Get the free Fidelity ID Assignment for Employees with Zero Social Security Numbers - ucop

Show details

This document outlines the detailed design for assigning Fidelity IDs to employees without Social Security Numbers, including processing changes and database structures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity id assignment for

Edit your fidelity id assignment for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity id assignment for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

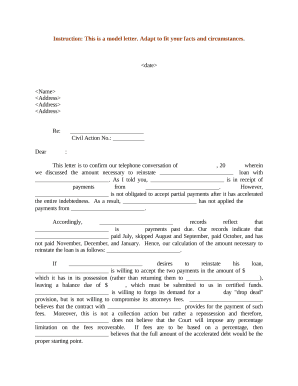

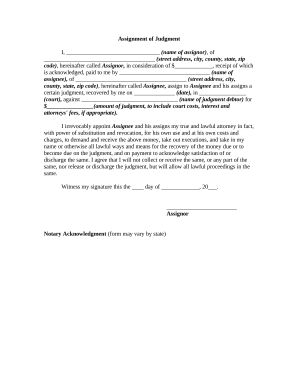

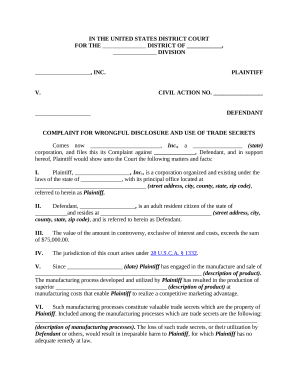

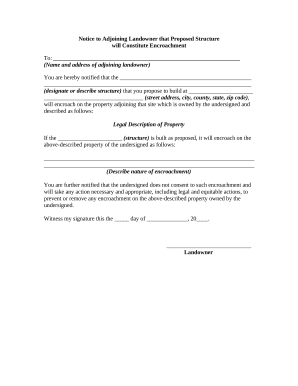

How to edit fidelity id assignment for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fidelity id assignment for. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity id assignment for

How to fill out Fidelity ID Assignment for Employees with Zero Social Security Numbers

01

Begin by logging into the Fidelity ID Assignment portal.

02

Select the option for 'Employee with Zero Social Security Numbers'.

03

Fill in the required employee details, including name, address, and date of birth.

04

Indicate 'Zero Social Security Number' in the specified field.

05

Attach any necessary supporting documents as required by the form.

06

Review all entered information for accuracy.

07

Submit the form by clicking the 'Submit' button on the page.

08

Confirm submission and save any reference number provided for future tracking.

Who needs Fidelity ID Assignment for Employees with Zero Social Security Numbers?

01

New hires who do not possess a Social Security Number.

02

Employees who are in the process of obtaining their Social Security Number.

03

Contract workers needing an ID for employment verification.

04

Individuals working under different employment classifications without SSNs.

Fill

form

: Try Risk Free

People Also Ask about

Can I open Fidelity without SSN?

The answer is YES! Through an Individual Taxpayer Identification Number or (ITIN), people who do not have social security numbers can open investment accounts. Brokerage companies such as Vanguard, Charles Schwab, and Fidelity allow individuals with ITINs to open investment accounts.

Should I give my SSN to Fidelity?

The IRS requires you to certify your SSN or TIN to verify your U.S. tax status. If our information doesn't match what the IRS has on file, the IRS requires Fidelity to withhold 24% of the proceeds when you sell a security or receive dividends, interest, or other income. You may also be subject to penalties.

Can a non-US citizen invest in the stock market?

There's no citizenship requirement for owning stocks of American companies. While U.S. investment securities are regulated by U.S. law, there are no provisions forbidding individuals who are not citizens of the U.S. from participating in the U.S. stock market.

Does Fidelity allow non-US citizens?

Can I establish a relationship with Fidelity? Unfortunately, we do not open accounts for any new customers residing outside the United States.

What is alternative number for SSN?

An Individual Taxpayer ID Number (ITIN) may be required for individuals who do not have employment authorization and are not eligible for an SSN. ITINs are issued only for the purpose of federal tax reporting. Nonresidents filing an income tax return (e.g. 1040NR, 1040NR-EZ) may need an ITIN.

Can a non-US citizen use Fidelity?

No. Unfortunately, we do not open accounts for any new customers residing outside the United States. Q.

Can a green card holder open a Fidelity account?

Account Requirements Address. Social Security number (you must be a U.S. Citizen or permanent resident alien) Date of birth (you must be at least 18 years old to apply)

Can I open Fidelity without SSN?

The answer is YES! Through an Individual Taxpayer Identification Number or (ITIN), people who do not have social security numbers can open investment accounts. Brokerage companies such as Vanguard, Charles Schwab, and Fidelity allow individuals with ITINs to open investment accounts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fidelity ID Assignment for Employees with Zero Social Security Numbers?

Fidelity ID Assignment for Employees with Zero Social Security Numbers is a process used to assign a unique identifier to employees who do not have a valid Social Security Number (SSN), allowing them to be tracked for payroll and benefits purposes.

Who is required to file Fidelity ID Assignment for Employees with Zero Social Security Numbers?

Employers who have employees that do not possess a Social Security Number are required to file Fidelity ID Assignment to ensure compliance with payroll processing and reporting requirements.

How to fill out Fidelity ID Assignment for Employees with Zero Social Security Numbers?

To fill out the Fidelity ID Assignment, employers must provide the employee's name, contact information, and any relevant details regarding the reason for the absence of a Social Security Number, along with the assigned Fidelity ID.

What is the purpose of Fidelity ID Assignment for Employees with Zero Social Security Numbers?

The purpose of the Fidelity ID Assignment is to maintain accurate employee records, ensure compliance with tax and reporting regulations, and facilitate the provision of benefits to employees who do not have an SSN.

What information must be reported on Fidelity ID Assignment for Employees with Zero Social Security Numbers?

The information that must be reported includes the employee's full name, address, assigned Fidelity ID, and any relevant notes on the circumstances surrounding the lack of a Social Security Number.

Fill out your fidelity id assignment for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Id Assignment For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.