Get the free Application For Short-Term Loan Funds - ucmo

Show details

This document provides information about the Short-Term Loan Program available to enrolled students at the University of Central Missouri, including eligibility, application details, and repayment

We are not affiliated with any brand or entity on this form

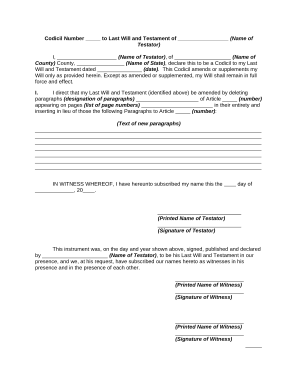

Get, Create, Make and Sign application for short-term loan

Edit your application for short-term loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for short-term loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for short-term loan online

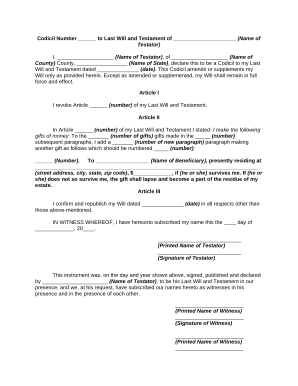

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for short-term loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

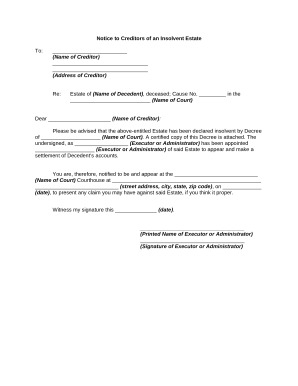

How to fill out application for short-term loan

How to fill out Application For Short-Term Loan Funds

01

Obtain the Application for Short-Term Loan Funds form from the appropriate financial institution or their website.

02

Read all instructions carefully before starting to fill out the application.

03

Provide your personal information, including your name, address, contact number, and Social Security number.

04

Specify the amount of loan you are applying for and the purpose of the loan.

05

Include details about your employment, including your employer's name, your position, and your income.

06

Provide any additional financial information required, such as existing debts or monthly expenses.

07

Review the application for any errors or omissions.

08

Sign and date the application form.

09

Submit the application along with any necessary documentation, such as proof of income or identification, as specified in the instructions.

Who needs Application For Short-Term Loan Funds?

01

Individuals or families seeking immediate financial assistance for unexpected expenses.

02

Students needing funds for tuition or educational purposes.

03

Small business owners looking for short-term working capital.

04

Anyone who requires quick access to funds with a short repayment period.

Fill

form

: Try Risk Free

People Also Ask about

How to get short-term funding?

8 Short-Term Financing Options for Businesses B2B Buy Now, Pay Later. Business Line of Credit. Working Capital Advance. Merchant Cash Advance. Invoice Financing. Trade Credit. Bank Loan. Payday Loan.

Which loan app gives instant money?

Chime – Best for those tired of bank fees The Chime Checking Account includes the MyPay feature, which allows you to access up to $500 of your paycheck within 24 hours for a flat $2 fee. Or, you can use your Chime account's Get Paid Early feature which gives you access to your paycheck up to two days early.

What is the app that gives you $500?

Where to get a $500 loan: 5 options and alternatives Cash advances. A cash advance is a short-term financing solution different from a personal loan. Personal loans. Not all lenders will approve personal loans for $500, as some require higher loan amounts. Credit card cash advance. Credit builder loans. Payday loans.

How do I write a short loan proposal?

Briefly describe your business, your market and how the loan will be used to help the company succeed. Think of the Executive Summary as your "elevator pitch." Then, flesh out the Summary in subsequent sections. Business Summary. Describe the history of the business, current activity and results.

How do I write a short loan application?

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader. Be sure to include a repayment plan.

How do I get approved for a short sale loan?

Here are two critical factors the mortgage company will consider when deciding whether to approve a short sale: The home has to be worth less than the homeowner's payoff amount. The homeowner must be able to prove financial hardship.

How do I write a short application letter for a loan?

Tips For Loan Request Letter Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader. Be sure to include a repayment plan.

How do you write a simple loan note?

What to include in a promissory note Amount of money borrowed (principal amount) Amount to be repaid (principal and interest) When and how often payments will be made (payment schedule, or “due dates”) Interest rate and repayment specifics. Time frame and maturity date (date the loan will be fully repaid)

What is the easiest app to borrow money?

RapidRupee makes it easy to overcome your financial gaps. We don't require a credit score and you can apply with a minimum income of just Rs. 10,000. We are also one of the only instant loan apps in India that welcomes both salaried and self-employed applicants.

Which app is best for short-term loans?

List of Best (RBI-Approved) Personal Loan Apps in India 2025 App NameLoan Range Dhani Up to ₹15,00,000 TruePay ₹5,000 - ₹5,00,000 Kissht Up to ₹2,00,000 KrazyBee Up to ₹1,00,00053 more rows • 6 days ago

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Short-Term Loan Funds?

Application For Short-Term Loan Funds is a formal request submitted by an individual or organization seeking financial assistance for a short duration, often to cover temporary cash flow needs.

Who is required to file Application For Short-Term Loan Funds?

Individuals or businesses needing immediate financial support, who meet the eligibility criteria set by the lending institution, are required to file an Application For Short-Term Loan Funds.

How to fill out Application For Short-Term Loan Funds?

To fill out the Application For Short-Term Loan Funds, one must provide personal or business information, specify the loan amount requested, describe the purpose of the loan, and submit any required documentation such as financial statements.

What is the purpose of Application For Short-Term Loan Funds?

The purpose of the Application For Short-Term Loan Funds is to obtain necessary funds to address short-term financial obligations, manage immediate expenses, or take advantage of timely opportunities without long-term debt commitments.

What information must be reported on Application For Short-Term Loan Funds?

The information that must be reported includes applicant's identity details, financial stability indicators, purpose of the loan, amount requested, and any existing debts or obligations that may affect repayment capabilities.

Fill out your application for short-term loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Short-Term Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.