Get the free The Charitable IRA Rollover Has Been Extended for 2009 - twu

Show details

This document provides information on how to make charitable contributions to the Texas Woman’s University (TWU) Foundation through IRA rollovers, as well as options for bequests and endowments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form charitable ira rollover

Edit your form charitable ira rollover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form charitable ira rollover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form charitable ira rollover online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form charitable ira rollover. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form charitable ira rollover

How to fill out The Charitable IRA Rollover Has Been Extended for 2009

01

Verify your eligibility: Ensure you are 70½ years or older to qualify for the Charitable IRA Rollover.

02

Consult your financial institution: Contact your IRA custodian to confirm the rollover process.

03

Select your charity: Choose a qualified 501(c)(3) organization to receive your charitable contribution.

04

Determine the amount: Decide how much of your IRA funds you wish to donate, keeping in mind the annual limit of $100,000.

05

Request a direct transfer: Instruct your IRA custodian to transfer the specified amount directly to the chosen charity.

06

Obtain documentation: Ensure you receive a receipt from the charity for your tax records, confirming the donation.

Who needs The Charitable IRA Rollover Has Been Extended for 2009?

01

Individuals aged 70½ or older who have traditional IRAs.

02

Taxpayers looking to meet their required minimum distribution (RMD) while reducing taxable income.

03

Charitable organizations that rely on donations from IRA rollovers to support their missions.

Fill

form

: Try Risk Free

People Also Ask about

Can I donate my IRA to a donor-advised fund?

Upon death, your IRA assets can fund the donor-advised fund. Donations can then be distributed to charities immediately or over time through an endowed giving program.

What assets can be contributed to a donor-advised fund?

What You Can Donate Cash. Cash contributions can be used to open or add to your donor-advised fund. Non-Cash Assets. Publicly Traded Securities. Restricted and Control Stock. Closely Held Business Interests. Hedge Fund Interests and Private Equity. Real Estate. Fine Art, Collectibles or Other Tangible Personal Property.

Can you fund a donor-advised fund with an inherited IRA?

IRA funds can still be used to fund a DAF; but, the individual would first need to receive their RMD, and then subsequently contribute a portion or the full amount of their RMD to the DAF. The RMD is then included in the individual's taxable income (but, a charitable deduction is available for those who itemize).

Can you transfer IRA assets to a donor-advised fund?

Can donors contribute IRA assets to a donor advised fund? Yes. However, since such distributions do not count as qualified distributions from IRAs under these special rules, donors will have to first recognize those distributions as income.

Can I donate an inherited IRA to a donor-advised fund?

However, you can choose to take your RMD as income and then use the funds to establish a donor-advised fund. This has the potential to give you a tax deduction depending on the size of the gift. This is a great option for beneficiaries under the age of 70 ½.

Can I donate money from my IRA to a charity?

The full amount of your retirement account will directly benefit the charity of your choice because charities do not pay income tax. You also have the option of dividing your retirement assets between charities and heirs. Lastly, you can support a cause you care about as part of your legacy.

What is a charitable IRA rollover?

The IRA charitable rollover allows taxpayers to make tax-free charitable gifts directly from their Individual Retirement Accounts to eligible charities, meeting the annual required minimum distribution.

Can an inherited IRA be donated?

A person over age 70½ who is the beneficiary of an inherited IRA may make charitable transfers from that IRA. Charitable transfers may be made from a SEP or a SIMPLE IRA if no employer contributions were made to the IRA in the year of the transfer.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

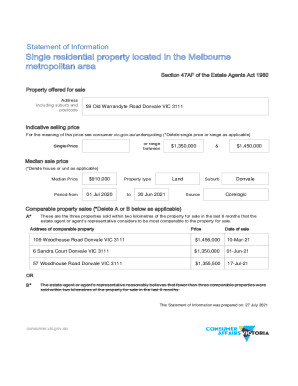

What is The Charitable IRA Rollover Has Been Extended for 2009?

The Charitable IRA Rollover is a provision that allows individuals aged 70½ or older to transfer up to $100,000 from their traditional IRAs directly to qualifying charities without incurring income tax on the withdrawal. This provision was extended for the year 2009.

Who is required to file The Charitable IRA Rollover Has Been Extended for 2009?

Individuals who are 70½ years old or older who wish to take advantage of the Charitable IRA Rollover must file. It is typically not required to file this specific rollover as income but anyone utilizing the rollover may need to report it on their tax returns.

How to fill out The Charitable IRA Rollover Has Been Extended for 2009?

To fill out the Charitable IRA Rollover for 2009, individuals should ensure that their IRA custodian sends the specified amount directly to a qualified charitable organization and keep records of the transaction. Form 1040 may need to be filled out to reflect this transaction and show that it is excluded from taxable income.

What is the purpose of The Charitable IRA Rollover Has Been Extended for 2009?

The purpose of the Charitable IRA Rollover is to encourage charitable giving while allowing retirees to fulfill their required minimum distribution without facing tax penalties. It also supports charities by providing them with financial contributions.

What information must be reported on The Charitable IRA Rollover Has Been Extended for 2009?

The information that must be reported includes the amount of the IRA rollover to charity, the name of the charity, and the date of the transfer. This information helps ensure that the rollover is not considered taxable income.

Fill out your form charitable ira rollover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Charitable Ira Rollover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.