Get the free Planning for Your 2008-2009 Education Expenses - regis

Show details

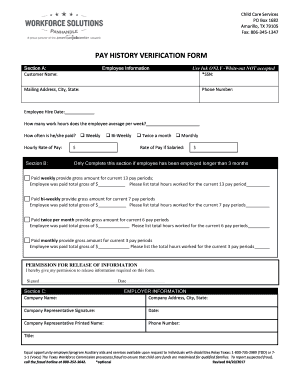

This document provides information on financing options for college education, including financial aid, loans, scholarships, and budgeting tips for adult students. It includes worksheets to help calculate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign planning for your 2008-2009

Edit your planning for your 2008-2009 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your planning for your 2008-2009 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit planning for your 2008-2009 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit planning for your 2008-2009. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out planning for your 2008-2009

How to fill out Planning for Your 2008-2009 Education Expenses

01

Gather all necessary financial documents, including income statements and tax returns.

02

Determine the total education expenses you expect for the academic year, including tuition, books, and supplies.

03

Identify any financial aid or scholarships you may be eligible for.

04

Calculate the total amount of funding needed by subtracting any aid from the total education expenses.

05

Complete the planning form by entering all gathered information in the appropriate sections.

06

Review the form for accuracy and completeness before submitting it.

Who needs Planning for Your 2008-2009 Education Expenses?

01

Students intending to enroll in educational programs in the 2008-2009 academic year.

02

Parents or guardians planning to assist with their child's educational expenses.

03

Financial planners assisting clients with education funding.

04

Schools or educational institutions advising students on financial planning for education.

Fill

form

: Try Risk Free

People Also Ask about

What qualified education expenses for American Opportunity Credit?

For AOTC only, expenses for books, supplies, and equipment the student needs for a course of study are included in qualified education expenses even if it is not paid to the school. For example, the cost of a required course book bought from an off-campus bookstore is a qualified education expense.

What expenses are eligible for the lifetime learning credit?

To qualify for the Lifetime Learning Credit, you must meet requirements regarding your student status, educational institution, and expenses you want to claim. Eligible school expenses include tuition and fees and required course-related equipment like books, beakers, and yes, maybe even that pottery wheel.

Which of the following is a qualified education expense?

Tuition and fees. Room and board. Books, supplies, and equipment. Other necessary expenses (such as transportation)

What are examples of education expenses?

Tuition and fees. Books, supplies, computers and peripheral equipment. Room and board (if attending school more than half-time)

What are considered qualified education expenses?

Tuition and fees. Room and board. Books, supplies, and equipment. Other necessary expenses (such as transportation)

Is a laptop a qualified education expense?

Education tax credits A computer for school purposes may or may not qualify for these credits. Generally, if your computer is a necessary requirement for enrollment or attendance at an educational institution, the IRS deems it a qualifying expense.

What are qualified education expenses for 1099 Q?

Qualified expenses include tuition, fees, books, supplies, and equipment required for enrollment at an eligible school; expenses for room and board if the student is enrolled at least half-time; expenses for special needs services; and qualified elementary and secondary expenses (for ESA distributions only).

What does the IRS consider qualified education expenses?

Qualified expenses are amounts paid for tuition, fees and other related expense for an eligible student that are required for enrollment or attendance at an eligible educational institution. You must pay the expenses for an academic period* that starts during the tax year or the first three months of the next tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Planning for Your 2008-2009 Education Expenses?

Planning for Your 2008-2009 Education Expenses is a framework that helps students and families estimate, budget, and manage the costs associated with education for that academic year, including tuition, fees, and living expenses.

Who is required to file Planning for Your 2008-2009 Education Expenses?

Students and their families who are seeking financial aid or planning to manage their education funding for the 2008-2009 academic year are typically required to fill out this planning form.

How to fill out Planning for Your 2008-2009 Education Expenses?

To fill out the Planning for Your 2008-2009 Education Expenses, individuals must gather necessary financial information, estimate costs for tuition, fees, and living expenses, and accurately report income and other financial data as required.

What is the purpose of Planning for Your 2008-2009 Education Expenses?

The purpose of this planning document is to assist students and their families in understanding and preparing for the financial obligations of education, ensuring they can strategize for funding and manage education-related spending effectively.

What information must be reported on Planning for Your 2008-2009 Education Expenses?

It is essential to report details such as projected tuition and fees, living expenses, expected financial aid, scholarships, and family contributions, in order to create a comprehensive financial plan for the academic year.

Fill out your planning for your 2008-2009 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Planning For Your 2008-2009 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.