Get the free APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE - tnstate

Show details

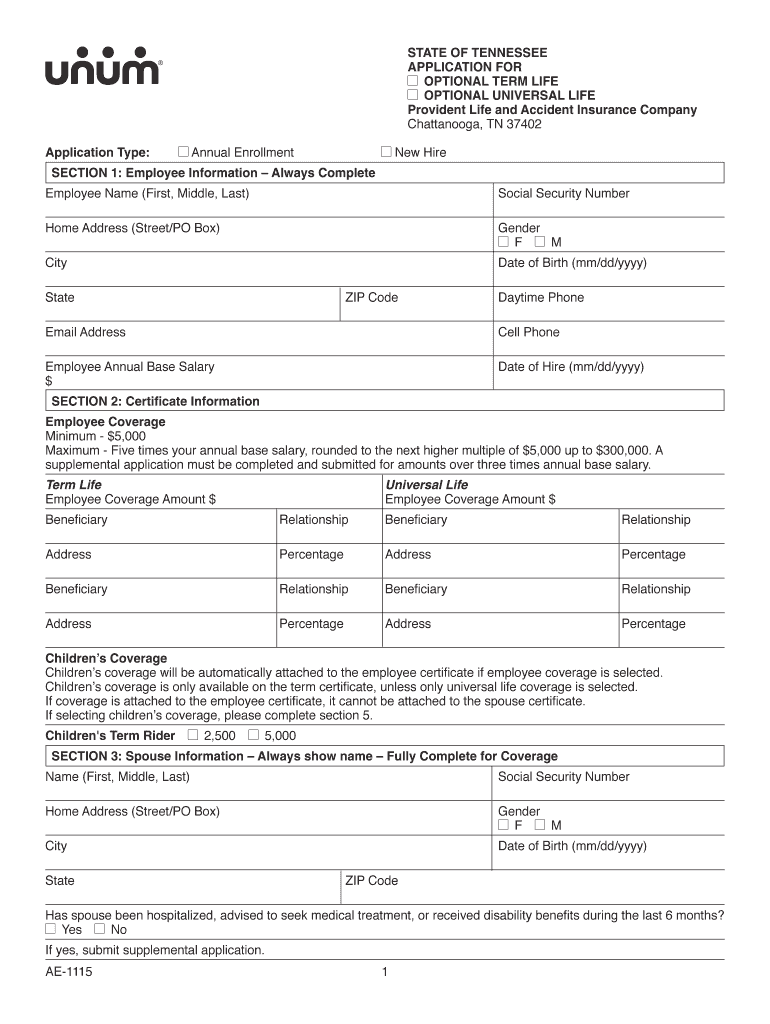

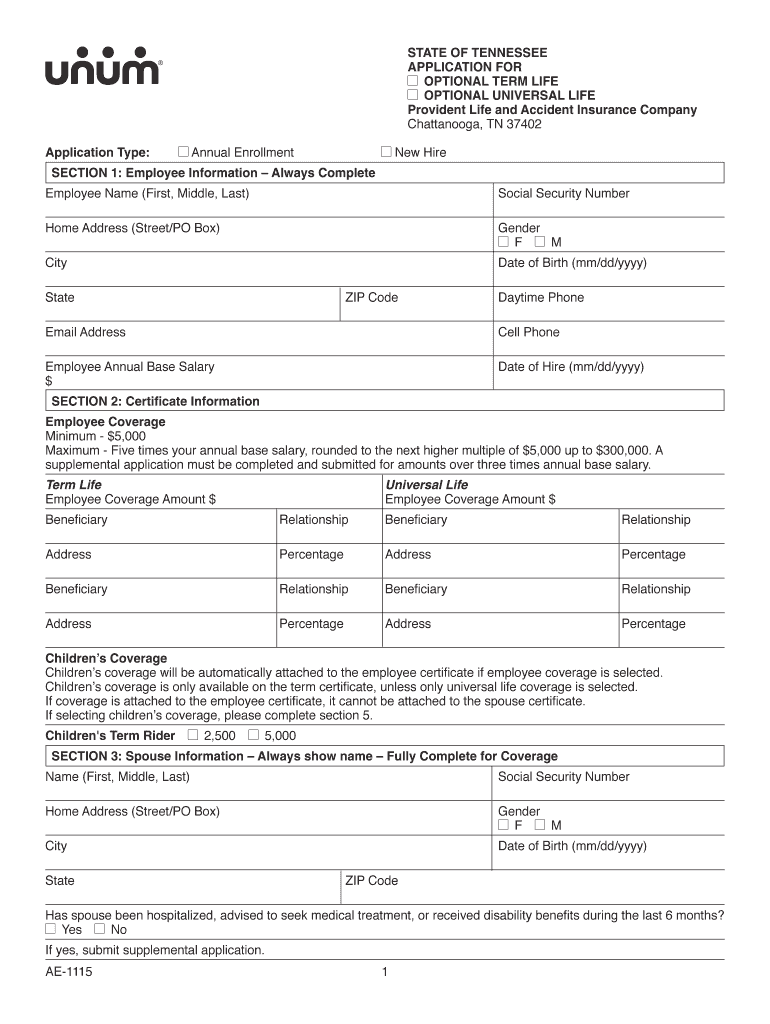

This document is an application for optional term and universal life insurance coverage provided by Provident Life and Accident Insurance Company. It collects personal and coverage details for employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for optional term

Edit your application for optional term form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for optional term form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for optional term online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for optional term. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for optional term

How to fill out APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE

01

Begin by downloading the APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE form from the insurance provider's website.

02

Start filling out your personal information in the first section, including your full name, address, date of birth, and contact information.

03

Provide details about your employment status and income in the next section.

04

Review the optional term life and optional universal life coverage options and choose the one that fits your needs.

05

Fill out the beneficiaries section by listing individuals or entities who will receive the benefits in the event of your passing.

06

Answer any health-related questions honestly, including medical history and current health status.

07

Review the premium payment options and select your preferred payment method.

08

Read through the terms and conditions carefully before signing the application.

09

Submit the completed application either online or by mailing it to the insurance provider.

Who needs APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

01

Individuals looking for additional financial protection for their families in case of untimely death.

02

People seeking to supplement their existing life insurance policies with optional term or universal coverage.

03

Employees offered optional life insurance benefits by their employer as part of their benefits package.

04

Individuals planning for future financial needs, such as paying off debts or funding children’s education.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between basic and optional life insurance?

Basic Term Life Insurance pays $5,000 to your beneficiary in the event of your death and includes $5,000 of accidental death & dismemberment (AD&D) coverage. Optional Term Life Insurance provides additional coverage, including AD&D coverage, up to four times your annual salary (Election 1, 2, 3 or 4).

Is optional Term Life Insurance worth it?

Even if you don't have a family dependent on you, there are many reasons why you should consider taking out an optional life insurance policy. Several unexpected costs arise after death such as funeral expenses and burial costs, medical expenses, and other costs that normally rise into the tens of thousands of dollars.

What does basic life insurance mean?

Basic life insurance offers a financial benefit to your beneficiaries in the event of your death, helping to provide for your loved ones. AD&D insurance complements this by offering additional coverage if you suffer severe injuries or death due to an accident.

What's the difference between basic life and voluntary life insurance?

Basic employee life insurance only provides a specific amount of coverage, but it is paid for by the employer at no cost to you; voluntary life insurance is optional coverage that you pay for.

Should I add optional life insurance?

Optional Life insurance can help protect your family's finances if something happens to you. This coverage can help provide financial support and stability to your family if you pass away. Optional Life insurance can help make things easier for the people you care about.

Should I get optional life insurance through my employer?

It's a good idea to take advantage of a group life insurance benefit if one is available to you — but it may not take care of all of your life insurance needs. In some cases, you might need additional coverage on top of the group policy.

What is the difference between basic life insurance and optional life insurance?

Basic life and basic AD&D is employer paid. Optional Life and optional AD&D is employee paid. In addition to purchasing optional life and AD&D for themselves, employees may also choose to purchase optional life and AD&D for their eligible dependents.

How does optional Term Life Insurance work?

Optional Term Life Insurance provides additional coverage, including AD&D coverage, up to four times your annual salary (Election 1, 2, 3 or 4). Maximum coverage is $400,000. The monthly premium is based on your coverage election, your salary and your age. Coverage begins to decrease when you reach age 70.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE is a form used by individuals to apply for additional life insurance options, specifically term life and optional universal life insurance coverage.

Who is required to file APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

Individuals who wish to obtain optional term life or optional universal life insurance coverage are required to file this application.

How to fill out APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

To fill out the application, applicants need to provide personal information, including name, date of birth, beneficiary details, and any relevant health information, following the instructions provided on the form.

What is the purpose of APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

The purpose of the application is to assess the applicant's eligibility for optional life insurance coverage and to gather necessary information for underwriting.

What information must be reported on APPLICATION FOR OPTIONAL TERM LIFE OPTIONAL UNIVERSAL LIFE?

The application must report personal identification information, health history, lifestyle choices, coverage amount requested, and beneficiary information.

Fill out your application for optional term online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Optional Term is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.