Get the free Fiscal Year-end Closing Instructions FY11 - alaska

Show details

This document outlines the procedures and instructions for the fiscal year-end closing for the University, detailing submission requirements, cutoff dates, and guidelines for financial reporting and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiscal year-end closing instructions

Edit your fiscal year-end closing instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiscal year-end closing instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiscal year-end closing instructions online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fiscal year-end closing instructions. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiscal year-end closing instructions

How to fill out Fiscal Year-end Closing Instructions FY11

01

Gather all necessary financial documents for the fiscal year.

02

Review the general ledger for accuracy and completeness.

03

Reconcile all bank accounts to ensure all transactions are recorded.

04

Accrue any outstanding expenses that have not yet been recorded.

05

Verify that all revenue has been recorded for the fiscal year.

06

Prepare the trial balance and check for discrepancies.

07

Make any necessary adjustments to the accounts.

08

Complete the fiscal year-end closing checklist provided in the instructions.

09

Submit the necessary reports to management for review.

10

Finalize and close the books for the fiscal year.

Who needs Fiscal Year-end Closing Instructions FY11?

01

Accounting staff responsible for financial reporting.

02

Finance team overseeing budget management.

03

Upper management for reviewing fiscal performance.

04

Auditors conducting the end-of-year financial audits.

Fill

form

: Try Risk Free

People Also Ask about

What are closing entries fiscal year?

The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero balance for all temporary accounts.

What is closing accounts in the fiscal year?

Also known as "closing the books", year-end closing is the process of reviewing, reconciling, and verifying that all financial transactions and aspects of the company ledgers from the past financial year add up. This involves calculating the business expenses, income, revenue, assets, investments, equity, and more.

What is the meaning of closing entry?

A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero.

What is the fiscal year end close process?

Year-end closing is the process of reviewing and reconciling accounts, adjusting entries (where necessary) and preparing financial statements for the fiscal year. This process is also called “closing the books” or “annual close.”

What is a closing entry in the fiscal year?

The vast majority of companies choose December 31 as the fiscal year end and if you want to use a different date, be sure to check with tax and accounting advisors.

What is the financial year end closing checklist?

What Is a Closing Entry? A closing entry is a journal entry made at the end of an accounting period to transfer the balances of temporary accounts (like revenues, expenses, and dividends) to the permanent accounts (like retained earnings).

What is the fiscal year-end closing?

Year-end closing is the process of reviewing and reconciling accounts, adjusting entries and preparing financial statements for the fiscal year. The goal of closing the books is to ensure your financial statements accurately reflect your company's financial activities for the accounting year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fiscal Year-end Closing Instructions FY11?

Fiscal Year-end Closing Instructions FY11 are guidelines provided to help organizations properly close their financial books for the fiscal year ending in 2011. These instructions outline the specific procedures and timelines for completing financial reporting and ensuring compliance with relevant regulations.

Who is required to file Fiscal Year-end Closing Instructions FY11?

All entities that are required to submit their financial reports for the fiscal year 2011, including government agencies, nonprofits, and corporations, must file Fiscal Year-end Closing Instructions FY11 as part of their financial closing process.

How to fill out Fiscal Year-end Closing Instructions FY11?

To fill out Fiscal Year-end Closing Instructions FY11, organizations should follow the prescribed format provided in the instructions, ensuring that all required fields are completed with accurate financial data, appropriate signatures are included, and submissions are made by the specified deadlines.

What is the purpose of Fiscal Year-end Closing Instructions FY11?

The purpose of Fiscal Year-end Closing Instructions FY11 is to ensure that all financial transactions are properly accounted for and reported, thereby facilitating consistency, accuracy, and compliance with accounting standards and regulations during the year-end financial closing process.

What information must be reported on Fiscal Year-end Closing Instructions FY11?

The information that must be reported includes total revenues, expenses, net assets, liabilities, and any other financial results pertinent to the fiscal year ending in 2011, alongside any necessary explanations or supporting documentation as required by the guidelines.

Fill out your fiscal year-end closing instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiscal Year-End Closing Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

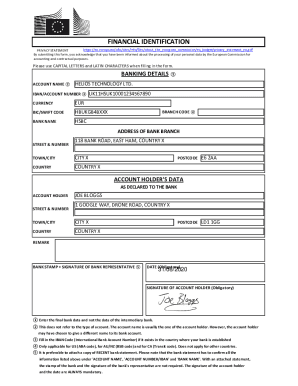

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.