Get the free PCI Credit Card Processing Authorization Form - tntech

Show details

This form is used by Tennessee Technological University for authorizing PCI credit card processing, including details such as Merchant ID, fiscal year, employee information, and requisite signatures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pci credit card processing

Edit your pci credit card processing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pci credit card processing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pci credit card processing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pci credit card processing. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pci credit card processing

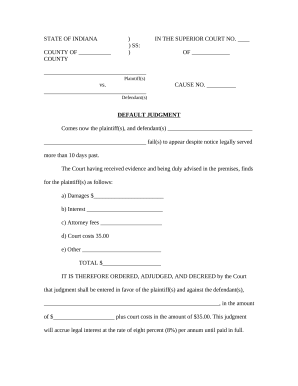

How to fill out PCI Credit Card Processing Authorization Form

01

Start by obtaining the PCI Credit Card Processing Authorization Form from your payment processor or bank.

02

Complete the merchant's information section, including your business name, address, and contact details.

03

Provide your business's tax identification number (TIN) or social security number if applicable.

04

Fill out the credit card processor's information, including their name and contact information.

05

Specify the types of transactions you will be processing (e.g., credit, debit, recurring payments).

06

Indicate the volume of card transactions you expect to process monthly.

07

Sign and date the form where indicated, confirming that the information provided is accurate.

08

Submit the form according to the instructions provided by your payment processor or bank.

Who needs PCI Credit Card Processing Authorization Form?

01

Businesses that accept credit card payments and require authorization to process transactions.

02

Merchants who need to comply with PCI DSS (Payment Card Industry Data Security Standards) requirements.

03

Retailers, online stores, and service providers using credit card processing services.

Fill

form

: Try Risk Free

People Also Ask about

Can you authorize someone to use your credit card?

A holder of a credit card generally cannot add a user to the card without the permission of the credit card company. The holder of the credit card is generally responsible for all charges, unless the credit card is stolen. However, an oral agreement between a credit card holder can generally be enforced in court.

Can you use an authorization letter for a credit card?

A letter of authorization for credit card use is a digital or physical form permitting businesses to charge a payment method. The document says the cardholder agrees to the merchant's terms for the specified products or services. Customers must sign the credit card authorization form electronically or physically.

Is it okay to send a credit card authorization form over email?

PCI DSS requirement 4.2 states that credit card information must not be captured, transmitted, or stored via email.

How to write a credit card authorization form?

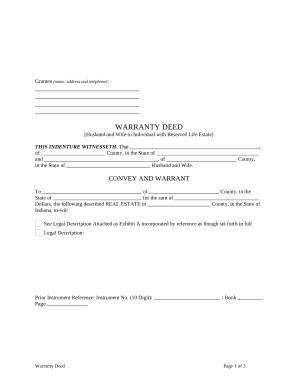

Typically it contains: The cardholder's credit card information: Card type, Name on card, Card number, Expiration date. The merchant's business information. Cardholder's billing address. Language authorizing the merchant to charge the customer's card on file. Name and signature of the cardholder. Date.

Are credit card authorization forms legal?

PCI DSS requirement 4.2 states that credit card information must not be captured, transmitted, or stored via email.

Is it safe to email a credit card authorization form?

You may assign an authorized representative to receive the card on your behalf in case you will not be around to receive the card upon delivery.

Is it safe to give credit card authorization form?

Physical credit authorization forms have many security issues: They may get lost, stolen, or mishandled by employees. Having to type data manually may lead to errors and financial discrepancies. Physical forms are not encrypted, meaning anyone can read and understand the information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PCI Credit Card Processing Authorization Form?

The PCI Credit Card Processing Authorization Form is a document used by businesses to obtain authorization for processing credit card transactions in compliance with Payment Card Industry (PCI) standards.

Who is required to file PCI Credit Card Processing Authorization Form?

All businesses that accept, process, or store credit card information must file the PCI Credit Card Processing Authorization Form to ensure compliance with PCI standards.

How to fill out PCI Credit Card Processing Authorization Form?

To fill out the PCI Credit Card Processing Authorization Form, businesses should provide required details such as business name, contact information, and the credit card processing methods used, along with signatures from authorized personnel.

What is the purpose of PCI Credit Card Processing Authorization Form?

The purpose of the PCI Credit Card Processing Authorization Form is to ensure that businesses comply with PCI regulations and to protect sensitive credit card information during transactions.

What information must be reported on PCI Credit Card Processing Authorization Form?

The information that must be reported includes the business name, address, contact information, types of credit card transactions processed, and the name and signature of the individual authorizing the processing.

Fill out your pci credit card processing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pci Credit Card Processing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.