Get the free Form to Decline or Change Group Retiree Coverage - uco

Show details

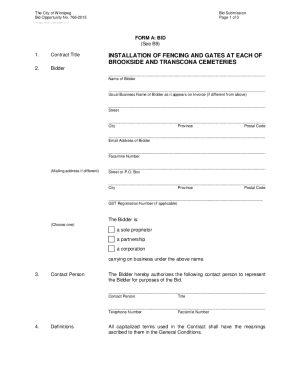

This form is used by retirees to decline or change their group retiree health coverage options, including medical and prescription plans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form to decline or

Edit your form to decline or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form to decline or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form to decline or online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form to decline or. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form to decline or

How to fill out Form to Decline or Change Group Retiree Coverage

01

Obtain the Form to Decline or Change Group Retiree Coverage from your employer or plan administrator.

02

Fill in your personal details such as name, address, and contact information in the designated sections.

03

Indicate your reason for declining or changing coverage in the provided field.

04

Review the options for coverage changes, and select the desired option if applicable.

05

Sign and date the form to confirm your request.

06

Submit the completed form to your employer or plan administrator by the specified deadline.

Who needs Form to Decline or Change Group Retiree Coverage?

01

Retirees who are currently enrolled in a group retiree coverage plan.

02

Individuals who wish to decline their current coverage.

03

Retirees seeking to make changes to their existing group coverage.

Fill

form

: Try Risk Free

People Also Ask about

Can I opt out of group health insurance?

You can cancel your group coverage anytime if you don't pay your health insurance premiums through payroll deductions on a pre-tax basis. But if your premium payments use pre-tax dollars, the IRS considers your group policy a Section 125 plan or cafeteria plan.

What is a waiver of group medical coverage?

An insurance waiver is a document that includes the employee's “declaration that you have been offered a plan, however, have chosen to refuse” the coverage offered and why. Depending on the organization or reason for the request, an employee may be required to provide proof of outside coverage.

What is a waiver of group health benefits?

A waiver of coverage is a form employees sign to opt-out of insurance. Employees can only waive coverage during certain time periods. Here are some examples of when employees can waive coverage: When the employee begins work at your business.

What are the disadvantages of group term insurance?

A group plan only covers up to three to five times the annual income. Group insurance, whether health or life, covers you only while you are a part of the organisation providing coverage. The policy does not cover you if you leave the company to work for another or retire.

What is a group waiver?

A group life waiver of premium means that during your approved long. term disability (LTD) claim you continue to be insured for group life. insurance at your pre-leave level coverage. You will continue to be. insured for all life insurance coverage that you had on your date of.

Can I cancel my group health insurance at any time?

During your employer group's annual open enrollment period each year, you can cancel or change your coverage. Outside of open enrollment, cancellation is typically only allowed for life status change events. Examples include marriage, divorce, having a baby, leaving the company, or significant plan changes.

Is it possible to opt out of health insurance?

Can you cancel your health insurance policy at any time? You can cancel your group coverage anytime if you don't pay your health insurance premiums through payroll deductions on a pre-tax basis. But if your premium payments use pre-tax dollars, the IRS considers your group policy a Section 125 plan or cafeteria plan.

Is a waiver of premium worth it?

Having said that, waiver of premium is not a good value, generally speaking. if you were disabled and still needed the life insurance, you would just pay that premium out of your disability income either from your disability income policy or from Social Security, or other assets, etc.

What does waiver mean in healthcare?

A waiver program allows the state to waive some requirements to meet the needs of individuals. For example, a waiver may help those more likely to need long-term care, such as those with behavioral issues or technologically dependent children.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form to Decline or Change Group Retiree Coverage?

The Form to Decline or Change Group Retiree Coverage is a document used by retirees to opt out of or make changes to their existing group health insurance coverage offered by their employer or group.

Who is required to file Form to Decline or Change Group Retiree Coverage?

Retirees who wish to decline or modify their group health insurance coverage are required to file this form.

How to fill out Form to Decline or Change Group Retiree Coverage?

To fill out the form, retirees must provide their personal information, select the option to decline or change coverage, and sign the form to indicate their decision.

What is the purpose of Form to Decline or Change Group Retiree Coverage?

The purpose of the form is to formally document a retiree's decision to opt out of or modify their group health insurance coverage, ensuring that their wishes are accurately processed.

What information must be reported on Form to Decline or Change Group Retiree Coverage?

The form typically requires personal identification details, the specific coverage options being declined or changed, and the retiree's signature and date of submission.

Fill out your form to decline or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form To Decline Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.