Get the free Substantiation Requirements at HealthEquity - uakron

Show details

This document outlines the substantiation requirements for debit card and manually submitted claims related to Flexible Spending Accounts (FSAs) and Health Reimbursement Accounts (HRAs), detailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign substantiation requirements at healformquity

Edit your substantiation requirements at healformquity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your substantiation requirements at healformquity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit substantiation requirements at healformquity online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit substantiation requirements at healformquity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out substantiation requirements at healformquity

How to fill out Substantiation Requirements at HealthEquity

01

Log in to your HealthEquity account.

02

Navigate to the 'Substantiation Requirements' section.

03

Review the list of expenses that require substantiation.

04

Gather all necessary documentation for each expense, such as receipts or invoices.

05

Scan or take clear pictures of the documents if submitting electronically.

06

Fill out the substantiation form provided by HealthEquity.

07

Attach the required documentation to the form.

08

Review all entries for accuracy and completeness.

09

Submit the substantiation requirements for processing.

10

Monitor your account for confirmation of acceptance or additional requests.

Who needs Substantiation Requirements at HealthEquity?

01

Individuals with HealthEquity accounts who have incurred expenses that require substantiation.

02

Participants in health savings accounts (HSAs) or flexible spending accounts (FSAs) funded through HealthEquity.

03

Employers managing benefits through HealthEquity on behalf of their employees.

Fill

form

: Try Risk Free

People Also Ask about

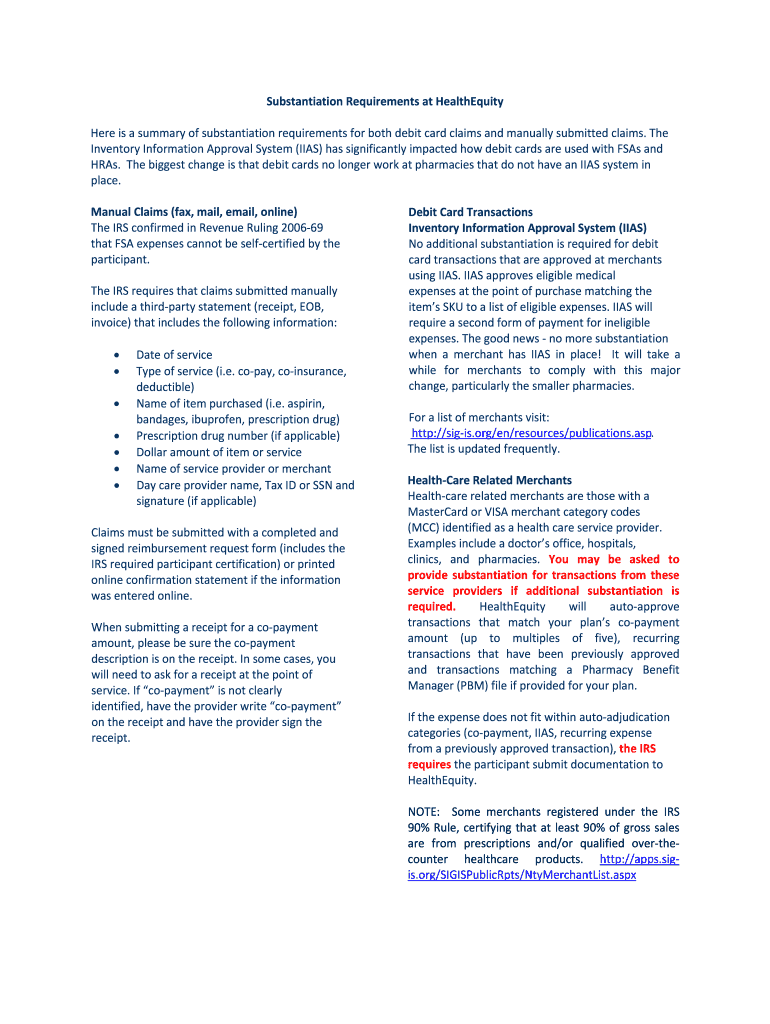

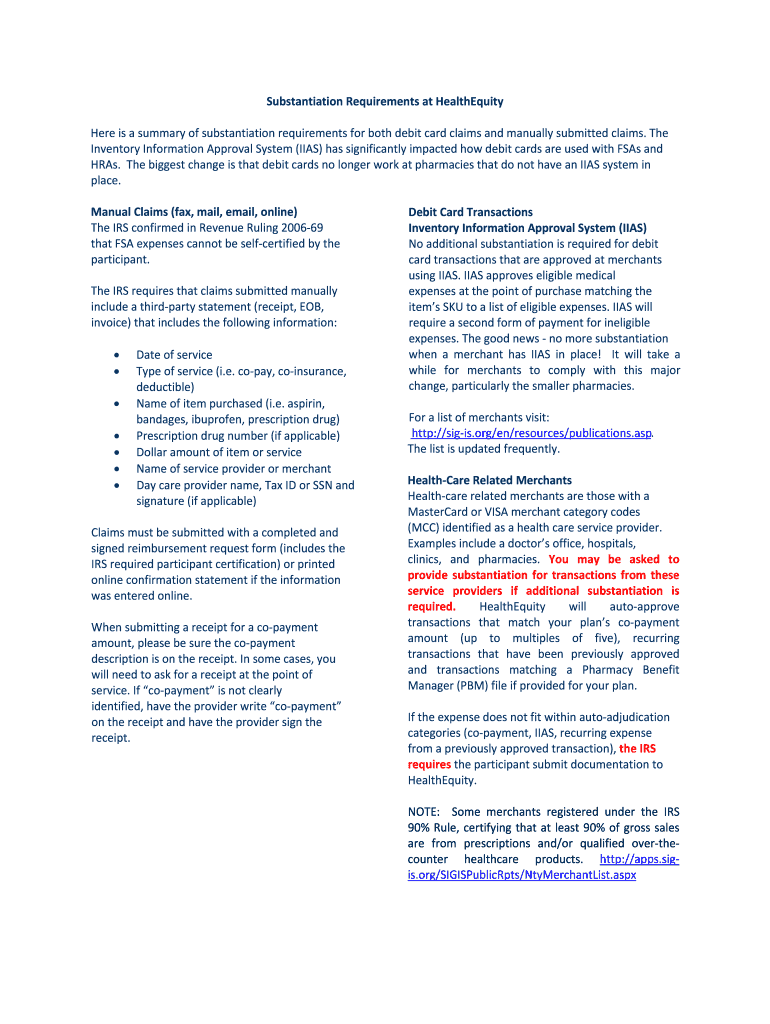

What are substantiation requirements?

A taxpayer must substantiate each element of an expenditure (described in paragraph (b) of this section) by adequate records or by sufficient evidence corroborating his own statement except as otherwise provided in this section.

What do you need for a HealthEquity receipt?

A grace period is a timeframe in the new plan year during which you can incur new expenses and file claims. This timeframe, established by your employer, is up to 2½ months after the end of the plan year.

What is the IRS rule on FSA?

Date of Service: The date on which services were provided or the item was purchased. Type of Service: A detailed description of the service provided or item purchased. Cost: The amount you paid for the service or product and/or the portion that is not reimbursed through your insurance carrier.

What documentation is required for FSA?

The IRS' use-or-lose rule states that FSA funds must be spent by the participant within the FSA's plan year. That means FSA participants typically need to spend most or all of their FSA funds by the end of the plan year. Unused funds at the end of the plan year are forfeited to the plan.

What are the requirements for FSA substantiation?

The substantiating document must include information describing the service or product, the date of the service or sale, and the amount of the expense. Health FSAs can reimburse only §213(d) qualified medical expenses that are incurred during the period of coverage and not reimbursed by another plan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Substantiation Requirements at HealthEquity?

Substantiation Requirements at HealthEquity refer to the process of providing documentation or proof for transactions to ensure that they meet applicable regulations and guidelines.

Who is required to file Substantiation Requirements at HealthEquity?

Individuals who utilize HealthEquity's accounts for qualified expenses must file Substantiation Requirements to validate their claims.

How to fill out Substantiation Requirements at HealthEquity?

To fill out Substantiation Requirements, users need to gather relevant documentation such as receipts and complete the required forms provided by HealthEquity, ensuring all necessary information is accurately filled in.

What is the purpose of Substantiation Requirements at HealthEquity?

The purpose of Substantiation Requirements at HealthEquity is to verify that expenses claimed for reimbursement are valid, ensuring compliance with tax regulations and safeguarding against misuse of funds.

What information must be reported on Substantiation Requirements at HealthEquity?

The information that must be reported includes the date of service, type of expense, amount, provider details, and any supporting documents such as receipts or invoices.

Fill out your substantiation requirements at healformquity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Substantiation Requirements At Healformquity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.