Get the free Short-Term Loan Program Application - ucmo

Show details

Application form for the University of Central Missouri's Short-Term Loan Program, designed to assist students needing quick financial assistance during the summer session.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short-term loan program application

Edit your short-term loan program application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short-term loan program application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

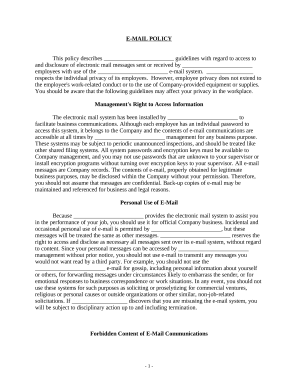

Editing short-term loan program application online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit short-term loan program application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

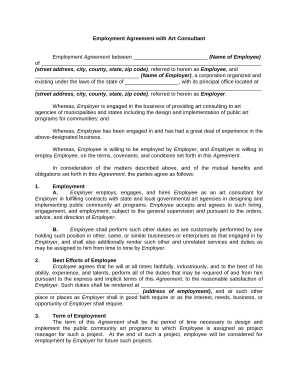

How to fill out short-term loan program application

How to fill out Short-Term Loan Program Application

01

Obtain the Short-Term Loan Program Application form from the official website or designated office.

02

Read the instructions on the form carefully before starting.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide details of your financial situation, including income, expenses, and any existing debts.

05

Specify the amount of loan you are applying for and the purpose of the loan.

06

Attach any required documentation, such as proof of income, identification, or financial statements.

07

Review your application for accuracy and completeness.

08

Submit the application by the specified deadline, either online or in person.

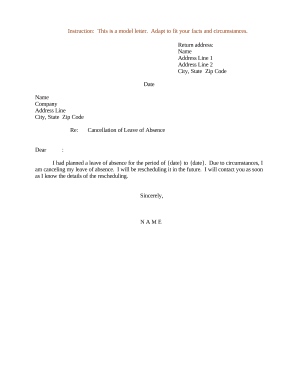

Who needs Short-Term Loan Program Application?

01

Individuals who are facing temporary financial difficulties and need quick access to funds.

02

Students seeking assistance for educational expenses.

03

Employees who encounter unexpected expenses before their next paycheck.

04

Any person in need of short-term financial relief.

Fill

form

: Try Risk Free

People Also Ask about

Can a start-up LLC get a loan?

The minimum credit score for an SBA loan is 680 with a 10% down payment to purchase the asset. The SBA 504 loan, or SBA CDC loan, offers long-term, fixed-rate funding of up to $5 million for major fixed assets (i.e., real estate, equipment, etc.) that promote business growth and job creation.

What are the easiest SBA loans to get?

LLC loans can be used for a wide range of purposes, including startup costs, working capital, inventory and equipment purchases, business expansion and debt refinancing. To qualify for an LLC loan with the best rates and terms, it's helpful to have multiple years in operation, good credit and strong finances.

How can I apply for a short-term loan?

Short-term personal loans are available through banks, credit unions and online lenders. The application process is straightforward, and borrowers can usually apply online. However, the exact requirements may differ from lender to lender, so research the specific requirements with your preferred lender before applying.

What disqualifies you from getting an SBA loan?

The SBA 7a program was launched in 1958, and it has been one of the most popular programs offered by the agency. The 7a program offers loans up to $5 million, and the SBA guarantees 75% of the loan amount. This guarantee can help businesses get approved for a loan even if they have bad credit or no collateral.

Do short-term loans hurt your credit?

Payday loans, also referred to as short-term loans, are small amounts of money you can borrow, usually at a high interest rate. Each loan typically has a value of about $500 or less. In most cases, payday loans are expected to be repaid by your next payday.

What is the easiest SBA loan to get approved for?

Credit score penalties: Short-term loans may also affect your credit score, both positively and negatively. Some companies make a hard inquiry on your credit, and your credit will take a slight hit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Short-Term Loan Program Application?

The Short-Term Loan Program Application is a form used by individuals or businesses to apply for short-term financing options that typically cover immediate expenses or cash flow needs.

Who is required to file Short-Term Loan Program Application?

Individuals, small businesses, or organizations looking for short-term financing solutions are required to file the Short-Term Loan Program Application.

How to fill out Short-Term Loan Program Application?

To fill out the Short-Term Loan Program Application, applicants should provide personal or business information, financial details, the amount of loan requested, and the purpose of the loan, ensuring all sections are completed accurately.

What is the purpose of Short-Term Loan Program Application?

The purpose of the Short-Term Loan Program Application is to evaluate an applicant's request for immediate financing and to assess their ability to repay the loan within a short timeframe.

What information must be reported on Short-Term Loan Program Application?

Applicants must report personal or business identification information, financial status, credit history, the amount of the loan request, and details regarding the intended use of the funds.

Fill out your short-term loan program application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short-Term Loan Program Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.