Get the free Accounts Receivable Security Access Request - uaf

Show details

This document is used by employees at the University of Alaska Fairbanks to request access to Banner Accounts Receivable, requiring prior FERPA training completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts receivable security access

Edit your accounts receivable security access form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts receivable security access form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts receivable security access online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accounts receivable security access. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

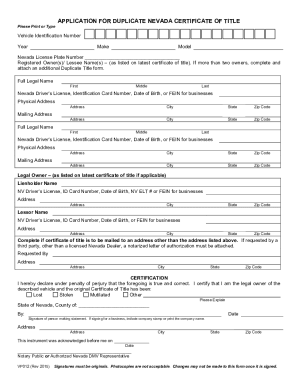

How to fill out accounts receivable security access

How to fill out Accounts Receivable Security Access Request

01

Obtain the Accounts Receivable Security Access Request form from the finance department.

02

Fill in your personal information, including name, employee ID, and department.

03

Specify the type of access you require to Accounts Receivable systems.

04

Provide a brief explanation of why you need this access.

05

Ensure you have the appropriate approvals from your supervisor or manager.

06

Review the completed form for accuracy before submission.

07

Submit the form to the designated security administrator.

Who needs Accounts Receivable Security Access Request?

01

Employees in the finance department who handle billing and collections.

02

Managers overseeing accounts receivable operations.

03

Staff involved in credit management and financial reporting.

04

Users requiring access for audits or compliance checks.

Fill

form

: Try Risk Free

People Also Ask about

Is accounts receivable susceptible to theft?

Accounts receivable is a thief's paradise due to the influx of money at all times. Accounts receivable fraudsters take advantage of the trust they've built with clients, using their professional position to line their pockets.

What is the biggest problem with accounts receivable?

Typical accounts receivable risks include: Overstatement of revenue: When revenue is overstated, more receivables are recorded than what customers actually owe. Unenforced cutoffs: Cutoffs ensure that financial transactions are accurate and accounted for in the correct accounting period.

What is the process of using accounts receivable as security for a loan is known as pledging accounts receivable?

Pledging receivables is when your business uses a receivable as collateral for a loan from the bank to help manage problems with their cash flow. Usually the loan amount is only 70-80% of the invoice receivables or – more commonly – an amount based on the age of the receivables.

Is accounts receivable a security?

Using accounts receivable as collateral for financing can provide quick access to cash flow without giving up equity or taking on debt. By pledging receivables, you are using them as security for a loan or line of credit from a financial institution.

Is accounts receivable susceptible to theft or manipulation?

One of the biggest problems for accounts receivable teams is how to address late and overdue payments. In an ideal world, everyone would pay your company what you're owed for goods and services rendered.

What asset is most susceptible to theft?

Unfortunately, the risk of accounts receivable fraud – or “accounts deceivable” – is especially high for small and midsized businesses, which may handle large volumes of delayed payments but lack the resources and personnel to establish robust internal checks and balances.

How to follow up accounts receivable?

Collecting payment: Follow up systematically on outstanding payments through reminders, calls or payment plan discussions. Consistent, professional collection practices help maintain both cash flow and customer relationships. Applying cash: Match incoming payments to their corresponding invoices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Accounts Receivable Security Access Request?

Accounts Receivable Security Access Request is a formal documentation process used to request access to accounts receivable systems and information within an organization.

Who is required to file Accounts Receivable Security Access Request?

Employees who require access to accounts receivable systems, such as financial analysts, accountants, and any personnel handling invoicing or collections, are required to file an Accounts Receivable Security Access Request.

How to fill out Accounts Receivable Security Access Request?

To fill out the Accounts Receivable Security Access Request, one must provide their personal information, specify the reason for access, indicate the level of access needed, and obtain the necessary approvals before submission.

What is the purpose of Accounts Receivable Security Access Request?

The purpose of the Accounts Receivable Security Access Request is to ensure that only authorized personnel have access to sensitive financial information, thereby protecting the organization from data breaches and ensuring compliance with internal policies.

What information must be reported on Accounts Receivable Security Access Request?

The information that must be reported includes the requestor's details (name, department, etc.), the specific access needed, justification for access, and any supervisor or manager approvals.

Fill out your accounts receivable security access online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Receivable Security Access is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.