Get the free T-NOTES - thiel

Show details

A weekly communication that shares updates, event announcements, and appreciation messages within the college community.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t-notes - thiel

Edit your t-notes - thiel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-notes - thiel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t-notes - thiel online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t-notes - thiel. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

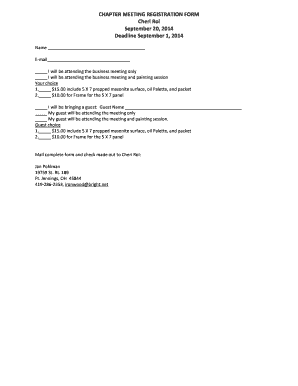

How to fill out t-notes - thiel

How to fill out T-NOTES

01

Gather necessary information such as your Social Security Number (SSN), income details, and tax identification.

02

Obtain the appropriate T-NOTES form from the IRS website or your tax professional.

03

Fill out the personal information section accurately, including your name, address, and filing status.

04

Report your income from various sources like wages, investments, and other taxable income.

05

Calculate your total tax liability using the provided instructions on the form.

06

Claim any deductions or credits you are eligible for to reduce your tax liability.

07

Review the filled form for accuracy and completeness before submission.

08

Submit the completed T-NOTES form to the IRS by the deadline.

Who needs T-NOTES?

01

Individuals who earn income and need to report it for tax purposes.

02

People who want to claim tax deductions or credits.

03

Self-employed individuals and freelancers who have specific tax obligations.

04

Taxpayers who are required to file federal income tax returns.

Fill

form

: Try Risk Free

People Also Ask about

How much does a $1000 treasury bill cost?

BondsYieldMonth US 3M 4.34 0.032% US 6M 4.31 0.101% US 52W 4.13 0.153% US 2Y 4.00 0.213%11 more rows

What is the downside to buying T bills?

The biggest downside of investing in T-bills is that you're going to get a lower rate of return compared to other investments, such as certificates of deposit, money market funds, corporate bonds or stocks. If you're looking to make some serious gains in your portfolio, T-bills may not be the best option.

What is a 1 year T bill paying today?

Basic Info. 1 Year Treasury Rate is at 4.15%, compared to 4.13% the previous market day and 5.20% last year. This is higher than the long term average of 2.99%.

What are the T notes?

Treasury notes, also known as T-notes, are intermediate-term U.S. debt securities available in two-, three-, five-, seven- and 10-year maturities.

What is the yield on a 6 month treasury bill?

Treasury bills, or bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x . 99986111 = $999.86111). * When the bill matures, you would be paid its face value, $1,000.

What is the T bill rate today?

Treasury Yield Curve 3 Year Treasury Rate3.96% 30-10 Year Treasury Yield Spread 0.53% 5 Year Treasury Rate 4.08% 6 Month Treasury Rate 4.35% 7 Year Treasury Rate 4.29%1 more row

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is T-NOTES?

T-NOTES, or Treasury Notes, are medium-term debt securities issued by the U.S. Department of the Treasury, typically maturing in two to ten years. They pay interest every six months and are used to finance government spending.

Who is required to file T-NOTES?

Investors and institutions that purchase T-NOTES are required to report their holdings for tax purposes, while financial advisors or brokers involved in the sale may have specific reporting obligations.

How to fill out T-NOTES?

To fill out documentation related to T-NOTES, you typically need to provide your personal information, details of the T-NOTES being acquired, such as the amount and maturity date, and any relevant tax identification numbers.

What is the purpose of T-NOTES?

The purpose of T-NOTES is to raise funds for government operations and projects, providing a safe investment choice for investors while also helping to manage the nation's debt.

What information must be reported on T-NOTES?

The information required to be reported on T-NOTES includes the purchase price, interest income received, maturity date, and any other relevant financing details. Additionally, investors may need to report gains or losses on the sale of T-NOTES.

Fill out your t-notes - thiel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-Notes - Thiel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.