Get the free Application to Qualify for Resident Tuition Based on Employment - tamiu

Show details

This document serves as an application for non-resident tuition exemption for employees, spouses, and dependents of Texas A&M International University who qualify based on their employment status.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to qualify for

Edit your application to qualify for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to qualify for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application to qualify for online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application to qualify for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to qualify for

How to fill out Application to Qualify for Resident Tuition Based on Employment

01

Gather required documentation, including proof of employment and residency.

02

Complete the application form with accurate personal information.

03

Provide details about your employment, including the employer's name and address.

04

Include any additional information requested about your residency status.

05

Review the application to ensure all information is correct and complete.

06

Submit the application along with any supporting documents by the designated deadline.

Who needs Application to Qualify for Resident Tuition Based on Employment?

01

Individuals who are employed in the state and wish to qualify for resident tuition rates.

02

Students moving to a new state for employment who want to establish residency for tuition purposes.

03

Employees who have recently relocated and meet specific residency qualifications.

Fill

form

: Try Risk Free

People Also Ask about

How to qualify for in-state tuition at the University of Florida?

If the student is a dependent student, eligibility for in-state tuition depends on the residence of the parent(s). If one parent lives in the state, that is usually sufficient. There may, however, be additional criteria, such as the student having attended and graduated from secondary school in the state.

Which parent best qualifies me for in-state tuition?

Take advantage of your parent's job. Some schools offer in-state tuition if your parents are in the military, first responders, or educators. Policies vary, so reach out to each school you're considering to see if this is an option. It could mean big savings down the road.

Which parent best qualifies me for in-state tuition?

If the student is a dependent student, eligibility for in-state tuition depends on the residence of the parent(s). If one parent lives in the state, that is usually sufficient. There may, however, be additional criteria, such as the student having attended and graduated from secondary school in the state.

How do I know if I qualify for Florida residency for tuition purposes?

A "Florida resident for tuition purposes" is a person who has, or a dependent person whose parent, legal guardian, or spouse, has established and maintained legal residence in Florida for at least twelve months before the first day of the academic term.

Can you claim residency in two states for college?

State Residence and Domicile A person can have multiple residences but only one domicile. People pay taxes and vote based on the location in which they are domiciled. Eligibility for in-state tuition is based on domicile, not residence.

How do you qualify for instate tuition in the US?

Most states require the student to have been a state resident and physically present for at least one year (12 consecutive months consisting of 365 days) prior to initial enrollment or registration.

How to get in-state tuition if you don't live there?

Take advantage of your parent's job. Some schools offer in-state tuition if your parents are in the military, first responders, or educators. Policies vary, so reach out to each school you're considering to see if this is an option. It could mean big savings down the road.

How long do you have to live in a state to get financial aid?

Most states require at least 12 months of residency prior to beginning classes for a student to be considered a state resident. Contact your college's or career/trade school's financial aid office for help answering permanent address questions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

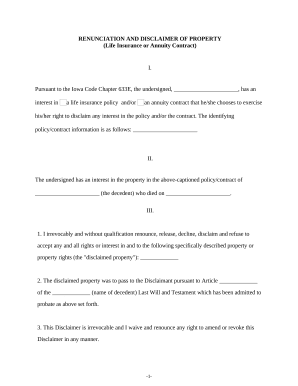

What is Application to Qualify for Resident Tuition Based on Employment?

The Application to Qualify for Resident Tuition Based on Employment is a formal request that allows individuals employed in the state to qualify for resident tuition rates at public institutions, helping them access educational opportunities at a lower cost.

Who is required to file Application to Qualify for Resident Tuition Based on Employment?

Individuals who are employed in the state and wish to obtain resident tuition rates need to file this application. This typically includes full-time employees, their dependents, or individuals who have maintained a physical presence in the state for a designated period.

How to fill out Application to Qualify for Resident Tuition Based on Employment?

To fill out the application, individuals must provide personal information, employment details, proof of employment, and any required documentation that verifies their residency and employment status in the state.

What is the purpose of Application to Qualify for Resident Tuition Based on Employment?

The purpose of the application is to determine eligibility for resident tuition rates based on employment, ensuring that individuals who contribute to the state's economy through their jobs can access higher education at a more affordable rate.

What information must be reported on Application to Qualify for Resident Tuition Based on Employment?

The application typically requires personal identifying information, details about the employment, duration of employment, proof of residency, and any other supporting documentation that may be necessary to establish eligibility for resident tuition.

Fill out your application to qualify for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Qualify For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.