Get the free Independent Contractor/Employee Status Certification Form - radford

Show details

This form is used to determine the classification of a worker as either an employee or an independent contractor for tax purposes within Radford University, ensuring compliance with IRS regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractoremployee status certification

Edit your independent contractoremployee status certification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractoremployee status certification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

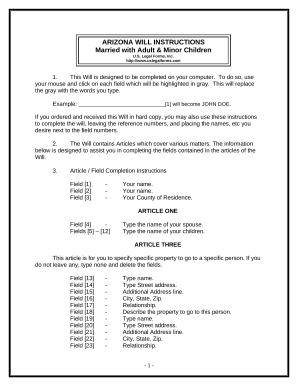

Editing independent contractoremployee status certification online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent contractoremployee status certification. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

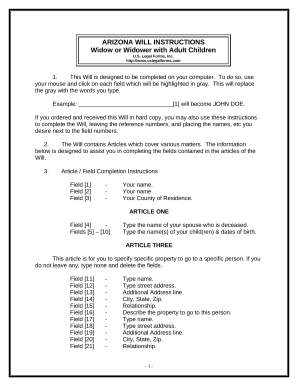

How to fill out independent contractoremployee status certification

How to fill out Independent Contractor/Employee Status Certification Form

01

Obtain the Independent Contractor/Employee Status Certification Form from the relevant authority or organization.

02

Read the instructions carefully to understand the requirements for completion.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Specify your role or position and the nature of the work you are performing.

05

Provide details about your working relationship with the hiring entity, including how you are compensated.

06

Indicate if you work independently or under the direction of the hiring entity.

07

Sign and date the form to certify the information provided is accurate.

08

Submit the completed form to the appropriate department or organization.

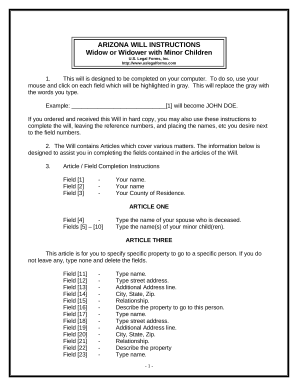

Who needs Independent Contractor/Employee Status Certification Form?

01

Individuals who are working as independent contractors or freelancers.

02

Businesses that need to establish the employment status of their workers for tax or legal purposes.

03

Employers who want to clarify the distinction between employees and independent contractors.

Fill

form

: Try Risk Free

People Also Ask about

How to write an employment verification letter for an independent contractor?

Be concise and factual, listing the necessary details the recipient needs to confirm the employee's employment. Include your company's contact information and offer to provide additional verification if needed. Ensure that the letter is signed by a company representative for authenticity.

How do I show proof of income if I'm an independent contractor?

How to Provide Proof of Income Annual Tax Return (Form 1040) This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS. 1099 Forms. Bank Statements. Profit/Loss Statements. Self-Employed Pay Stubs.

How do I prove independent contractor status?

Get a Form W-9 The first step to working with an independent contractor is getting a W-9 form. You can't complete your 1099-NEC* forms without it. The W-9 form captures the name, address and taxpayer identification number (TIN) of each contractor who requires a 1099-NEC.

How does the IRS determine whether someone is an independent contractor?

The general rule is that an individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What is the form for independent contractor status?

Form SS-8. If it is still unclear whether a worker is an employee or an independent contractor after reviewing the three categories of evidence, then Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, can be filed with the IRS.

What is proof of independent contractor status?

Form 1099-NEC reports the income independent contractors earn. Companies must file a copy with the IRS and send another to the contractor.

What forms do independent contractors need to fill out?

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Independent Contractor/Employee Status Certification Form?

The Independent Contractor/Employee Status Certification Form is a document used to determine whether an individual is classified as an independent contractor or an employee for tax and legal purposes.

Who is required to file Independent Contractor/Employee Status Certification Form?

Businesses and organizations that hire individuals must file the Independent Contractor/Employee Status Certification Form to correctly classify their workers for tax reporting and compliance.

How to fill out Independent Contractor/Employee Status Certification Form?

To fill out the form, provide accurate information regarding the worker's status, including details about the nature of the services performed, the relationship between the worker and the business, and any relevant contractual agreements.

What is the purpose of Independent Contractor/Employee Status Certification Form?

The purpose of the form is to ensure proper classification of a worker to comply with tax obligations, avoid penalties, and clarify the rights and responsibilities of both the worker and the business.

What information must be reported on Independent Contractor/Employee Status Certification Form?

The form typically requires information such as the worker's name, address, Social Security number, job description, payment arrangements, and the degree of control the business has over the worker's tasks.

Fill out your independent contractoremployee status certification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractoremployee Status Certification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.