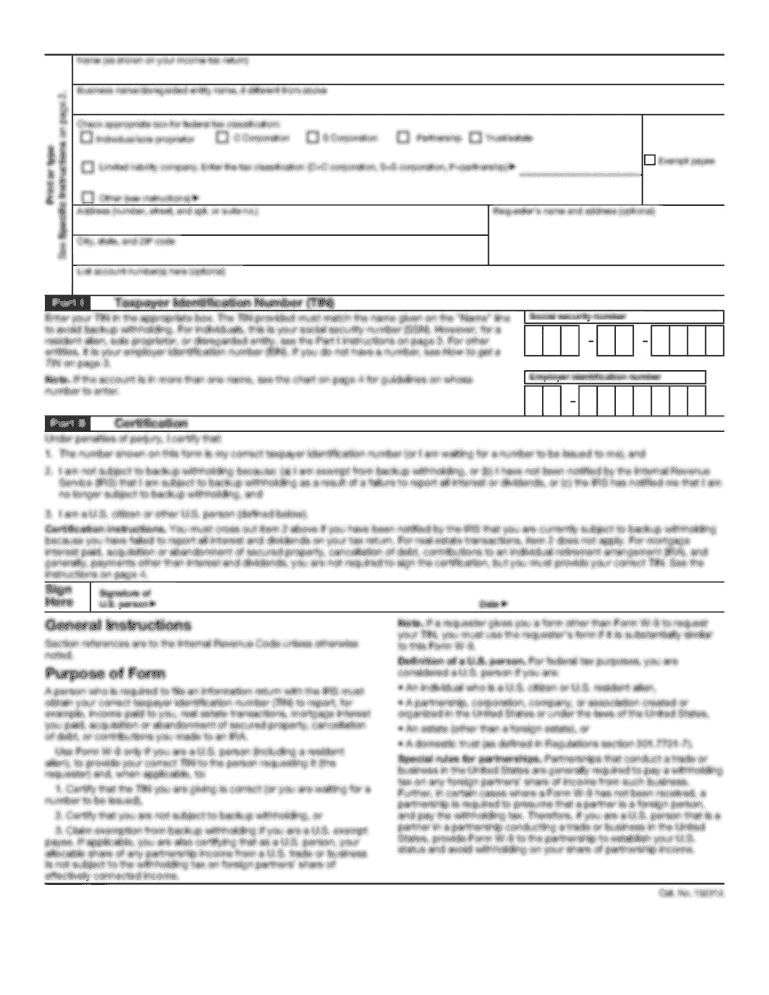

This form is used by borrowers of Federal Perkins Loans to request a deferment of repayment under specific qualifying conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for deferment of

Edit your request for deferment of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for deferment of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for deferment of online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request for deferment of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for deferment of

How to fill out Request for Deferment of Repayment - Federal Perkins Loan Program

01

Obtain the Request for Deferment of Repayment form from your loan servicer or the official website.

02

Fill out your personal information, including your name, address, and loan account number.

03

Specify the reason for the deferment request according to the eligibility criteria provided with the form.

04

Provide any required documentation to support your claim for deferment, such as proof of unemployment or enrollment in school.

05

Review the completed form for accuracy and ensure all necessary signatures are included.

06

Submit the completed form and any supporting documents to your loan servicer, following the instructions provided.

07

Keep a copy of the submitted form and any correspondence for your records.

Who needs Request for Deferment of Repayment - Federal Perkins Loan Program?

01

Borrowers who are experiencing financial hardship and are unable to make loan payments.

02

Students enrolled at least half-time in an eligible program of study.

03

Individuals who are unemployed and actively seeking employment.

04

Borrowers who meet other specific conditions outlined by the Federal Perkins Loan Program.

Fill

form

: Try Risk Free

People Also Ask about

Is a Perkins Loan eligible for forgiveness?

If you received a Perkins Loan, you might be eligible to have it forgiven – as long as you work in certain public service fields, such as education or law enforcement, and apply for forgiveness through your school or student loan servicer.

Can you still get a Perkins Loan?

Perkins loans are no longer offered, but borrowers who still hold one must repay the loan. As of 2023, other federal loans are available to students, including direct subsidized loans, direct unsubsidized loans, direct plus loans, and direct consolidation loans. Congressional Research Service.

Is a Perkins Loan a federal loan?

The Perkins Loan Decline With private loans becoming more prevalent, as well as the rising popularity of other government loan programs, the Perkins Loan is generally seen as obsolete, especially its fixed interest rate, which is higher than direct loans of the same type for undergrads.

What replaced Perkins loans?

With the wind-down of the Perkins Loan Program, this process has been replaced by a similar process, the Distribution of Assets process, which distributes the cash received through portfolio collections at year's end.

Why were Perkins Loans discontinued?

A borrower must repay his or her loan, plus interest, in 10 years. This repayment period never includes authorized periods of deferment, forbearance, or cancellation. The repayment plan must be established and disclosed to the student before the student ceases to be enrolled at least half-time.

Why did they stop Perkins loans?

With private loans becoming more prevalent, as well as the rising popularity of other government loan programs, the Perkins Loan is generally seen as obsolete, especially its fixed interest rate, which is higher than direct loans of the same type for undergrads.

Did Perkins loans get forgiven?

Depending on the kind of public service job you have, you could see up to 100% of your Perkins loans forgiven after five years. You can apply for a percentage of your loan amount to be forgiven as early as your first completed year in a qualifying public service position.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Deferment of Repayment - Federal Perkins Loan Program?

The Request for Deferment of Repayment for the Federal Perkins Loan Program is a formal application that allows borrowers to temporarily postpone repayment of their loans under specific conditions, such as enrollment in school or significant financial hardship.

Who is required to file Request for Deferment of Repayment - Federal Perkins Loan Program?

Borrowers who are experiencing qualifying circumstances such as returning to school, financial hardship, or other specified situations are required to file the Request for Deferment of Repayment for the Federal Perkins Loan Program.

How to fill out Request for Deferment of Repayment - Federal Perkins Loan Program?

To fill out the Request for Deferment of Repayment for the Federal Perkins Loan Program, borrowers must complete the application form by providing personal information, details of their loan, and the reason for deferment, ensuring all sections are accurately filled and any required documentation is attached.

What is the purpose of Request for Deferment of Repayment - Federal Perkins Loan Program?

The purpose of the Request for Deferment of Repayment for the Federal Perkins Loan Program is to provide financial relief to borrowers, enabling them to temporarily suspend loan payments without accruing additional interest during the deferment period.

What information must be reported on Request for Deferment of Repayment - Federal Perkins Loan Program?

The information that must be reported on the Request for Deferment of Repayment for the Federal Perkins Loan Program includes the borrower's identification details, loan account number, type of deferment requested, period for which deferment is being sought, and any relevant supporting documentation.

Fill out your request for deferment of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Deferment Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.