Get the free pa w4 form

Show details

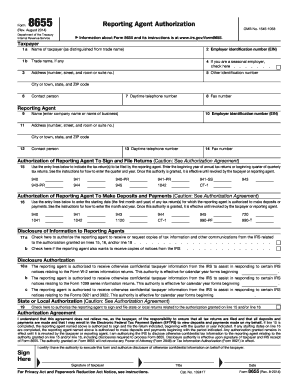

REV-420 AS 06-07 COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES PO BOX 280904 HARRISBURG PA 17128-0904 EMPLOYEE S STATEMENT OF NONRESIDENCE IN PENNSYLVANIA AND AUTHORIZATION TO WITHHOLD OTHER STATE S INCOME TAX PLEASE PRINT OR TYPE Employer Instructions You must keep a copy of this form on file for each employee who claims exemption from withholding of Pennsylvania Personal Income Tax on compensation receiv...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pa w 4 form

Edit your pennsylvania w4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa w 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa state w4 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pa w4 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa w4 form

How to fill out pa state withholding form:

01

Obtain the form: You can download the PA state withholding form from the Pennsylvania Department of Revenue's website or request a physical copy from their offices.

02

Provide personal information: Fill in your name, Social Security number, address, and other relevant personal details as requested on the form.

03

Enter your employment information: Provide details about your employer, including their name, address, and employer ID number.

04

Determine your withholding allowances: Use the worksheet provided with the form to calculate the number of allowances you are eligible for. This will help determine how much tax will be withheld from your paycheck.

05

Specify additional withholding: If you want to have additional tax withheld from each paycheck, indicate the amount in the appropriate section of the form.

06

Sign and date the form: After reviewing the information provided, sign and date the form to certify its accuracy.

07

Submit the form: Submit the completed form to your employer for processing.

Who needs pa state withholding form:

01

Employees working in Pennsylvania: Any individual who is employed within the state of Pennsylvania and earns taxable income must fill out the PA state withholding form.

02

Pennsylvania residents working out-of-state: If you are a Pennsylvania resident but work in a different state, you may still need to complete the PA state withholding form to ensure proper tax withholding for your home state.

03

Non-resident employees working in Pennsylvania: Non-residents who work in Pennsylvania but do not reside in the state may also need to fill out the PA state withholding form to ensure accurate tax withholding.

Please note that this response is provided for informational purposes only and does not constitute professional tax advice. It is recommended to consult a tax professional or the Pennsylvania Department of Revenue for specific guidance regarding your individual tax situation.

Fill

form

: Try Risk Free

People Also Ask about

Does PA require a state tax form?

If you are a PA resident, nonresident or a part-year PA resident, you must file a 2022 PA tax return if: • You received total PA gross taxable income in excess of $33 during 2022, even if no tax is due with your PA return; and/or • You incurred a loss from any transaction as an individual, sole proprietor, partner in a

Does Pennsylvania have a state w4 form?

All new employees for your business must complete a federal Form W-4. Unlike many other states, Pennsylvania does not have a separate state equivalent to Form W-4, but instead relies on the federal form.

What is the PA state withholding tax?

Definition of an Employer Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

How do I get a PA state tax form?

Many forms are available for download on the Internet. Order forms online to be mailed to you. You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

What is the 2023 PA state withholding?

Pennsylvania Income Tax Rate The withholding rate for 2023 remains at 3.07%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pa w4 form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your pa w4 form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the pa w4 form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your pa w4 form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit pa w4 form straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing pa w4 form.

What is pa state withholding form?

The PA State Withholding Form is a document that employers use to withhold state income tax from employees' wages.

Who is required to file pa state withholding form?

Employers in Pennsylvania are required to file the PA State Withholding Form.

How to fill out pa state withholding form?

To fill out the PA State Withholding Form, employers need to provide their business information, employee information, and the amount of tax to be withheld from each employee's wages.

What is the purpose of pa state withholding form?

The purpose of the PA State Withholding Form is to ensure that employers properly withhold and remit state income tax on behalf of their employees.

What information must be reported on pa state withholding form?

The PA State Withholding Form requires employers to report their business name, address, tax identification number, and employee information such as name, Social Security number, and wages.

Fill out your pa w4 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pa w4 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.