Get the free Verification of FAFSA Question 57 - ucmo

Show details

This form is used by the University of Central Missouri to verify a student's legal guardianship status as indicated on their FAFSA application, impacting their federal financial aid eligibility.

We are not affiliated with any brand or entity on this form

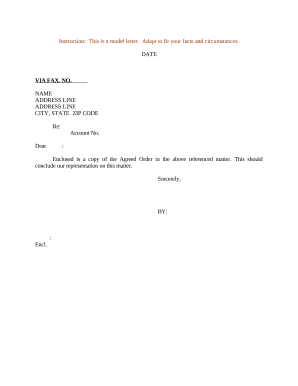

Get, Create, Make and Sign verification of fafsa question

Edit your verification of fafsa question form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of fafsa question form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit verification of fafsa question online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit verification of fafsa question. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verification of fafsa question

How to fill out Verification of FAFSA Question 57

01

Gather necessary documents such as tax returns, W-2 forms, and records of any other income.

02

Locate the FAFSA form and navigate to Question 57, which asks about your income and tax information.

03

Input the amounts from your tax returns or W-2 forms as prompted in the question.

04

Double-check the figures for accuracy to ensure they match your official documents.

05

If you have received any income that is not reported on the tax return, include that information as well.

06

Submit the completed verification documents along with your FAFSA application to the financial aid office.

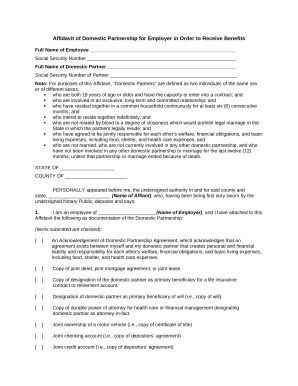

Who needs Verification of FAFSA Question 57?

01

Students selected for verification by their college or university financial aid office.

02

Individuals who reported certain types of income or discrepancies that require confirmation.

03

Those who have dependent students and need to provide parental income information for verification.

Fill

form

: Try Risk Free

People Also Ask about

How many people get selected for FAFSA verification?

About 17% of FAFSA forms were selected for verification during the first three quarters of the 2021-2022 cycle, ing to a 2021 NCAN/National Association of Student Financial Aid Administrators report. The U.S. Department of Education set goals to decrease overall verification rates in recent years.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

How to avoid FAFSA verification?

A: The best way to avoid being selected for verification is to complete your FAFSA using the IRS Data retrieval tool, if possible. IRS data retrieval isn't an option for every applicant, but this one step will significantly reduce the likelihood of your application being selected.

What does it mean when your FAFSA has been selected for verification?

Verification is a federal financial aid process that ensures the information submitted on the Free Application for Federal Student Aid (FAFSA®) is correct. If you've been selected for FAFSA verification, don't worry — it doesn't mean you've made a mistake.

What triggers FAFSA verification?

There are a variety of different reasons someone's FAFSA could be selected for verification, including random selection, applying to a college that verifies all students, to protect against identity theft, or most commonly, there was a mistake on your FAFSA that needs fixing.

How many people get selected for FAFSA verification?

FSA announced some good news at its most recent conference: For the current 2021-22 FAFSA cycle, the verification selection rate for all filers was reduced from 22% to 18%. However, the selection rate for Pell Grant-eligible FAFSA filers remains much higher.

What happens if you put false information on FAFSA?

If the student receives federal student aid based on incorrect or fraudulent information, they'll have to pay it back. You may also have to pay fines and fees. If you purposely provide false or misleading information on the FAFSA form, you may be fined up to $20,000, sent to prison, or both.

What happens if I don't do FAFSA verification?

Some people are selected for verification at random; and some schools verify all students' FAFSA forms. All you need to do is provide the documentation your school asks for — and be sure to do so by the school's deadline, or you won't be able to get federal student aid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

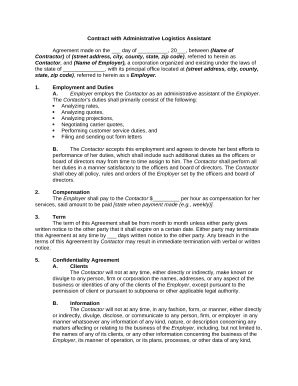

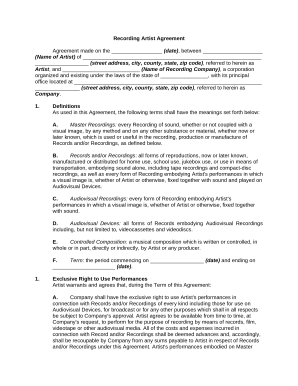

What is Verification of FAFSA Question 57?

Verification of FAFSA Question 57 refers to the process of confirming the information provided by students on the Free Application for Federal Student Aid (FAFSA) regarding their income and tax filing status.

Who is required to file Verification of FAFSA Question 57?

Students selected for verification by their college or university are required to complete Verification of FAFSA Question 57, which typically affects those who have discrepancies or incomplete information in their FAFSA.

How to fill out Verification of FAFSA Question 57?

To fill out Verification of FAFSA Question 57, students must provide accurate details regarding their tax filing status, including whether they filed a tax return, the type of tax form used, and information about their income.

What is the purpose of Verification of FAFSA Question 57?

The purpose of Verification of FAFSA Question 57 is to ensure the accuracy of the financial information reported on the FAFSA, which affects the amount of financial aid a student is eligible to receive.

What information must be reported on Verification of FAFSA Question 57?

Verification of FAFSA Question 57 requires reporting information such as the student's tax filing status, the type of tax return filed (if any), and details about income earned during the specified tax year.

Fill out your verification of fafsa question online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Fafsa Question is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.