Get the free Supplemental Pay Form - tarleton

Show details

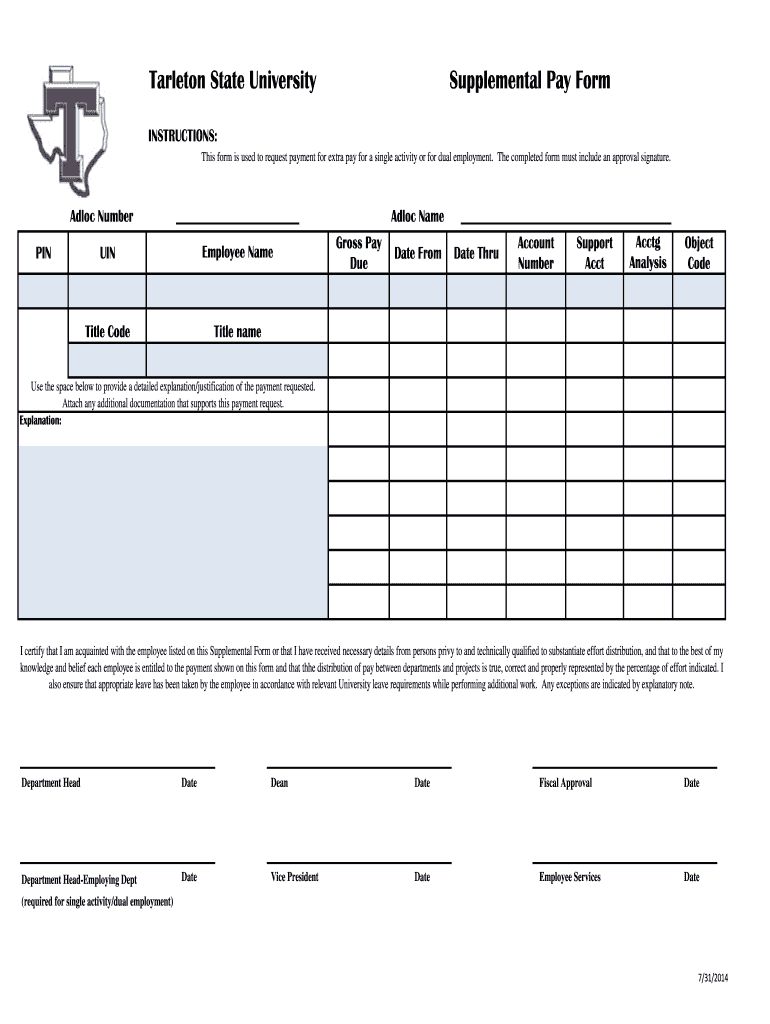

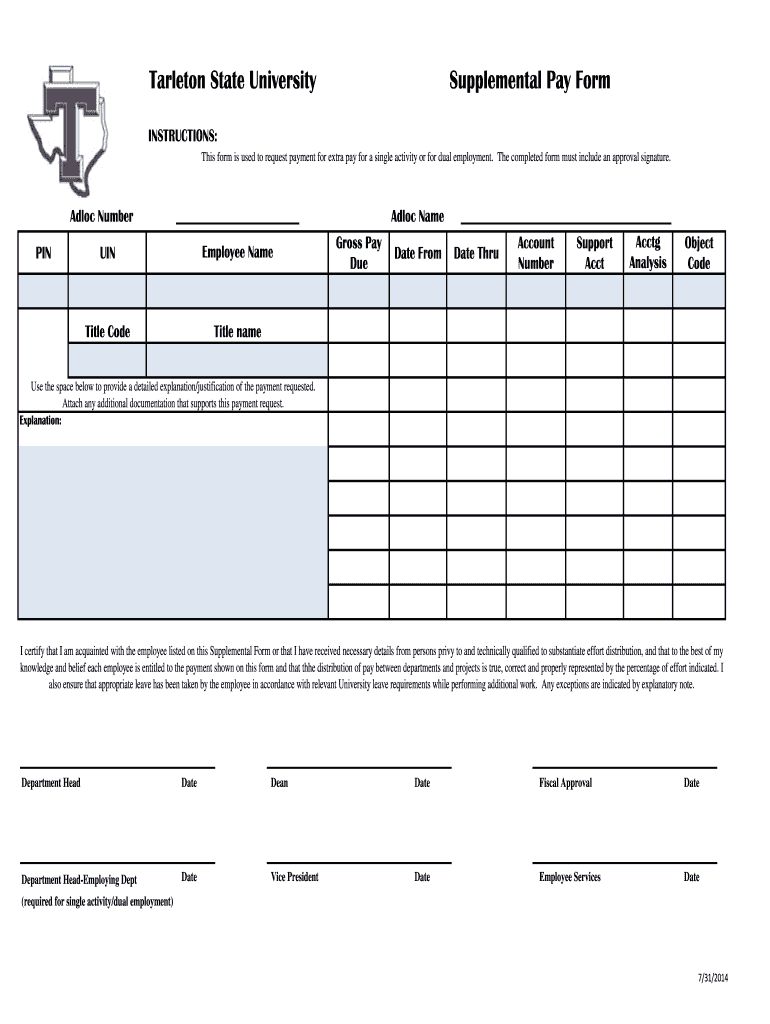

This form is used to request payment for extra pay for a single activity or for dual employment, requiring approval signatures from relevant university officials.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign supplemental pay form

Edit your supplemental pay form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your supplemental pay form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing supplemental pay form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit supplemental pay form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out supplemental pay form

How to fill out Supplemental Pay Form

01

Gather all necessary documentation, such as pay records or contracts.

02

Obtain a copy of the Supplemental Pay Form from your employer or human resources.

03

Fill out your personal information, including your name, employee ID, and department.

04

Provide the dates for which you are requesting supplemental pay.

05

Detail the reason for the supplemental pay request, explaining any specific circumstances.

06

Include the calculation of the additional pay amount being requested.

07

Review the form for any errors or missing information.

08

Submit the completed form to the designated person or department, adhering to submission deadlines.

Who needs Supplemental Pay Form?

01

Employees seeking additional compensation for extra duties performed.

02

Staff requesting reimbursement for expenses incurred during work-related activities.

03

Individuals entitled to bonuses or incentive payments due to performance.

Fill

form

: Try Risk Free

People Also Ask about

What is the supplemental pay?

Supplemental pay is an employee's additional income or compensation on top of their regular base earnings. Supplemental pay is also referred to as supplemental income and includes an employee's additional earnings, such as overtime, bonuses, or sick pay.

What is an example of a supplemental pay?

Supplemental pay is monetary compensation that an employer gives an employee in addition to their base salary. You'll often hear it referred to as supplemental wages, and it includes overtime pay, incentive pay, bonuses, accumulated sick pay, or anything in addition to someone's regular earnings.

What is the supplemental pay policy for CSU?

Supplemental pay may not exceed 20% of the individual's annualized salary or $25,000 in a given fiscal year, whichever is more. Exceptions to this requirement may be considered and approved by the Provost/Executive Vice President.

What is the supplemental pay policy?

ing to the IRS, supplemental pay includes: Overtime pay. Supplementary wages earned by a non-exempt employee who works any hours over their 40-hour workweek. ing to the FLSA (Fair Labor Standards Act), you must pay employees 1.5 times their regular rate of pay for every additional hour worked.

Is supplemental pay a bonus?

The IRS considers bonuses to be “supplemental wages.” A supplemental wage is money paid to an employee that isn't part of his or her regular wages, ing to the IRS. In general, bonuses of any kind, including signing bonuses and severance pay, fit into the supplemental wages category.

What is the supplemental pay?

Supplemental pay is an employee's additional income or compensation on top of their regular base earnings. Supplemental pay is also referred to as supplemental income and includes an employee's additional earnings, such as overtime, bonuses, or sick pay.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Supplemental Pay Form?

The Supplemental Pay Form is a document used to report additional compensation paid to an employee, such as bonuses, commissions, or other supplementary payments that are not part of the base salary.

Who is required to file Supplemental Pay Form?

Employers who provide supplemental pay to their employees must file the Supplemental Pay Form to ensure proper reporting of income for tax purposes.

How to fill out Supplemental Pay Form?

To fill out the Supplemental Pay Form, include details such as the employee's name, social security number, amount of supplemental pay, payment date, and any relevant employer information.

What is the purpose of Supplemental Pay Form?

The purpose of the Supplemental Pay Form is to accurately report any additional compensation paid to employees, ensuring compliance with tax regulations and proper documentation for both employers and employees.

What information must be reported on Supplemental Pay Form?

The information that must be reported on the Supplemental Pay Form includes the employee's personal details, the type and amount of supplemental pay, payment date, and the employer's tax identification number.

Fill out your supplemental pay form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Supplemental Pay Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.