Get the free Report of Travel Expenses - jefferson

Show details

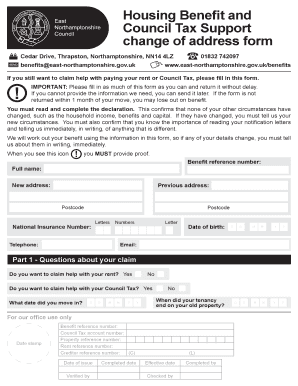

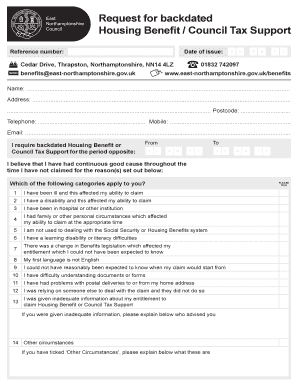

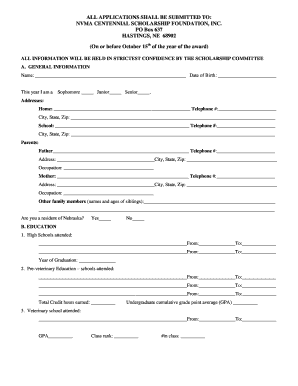

A form used by employees to report and itemize travel expenses incurred during official duties.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of travel expenses

Edit your report of travel expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of travel expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing report of travel expenses online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit report of travel expenses. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out report of travel expenses

How to fill out Report of Travel Expenses

01

Gather all receipts related to travel expenses including transportation, lodging, meals, and other incidentals.

02

Complete the header section of the Report of Travel Expenses by entering your name, date, and trip details.

03

List each expense in the designated sections, including the date, description, and amount for every receipt.

04

Attach copies of all receipts and any other necessary documentation to support your claims.

05

Review the report for accuracy and completeness before submission.

06

Submit the completed report to your supervisor or finance department as per company policy.

Who needs Report of Travel Expenses?

01

Employees who have traveled for business purposes.

02

Finance and accounting departments for reimbursement processing.

03

Managers needing to track travel expenses for budgeting.

04

Human resources for compliance and policy adherence.

Fill

form

: Try Risk Free

People Also Ask about

How to write off travel expenses?

You can deduct a portion of the travel if you are self-employed and the travel was necessary for your job. The IRS allows you to deduct expenses that are ``ordinary'' and ``necessary'' for your job. If it is ordinary and necessary for you to take the trip for your work, then the travel expenses are deductible.

How do you treat travel expenses in accounting?

Report travel expenses on Schedule C (Form 1040) under the following lines: Line 24a: travel (includes transportation, lodging, and other related costs). Line 24b: meals (remember, only 50% of eligible business meals are deductible).

How do you write travel expenses?

What are the Key Components of a Travel Expense Report? Date and Duration: The dates of your trip and the length of stay. Purpose of the Trip: Clearly state the reason for your travel. Detailed Expense List: Break down costs by category (transportation, accommodation, meals, etc.).

How to write a travel expense report?

How do you write a travel expense report? To write a travel expense report, list all expenses incurred during the trip, including dates, descriptions, and amounts. Attach relevant receipts for each expense and ensure all details align with your company's travel expense policy.

How do you record travel expenses?

How do you record travel expenses? Record travel expenses by documenting all costs related to travel, such as transportation, lodging, and meals. Use receipts and a travel expense form to track and categorize these expenses in your accounting system.

How do you use travel expenses in a sentence?

She received a little compensation for her efforts, usually travel expenses and a small percentage of the nightly income. Parents were reimbursed for travel expenses and their time, and children were given a small toy after the experimental session. He received no fee and paid his own travel expenses.

How do you say travel expenses?

Examples of 'travelling expenses' in a sentence travelling expenses The decrease was primarily due to decreased travelling expenses and administrative staff salary during the lock-down period. The year-over-year decrease was a result of decreased salary and travelling expenses.

How to write a travel report?

A standard template should include the following: Personal information – name, job title and company department. Trip information – a summary of the trip itinerary. Trip purpose – objectives and KPIs. Expense information – daily budget, as well as how to record and submit expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report of Travel Expenses?

A Report of Travel Expenses is a document used to itemize and summarize expenses incurred during business travel, often required for reimbursement.

Who is required to file Report of Travel Expenses?

Employees or individuals who have incurred expenses while traveling for work purposes are typically required to file a Report of Travel Expenses.

How to fill out Report of Travel Expenses?

To fill out a Report of Travel Expenses, one should list all travel-related expenses, categorizing them by type (e.g., lodging, meals, transportation), providing receipts, and summarizing total costs.

What is the purpose of Report of Travel Expenses?

The purpose of a Report of Travel Expenses is to track and document all costs associated with business travel for reimbursement and budget management.

What information must be reported on Report of Travel Expenses?

Information that must be reported includes dates of travel, locations visited, detailed descriptions of each expense, receipt attachments, and the total amount claimed.

Fill out your report of travel expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Travel Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.