NY CSC-1 2013 free printable template

Show details

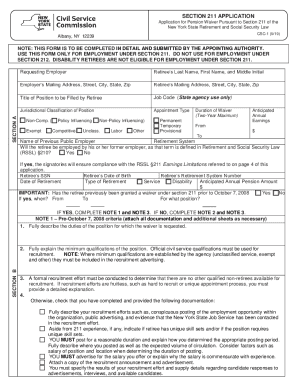

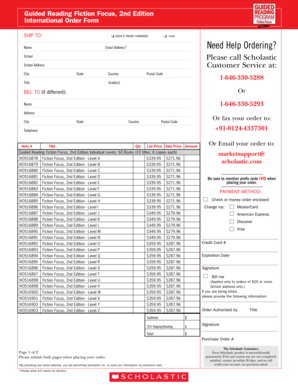

State of New York Department of Civil Service Albany NY 12239 SECTION 211 APPLICATION Application for Pension Waiver Pursuant to Section 211 of the New York State Retirement and Social Security Law CSC-1 2/13L NOTE THIS FORM IS TO BE COMPLETED IN DETAIL AND SUBMITTED BY THE APPOINTING AUTHORITY. USE THIS FORM ONLY FOR EMPLOYMENT UNDER SECTION 211. DO NOT USE FOR EMPLOYMENT UNDER SECTION 212. DISABILITY RETIREES ARE NOT ELIGIBLE FOR EMPLOYMENT UNDER SECTION 211. Retiree s Last Name First Name...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CSC-1

Edit your NY CSC-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CSC-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY CSC-1 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY CSC-1. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CSC-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CSC-1

How to fill out NY CSC-1

01

Obtain the NY CSC-1 form from the New York State Department of Labor website or your local office.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide details about your employment history, including previous employers and job titles.

04

Indicate the reason for your claim, selecting from the provided options.

05

Review the eligibility criteria and confirm that you meet them.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form through the designated method (online, by mail, or in person) as per the instructions provided.

Who needs NY CSC-1?

01

Individuals who are unemployed or underemployed and seeking unemployment insurance benefits in New York.

02

Workers who have lost their job through no fault of their own and need financial assistance during their job search.

Fill

form

: Try Risk Free

People Also Ask about

What are the retirement laws in NYS?

To receive the full retirement benefit, you must retire at age 62 or older or, if you have at least 30 years of credited service, you may retire as early as age 55. With less than 30 years of credited service, you may retire between the ages 55 and 62 and receive a reduced benefit.

What is the NYS executive order for retirement?

Under the executive order, post-retirement earnings with a public employer will not count toward the annual calendar-year earnings limit during the following time periods: January 1, 2023 through May 22, 2023. January 1, 2022 through December 31, 2022.

How many years do you need to be vested in the NYS retirement system?

Vesting is automatic; you do not have to fill out any paperwork to become vested. Tier 1, 2, 3 or 4 members who have at least five years of credited service are vested. As of April 9, 2022, Tier 5 and 6 members also only need five years of service credit to be vested.

What is the income limit for retirement in NY?

Provide notification when a NYSLRS retiree earns more than the Section 212 limit. The earnings limit is currently $35,000, however, the limit was suspended through much of 2020 and 2021, all of 2022, and, so far, from January 1, 2023 through June 8, 2023, by executive order of the Governor.

What is the new law for retirement in NY?

In October 2021, New York Governor Kathy Hochul signed legislation into law that requires most employers with 10 or more employees to provide retirement options for workers.

What is Section 211 of the NYS retirement and Social Security law?

Section 211 (RSSL) Under Section 211, earnings from public employment are not limited for a retiree receiving a pension payment if: The retiree returns to work for a public employer that has obtained the necessary Section 211 approval (also referred to as a Section 211 waiver), and.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

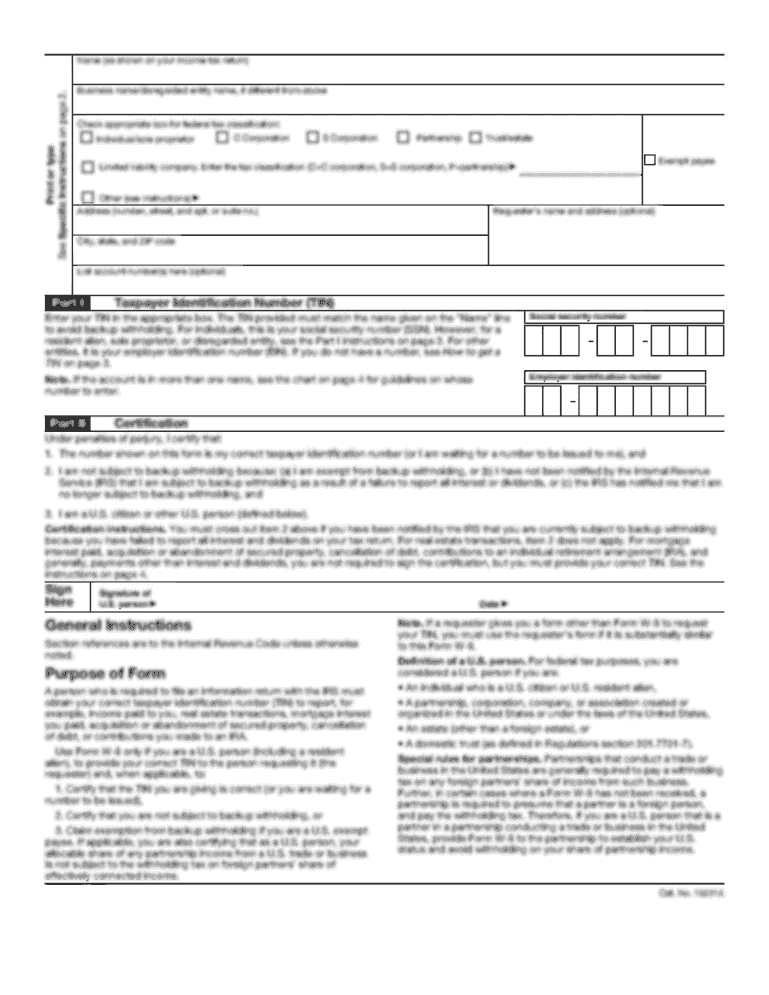

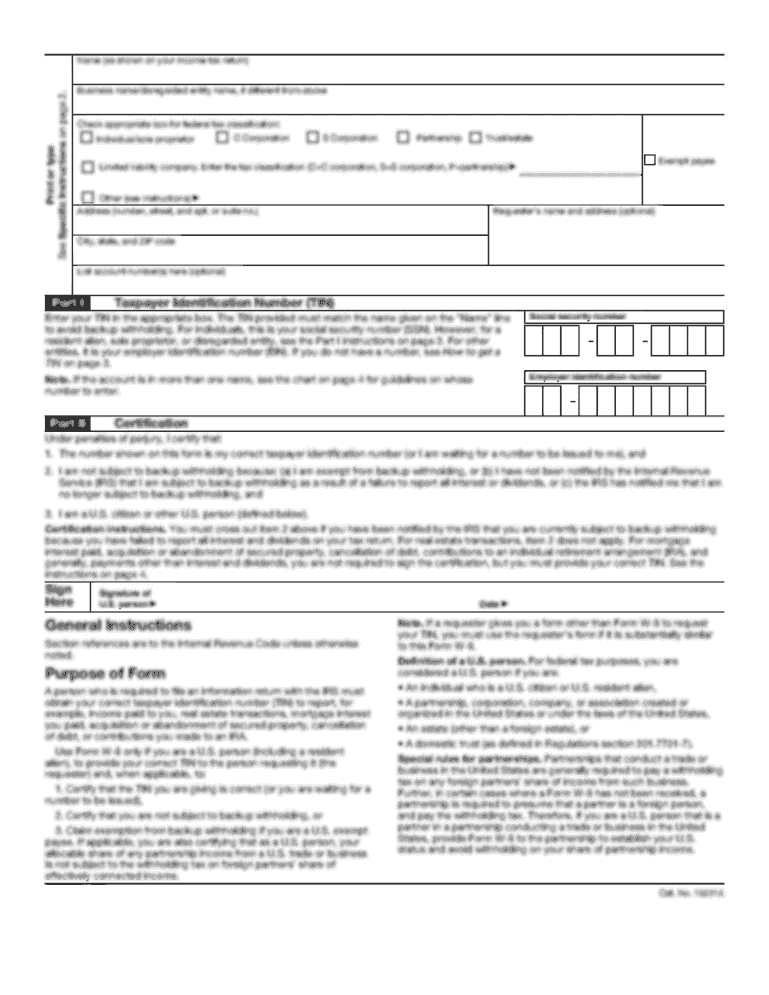

Can I sign the NY CSC-1 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your NY CSC-1 in minutes.

Can I create an eSignature for the NY CSC-1 in Gmail?

Create your eSignature using pdfFiller and then eSign your NY CSC-1 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out NY CSC-1 using my mobile device?

Use the pdfFiller mobile app to complete and sign NY CSC-1 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is NY CSC-1?

NY CSC-1 is a form used in New York State for reporting certain financial information and compliance related to corporate tax obligations.

Who is required to file NY CSC-1?

Corporations in New York State that are subject to the corporation tax and meet specific criteria are required to file the NY CSC-1.

How to fill out NY CSC-1?

To fill out NY CSC-1, individuals must provide accurate financial data, including total income, deductions, and any relevant details specific to their business activities as outlined in the form instructions.

What is the purpose of NY CSC-1?

The purpose of NY CSC-1 is to ensure compliance with New York State tax laws and to collect information necessary for the accurate assessment of corporate tax obligations.

What information must be reported on NY CSC-1?

Information that must be reported on NY CSC-1 includes the corporation's name, address, type of business, income details, deductions, and any other relevant financial information required by the form.

Fill out your NY CSC-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY CSC-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.