Get the free USM REQUEST FOR TUITION REMISSION - towson

Show details

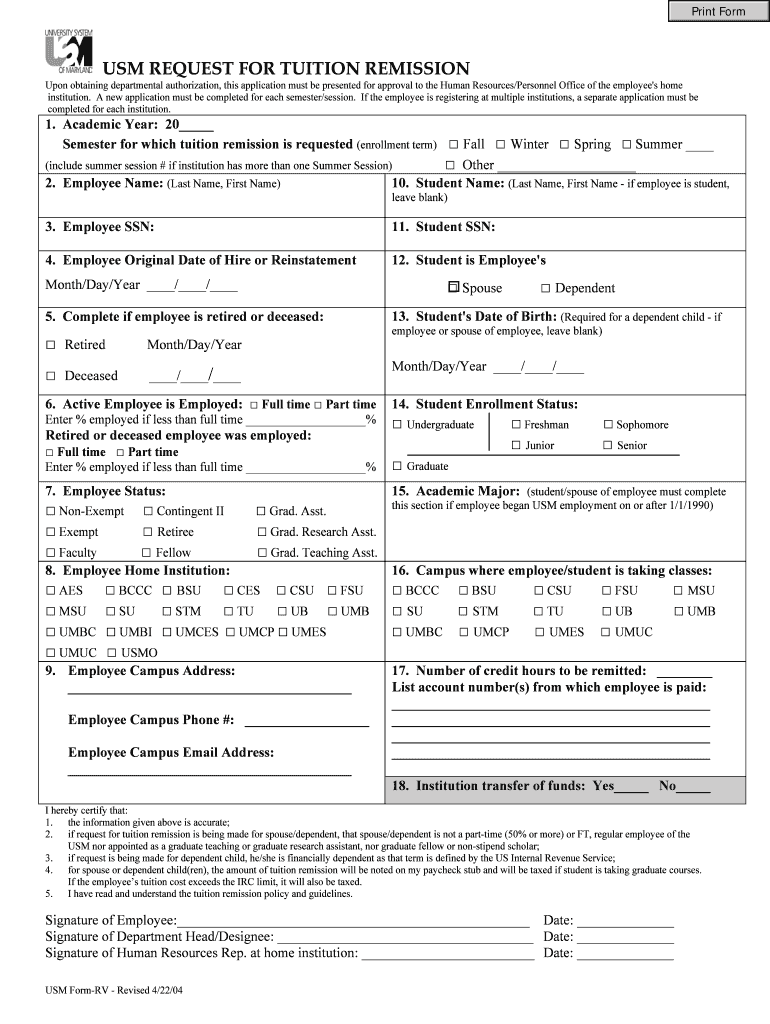

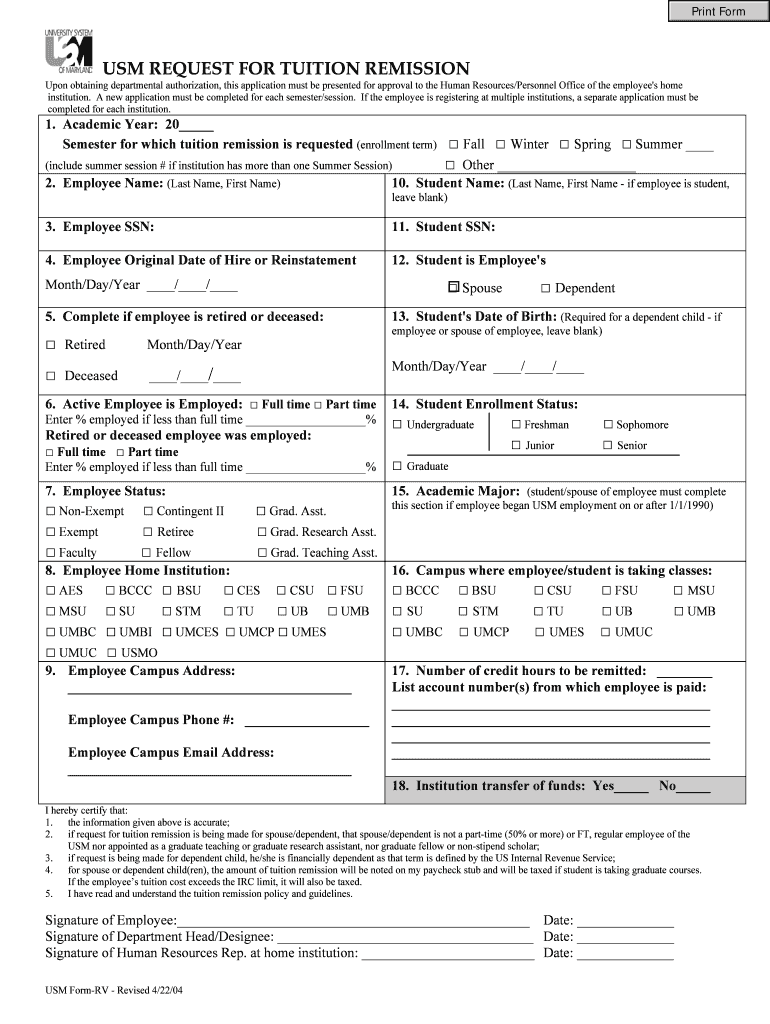

A document to request tuition remission for employees and their dependents, requiring approval from HR and departmental authorization.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign usm request for tuition

Edit your usm request for tuition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your usm request for tuition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit usm request for tuition online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit usm request for tuition. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out usm request for tuition

How to fill out USM REQUEST FOR TUITION REMISSION

01

Obtain the USM REQUEST FOR TUITION REMISSION form from your HR department or the USM website.

02

Fill in your personal information such as name, employee ID, and contact details.

03

Specify the course or program for which tuition remission is being requested.

04

Include information about the institution and the tuition costs associated.

05

Attach any required documentation that supports your request, such as proof of enrollment.

06

Review the form for accuracy and completeness.

07

Submit the completed form to the appropriate department for approval.

08

Follow up to ensure that your application is processed in a timely manner.

Who needs USM REQUEST FOR TUITION REMISSION?

01

Employees of USM who are seeking financial assistance for continuing education.

02

Spouses and dependents of USM employees who are attending eligible programs or courses.

Fill

form

: Try Risk Free

People Also Ask about

What is the USM tuition remission system?

Tuition remission is a program that provides University System of Maryland (USM) employees with an opportunity to take classes at a USM institution with waived tuition. Approved tuition remission is applied to your student account by Student Financial Services.

What does remission of tuition mean?

Tuition remission you receive at the beginning of the year is not taxed under the $5,250 exclusion. Once you exceed that amount, every dollar of the tuition remission benefit is taxable.

Is tuition remission considered income?

Tuition remission you receive at the start of the calendar year falls under the $5,250 exclusion and is not taxable. Once you exceed that amount, every dollar of the graduate remission is taxable.

Does tuition assistance count as income?

Under federal tax law, each year you can be reimbursed from your employer for up to $5,250 in tax-free tuition. This means that you don't need to report tuition reimbursement up to this limit on your federal income taxes, provided your company has a written policy that adheres to all federal tax guidelines.

Does a tuition waiver count as income?

How will the withholding be made? When the value of the tuition waiver exceeds $5,250 in a calendar year, the excess is included as taxable income as non-cash earnings. This means you will not see a pay increase in your check, but rather the excess waiver amount is added to your regular earnings.

Do tuition grants count as income?

Most students leave this question blank because most scholarships and grants are not taxable, unless those award amounts exceed the total amount the student paid for tuition, fees, books, supplies, and required equipment. Typically, this isn't the same amount as the adjusted gross income (IRS Form 1040, line 11).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is USM REQUEST FOR TUITION REMISSION?

USM REQUEST FOR TUITION REMISSION is a form used by the University of Southern Maine (USM) to request the remission of tuition fees for eligible employees or their dependents.

Who is required to file USM REQUEST FOR TUITION REMISSION?

Employees of the University of Southern Maine who wish to use their tuition remission benefits or those of their dependents must file the USM REQUEST FOR TUITION REMISSION.

How to fill out USM REQUEST FOR TUITION REMISSION?

To fill out the USM REQUEST FOR TUITION REMISSION, complete the application form with required personal and employment information, include details about the course or program, and submit it to the appropriate department for approval.

What is the purpose of USM REQUEST FOR TUITION REMISSION?

The purpose of the USM REQUEST FOR TUITION REMISSION is to provide a formal process for employees to request financial assistance for tuition costs for themselves or their family members.

What information must be reported on USM REQUEST FOR TUITION REMISSION?

The USM REQUEST FOR TUITION REMISSION must report the employee's name, ID number, relationship to the dependent (if applicable), details of the program or course, and the semester for which the request is made.

Fill out your usm request for tuition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Usm Request For Tuition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.