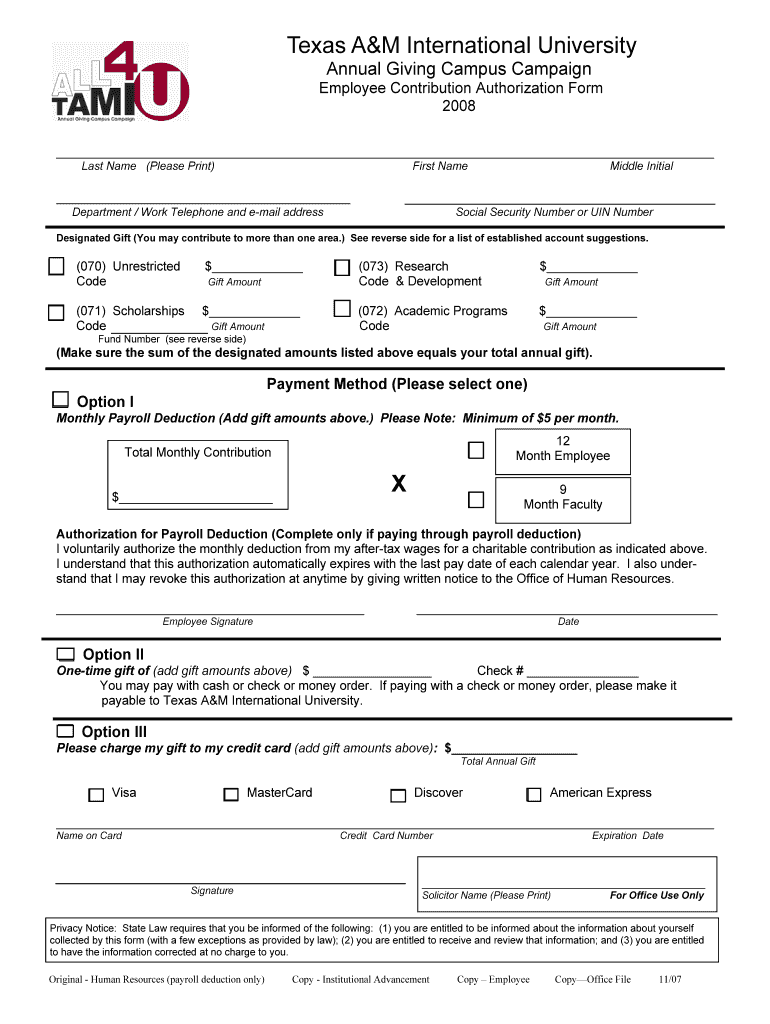

Get the free Employee Contribution Authorization Form - tamiu

Show details

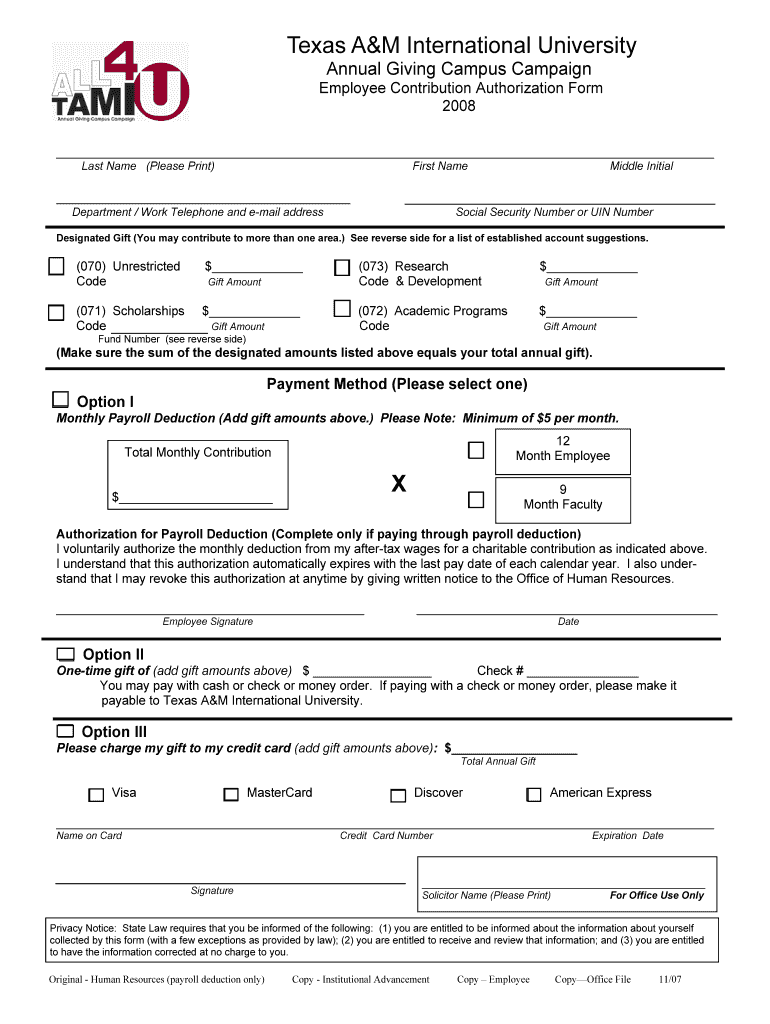

This form allows employees at Texas A&M International University to authorize contributions to various funds, including scholarships and academic programs, through payroll deductions or one-time donations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee contribution authorization form

Edit your employee contribution authorization form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee contribution authorization form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee contribution authorization form online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee contribution authorization form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee contribution authorization form

How to fill out Employee Contribution Authorization Form

01

Obtain the Employee Contribution Authorization Form from your HR department or company website.

02

Enter your personal information, including your name, employee ID, and department.

03

Indicate the type of contribution you wish to authorize (e.g., retirement plan, health insurance).

04

Specify the amount or percentage of your salary you wish to contribute.

05

Review the terms and conditions associated with the contributions, noting any deadlines.

06

Sign and date the form to verify your authorization.

07

Submit the completed form to your HR department or designated personnel.

Who needs Employee Contribution Authorization Form?

01

All employees who wish to participate in a contribution program within the company.

02

Employees looking to contribute to retirement plans, health savings accounts, or any other company-sponsored benefit.

03

New employees enrolling in benefit programs for the first time.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of employee authorization?

Having an Employment Authorization Document (Form I-766/EAD) is one way to prove that you are authorized to work in the United States for a specific time period. To request an EAD, you generally must file Form I-765, Application for Employment Authorization.

Who gives employment authorization?

Depending on your immigration category, your EAD work permit will be good for 1 or 2 years. If the U.S. Citizenship and Immigration Services (USCIS) approves your request, they may send your EAD in the mail. Or you may be required to get it in person. Find your nearest USCIS office.

What is an employee authorization form?

Having an Employment Authorization Document (Form I-766/EAD) is one way to prove that you are authorized to work in the United States for a specific time period. To request an EAD, you generally must file Form I-765, Application for Employment Authorization.

What is a form of employment authorization?

An EAD gives a person legal status to work in the United States but has fewer privileges than a green card. It shows an expiration date (usually one year from date issued) and is renewable. Any alien with a valid Employment Authorization Document (Form I-766 or Form I-688B) can be issued a Social Security number.

What is an employer authorization form?

Use Form I-9, Employment Eligibility Verification, to verify the identity and employment authorization of individuals hired for employment in the United States. All U.S. employers must properly complete Form I-9 for every individual they hire for employment in the United States. This includes citizens and aliens.

What is the tax form for 401k contributions?

Formally known as IRS Form 5500, the 401k tax form is a mandatory report that provides the Internal Revenue Service with information about the 401k's financial status, operations, and compliance with government regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Contribution Authorization Form?

The Employee Contribution Authorization Form is a document that allows employees to authorize deductions from their wages for contributions to retirement accounts, benefits, or other programs.

Who is required to file Employee Contribution Authorization Form?

Typically, employees who wish to participate in a retirement plan or benefit program that requires payroll deductions must file the Employee Contribution Authorization Form.

How to fill out Employee Contribution Authorization Form?

To fill out the form, employees must provide their personal information, specify the amount they wish to contribute, select the plan or account for contributions, and sign the form to authorize the deductions.

What is the purpose of Employee Contribution Authorization Form?

The purpose of the form is to ensure that employees can officially authorize their employers to deduct specified contributions from their paychecks for designated benefit plans.

What information must be reported on Employee Contribution Authorization Form?

The form typically requires the employee's name, employee ID, contribution amount, type of contribution, frequency of deductions, and the employee's signature and date.

Fill out your employee contribution authorization form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Contribution Authorization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.