Get the free Manual Check Request for Non-Exempt - ttuhsc

Show details

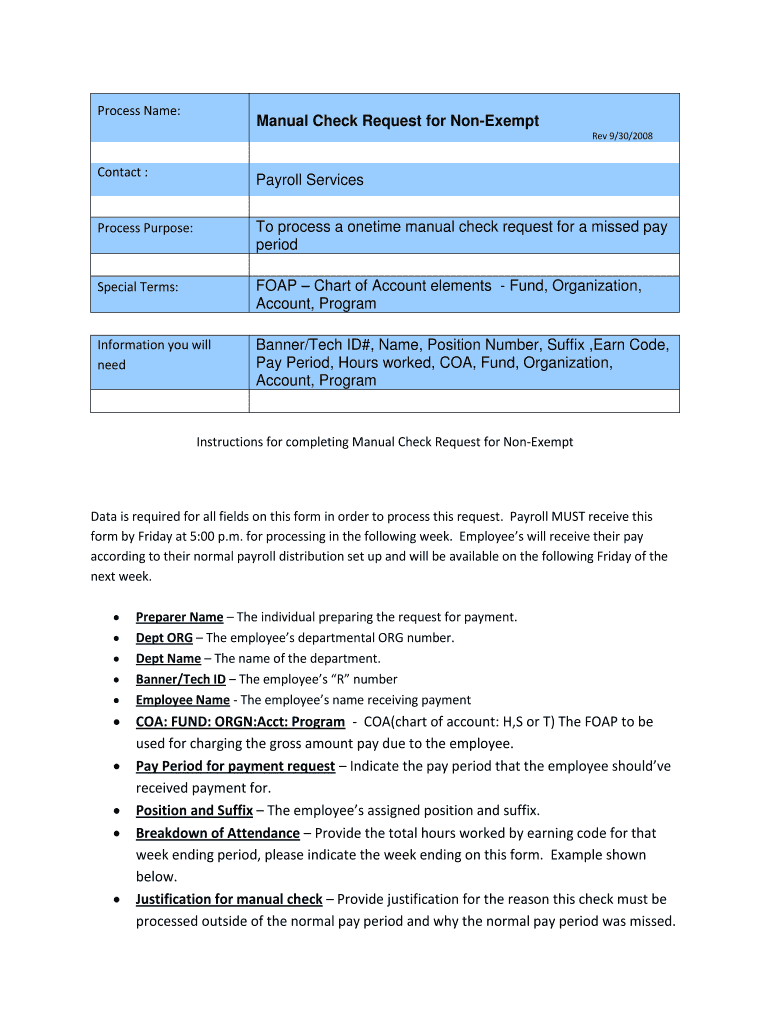

This document is used to request a manual check for an employee who missed the regular pay period, requiring specific payroll information and justifications.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manual check request for

Edit your manual check request for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manual check request for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit manual check request for online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manual check request for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

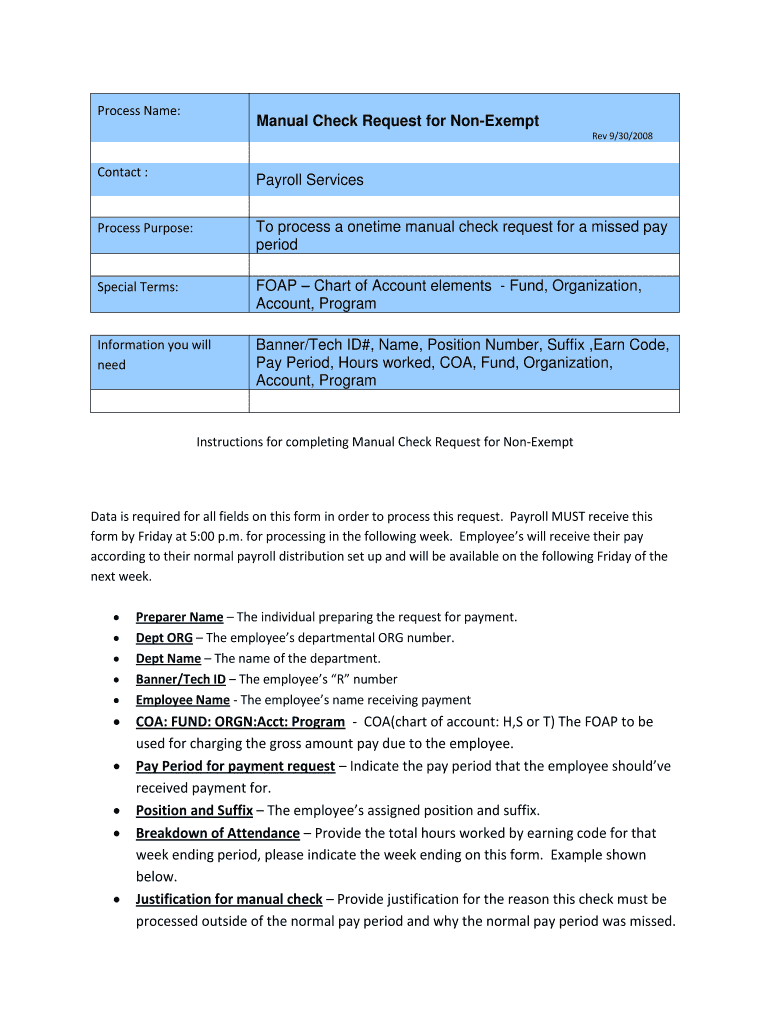

How to fill out manual check request for

How to fill out Manual Check Request for Non-Exempt

01

Obtain the Manual Check Request form from your HR or finance department.

02

Fill in the employee's personal information, including name, employee ID, and department.

03

Specify the reason for the manual check request.

04

Enter the amount that needs to be processed.

05

Provide the date the payment is needed by.

06

Obtain necessary approvals from your manager or supervisor.

07

Submit the completed form to the finance department for processing.

Who needs Manual Check Request for Non-Exempt?

01

Employees who are non-exempt and require payment for hours worked outside of the regular payroll schedule.

02

Employees who have incurred expenses that need reimbursement outside of standard payment cycles.

Fill

form

: Try Risk Free

People Also Ask about

What does a manual check mean?

A manual is a check that was issued to an employee outside of the payroll system. These checks could be for: an error in payroll. reimbursement for a business expense. or even given as a bonus for the employee.

How long does manual check take?

Usually, it takes about two business days for a check to clear. However, this can vary from check to check. It's important to review your financial institution's deposit agreement, which will specify how long they typically hold checks.

How to deposit a manual check?

How to Deposit or Cash a Check at the Bank Step 1: Bring a valid ID. Be sure to have a valid form of ID with you when you go to your bank to deposit a check. Step 2: Endorse the check. Once you arrive at the branch, flip the check over to the back and look for two grey lines. Step 3: Present the check to the banker.

What is a manual check request?

Manual check requests are to be used for individuals who will suffer financial hardship if not paid; otherwise, they will receive back pay in the next payroll cycle. The Payroll Office reserves the right to approve a manual check.

How do you write a manual check?

How to Write a Check: Step-by-Step Instructions and Examples Step 1: Date the check. Write the date on the line at the top right-hand corner. Step 2: Who is this check for? Step 3: Write the payment amount in numbers. Step 4: Write the payment amount in words. Step 5: Write a memo. Step 6: Sign the check.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

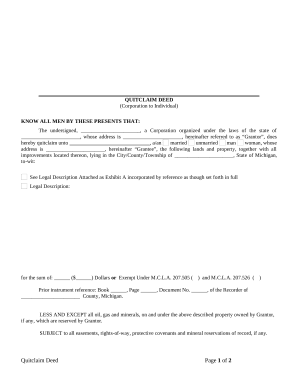

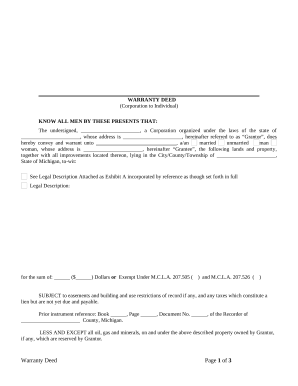

What is Manual Check Request for Non-Exempt?

A Manual Check Request for Non-Exempt is a form used to initiate a request for a manual payment to employees who do not qualify for exempt status under employment regulations.

Who is required to file Manual Check Request for Non-Exempt?

Employees, payroll administrators, or managers are required to file a Manual Check Request for Non-Exempt when a manual payment needs to be issued to non-exempt employees.

How to fill out Manual Check Request for Non-Exempt?

To fill out a Manual Check Request for Non-Exempt, provide employee details, the reason for the manual payment, the amount to be paid, and appropriate approvals from management.

What is the purpose of Manual Check Request for Non-Exempt?

The purpose of the Manual Check Request for Non-Exempt is to facilitate timely manual payments to non-exempt employees for hours worked or other compensatory reasons that may not have been processed in the regular payroll cycle.

What information must be reported on Manual Check Request for Non-Exempt?

The information that must be reported includes employee name, employee ID, payment amount, reason for the request, department, and the required signatures for approval.

Fill out your manual check request for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manual Check Request For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.