Get the free HOMEBUYER APPLICATION - huntingtonbeachca

Show details

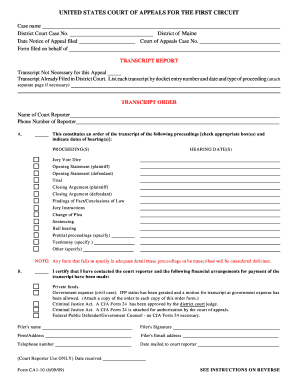

This document is an application for potential homebuyers to participate in the Inclusionary Housing Program of Huntington Beach, which includes eligibility requirements, income limitations, and required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homebuyer application - huntingtonbeachca

Edit your homebuyer application - huntingtonbeachca form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homebuyer application - huntingtonbeachca form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homebuyer application - huntingtonbeachca online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit homebuyer application - huntingtonbeachca. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homebuyer application - huntingtonbeachca

How to fill out HOMEBUYER APPLICATION

01

Collect necessary documents: Gather your financial statements, tax returns, and identification.

02

Fill in personal information: Provide your name, address, and contact details.

03

Detail your employment history: Include your current employer, position, and duration of employment.

04

List your income sources: Specify your salary, bonuses, and any other income.

05

Disclose your financial obligations: Include existing loans, credit cards, and other debts.

06

Indicate your desired loan amount: State how much you wish to borrow.

07

Review and double-check: Ensure all information is accurate and complete.

08

Submit the application: Send the completed form along with any required documentation.

Who needs HOMEBUYER APPLICATION?

01

Individuals or couples looking to purchase their first home.

02

Anyone interested in obtaining financing for a home purchase.

03

People who wish to apply for government assistance or programs for homebuyers.

Fill

form

: Try Risk Free

People Also Ask about

What are the qualifications for a first time home buyer in Illinois?

Homebuyers must have a minimum credit score of 640; make a minimum contribution of $1,000 or 1% of the purchase price toward the sale, whichever is greater; and have an annual income that meets the threshold set for their county, the number of people in their household, and the type of property they're buying.

What is the $10 000 first-time home buyer grant in PA?

Government-backed mortgage loans The Federal Housing Administration (FHA), Department of Veterans Affairs (VA) and Department of Agriculture (USDA) back mortgage programs that are often an option for first-time homebuyers.

What is the income limit for the first time home buyer tax credit?

The full credit is available to taxpayers with MAGI up to $75,000, or $150,000 for joint filers. Those with MAGI between $75,000 and $95,000, or $150,000 and $170,000 for joint filers, are eligible for a reduced credit. Those with higher incomes do not qualify.

What is the $10,000 grant for first time home buyers in Illinois?

The IHDAccess Repayable Mortgage program offers assistance of up to 10% of purchase price (up to $10,000) alongside your 30-year, fixed-rate mortgage. It's an interest-free loan for down payment and closing costs and is repayable monthly over 10 years.

What is the income limit for first-time home buyers in Illinois?

The Philly First Home Program provides first-time homebuyer's assistance up to $10,000 or 6% of the purchase price (whichever is less), to help pay for the down payment or closing costs.

How do English mortgages work?

There are two main types of repayment mortgage: Fixed rate mortgage – your interest rate is guaranteed to stay the same for a set period. Tracker mortgage – your interest rate tracks the Bank of England Base Rate, plus a bit more. This means your monthly repayments and interest rates can go up or down during your term.

What is the minimum income to qualify for a house?

There's no universal minimum income required for mortgage loans. Your approval depends on the mortgage amount, your debt-to-income ratio, credit score, and other factors. However, you need to prove that you have a stable income that's sufficient to cover the mortgage payments, property taxes, and homeowner's insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HOMEBUYER APPLICATION?

The HOMEBUYER APPLICATION is a form that prospective homebuyers submit to initiate the process of purchasing a home, often to qualify for financial assistance or mortgage lending.

Who is required to file HOMEBUYER APPLICATION?

Individuals intending to purchase a home, especially first-time buyers or those seeking financial assistance from state or local programs, are typically required to file a HOMEBUYER APPLICATION.

How to fill out HOMEBUYER APPLICATION?

To fill out the HOMEBUYER APPLICATION, provide personal information, financial details, and information about the property being purchased. Ensure that all sections are completed accurately and review for any required documentation.

What is the purpose of HOMEBUYER APPLICATION?

The purpose of the HOMEBUYER APPLICATION is to assess the eligibility of applicants for mortgage loans and financial assistance programs, ensuring that they meet the necessary criteria to qualify for home ownership.

What information must be reported on HOMEBUYER APPLICATION?

The information reported on the HOMEBUYER APPLICATION typically includes personal identification details, income information, employment history, credit history, and specifics about the desired property.

Fill out your homebuyer application - huntingtonbeachca online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homebuyer Application - Huntingtonbeachca is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.