Get the free Alternative LOAN, No FAFSA CERTIFICATION PAGE - trine

Show details

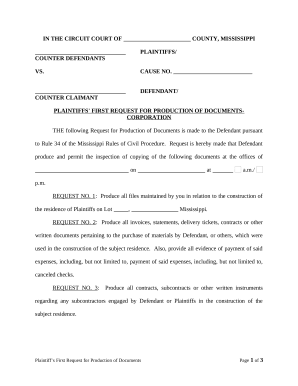

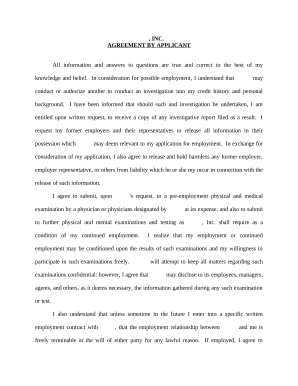

This document certifies the student's decision to decline federal financial aid in favor of using an alternative loan to finance their education, as well as capturing required personal and enrollment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alternative loan no fafsa

Edit your alternative loan no fafsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alternative loan no fafsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alternative loan no fafsa online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit alternative loan no fafsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alternative loan no fafsa

How to fill out Alternative LOAN, No FAFSA CERTIFICATION PAGE

01

Gather your personal information, including your Social Security number and income details.

02

Obtain the Alternative Loan application form from your lender's website or office.

03

Fill out the personal information section accurately, including your name, address, and contact details.

04

Provide your school information, including the name and address of your institution.

05

Enter the loan amount you are requesting and any other financial information as required.

06

Review your entries for accuracy to ensure all information is correctly filled out.

07

Sign and date the certification page, certifying that the information provided is accurate and complete.

08

Submit the completed form to the lender along with any additional required documentation.

Who needs Alternative LOAN, No FAFSA CERTIFICATION PAGE?

01

Students who do not qualify for federal financial aid through FAFSA.

02

Individuals pursuing advanced degrees or programs that are not covered by federal loans.

03

Borrowers who need additional financing beyond federal loans for educational expenses.

04

International students or those whose financial circumstances do not meet federal aid eligibility.

Fill

form

: Try Risk Free

People Also Ask about

Why am I ineligible for IBR?

Why Can't I Qualify for IBR? You don't qualify for Income-Based Repayment because you either don't have a partial financial hardship, your loans are ineligible, or you have documentation issues.

Can I take out a loan without FAFSA?

Research private or alternative loans. Some private financial institutions, such as a bank or credit union, may offer education loans that don't require the FAFSA form. Federal student loans provide many benefits that aren't typically available with private student loans.

Why are my loans not eligible for IDR?

Private student loans and defaulted federal student loans cannot be repaid under any of the income-driven plans. *A loan type identified as “eligible if consolidated” cannot be repaid under the listed income-driven plan, unless you consolidate that loan type into a Direct Consolidation Loan.

Can you be denied income-driven repayment?

Your loan servicer's response to your income-driven repayment (IDR) plan application includes any denial reasons. You must sign your IDR application and provide acceptable proof of income. Contact your loan servicer for any next steps.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

Why aren't my loans eligible for the IDR plan?

In some cases, you might need to consolidate your student loans to be able to repay the loan under a specific plan. Defaulted loans are not eligible for any IDR plans. Learn how to get out of default.

What is a loan certification form?

For private student loans, a Private Education Loan Applicant Self-Certification form is required. This highlights borrower-protection language, informs you of your ability to submit a Free Application for Federal Student Aid (FAFSA®), and explains how a private loan might affect your other financial aid awards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Alternative LOAN, No FAFSA CERTIFICATION PAGE?

An Alternative Loan, No FAFSA Certification Page refers to a type of student loan that a borrower can access without filing the Free Application for Federal Student Aid (FAFSA). These loans are often used to bridge gaps in funding not covered by federal loans or grants.

Who is required to file Alternative LOAN, No FAFSA CERTIFICATION PAGE?

Students seeking to obtain Alternative Loans who do not wish to or are not eligible to file the FAFSA are required to complete the Alternative Loan, No FAFSA Certification Page to verify their loan request.

How to fill out Alternative LOAN, No FAFSA CERTIFICATION PAGE?

To fill out the Alternative Loan, No FAFSA Certification Page, borrowers typically need to provide personal identification details, loan amount requested, educational institution information, and signatures as required by the lending institution.

What is the purpose of Alternative LOAN, No FAFSA CERTIFICATION PAGE?

The purpose of the Alternative Loan, No FAFSA Certification Page is to certify the borrower's eligibility and confirm details about the loan requested, ensuring that the loan can be processed without FAFSA documentation.

What information must be reported on Alternative LOAN, No FAFSA CERTIFICATION PAGE?

The information that must be reported on the Alternative Loan, No FAFSA Certification Page includes borrower identification information, school information, loan amount, and any additional disclosures required by the lender.

Fill out your alternative loan no fafsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alternative Loan No Fafsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.