Get the free Medical Expenses Worksheet for Financial Aid - colorado

Show details

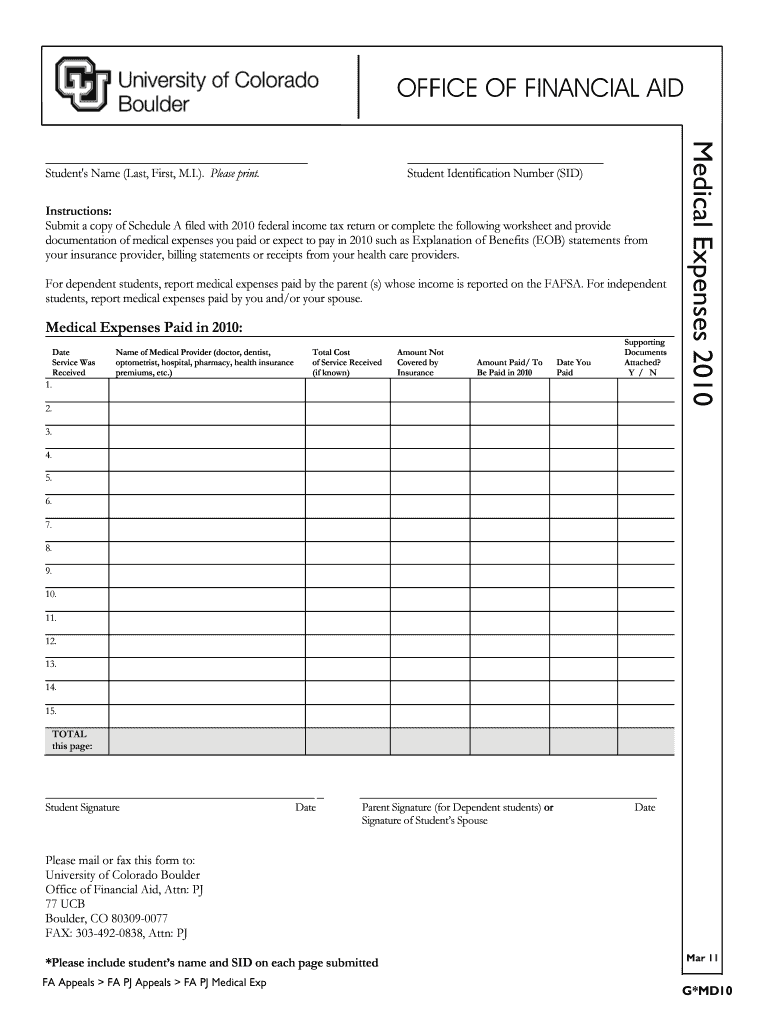

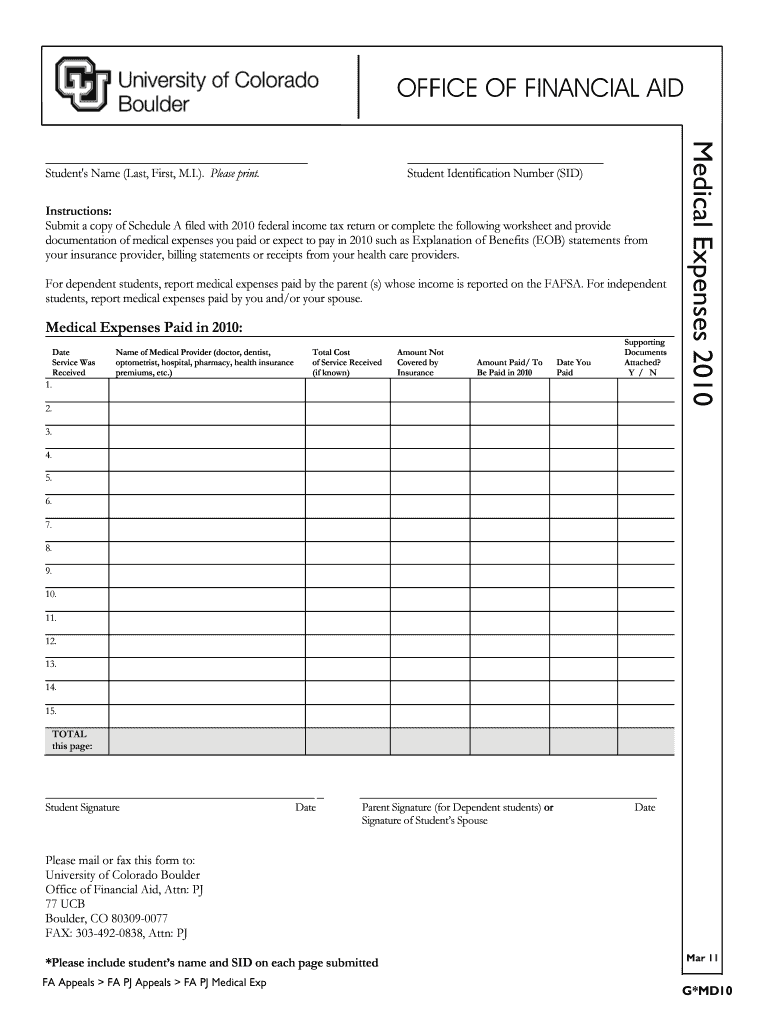

This document is a worksheet for students to report their medical expenses paid in 2010 for the financial aid application process. It requires submission of medical expense documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical expenses worksheet for

Edit your medical expenses worksheet for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medical expenses worksheet for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medical expenses worksheet for online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit medical expenses worksheet for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medical expenses worksheet for

How to fill out Medical Expenses Worksheet for Financial Aid

01

Gather all medical expense documentation including receipts, bills, and insurance statements.

02

Download or obtain a copy of the Medical Expenses Worksheet from your financial aid office or website.

03

Fill out your personal information at the top of the worksheet, including your name and student ID.

04

List all medical expenses incurred in the last year, including out-of-pocket costs not covered by insurance.

05

Categorize expenses as required, such as medical, dental, and vision care.

06

Include additional comments or explanations for any unique situations or high expenses if required.

07

Review all entries for accuracy and completeness before submitting the worksheet.

Who needs Medical Expenses Worksheet for Financial Aid?

01

Students applying for financial aid who have incurred significant medical expenses not covered by insurance.

02

Families looking to appeal financial aid decisions based on unexpected medical costs.

03

Anyone seeking to provide additional documentation regarding their financial situation related to health care costs.

Fill

form

: Try Risk Free

People Also Ask about

What are the limitations on medical expenses?

Generally, you can deduct on Schedule A (Form 1040) only the amount of your medical and dental expenses that is more than 7.5% of your AGI.

What expenses are eligible for financial aid?

Federal student aid from the Department of Education covers such expenses as tuition and fees, housing and food, books and supplies, and transportation. Aid can also help pay for other related expenses, such as a computer and dependent care.

What claims are typically excluded from medical expense policies?

Exclusions common in medical expense insurance policies include: Custodial care in nursing homes. Dental care, unless due to a covered accident. Vision care.

What proof do I need to deduct medical expenses?

You should also keep a statement or itemized invoice showing: What medical care was received. Who received the care. The nature and purpose of any medical expenses. The amount of the other medical expenses.

What cannot be claimed as a medical expense?

Examples of Medical and Dental Payments you CANNOT deduct: Health club dues, gym membership fees, or spa dues. Electrolysis or hair removal. The cost of diet food or nutritional supplements (vitamins, herbal supplements, "natural medicines") Teeth whitening.

How do you calculate qualified medical expenses?

Calculating Your Medical Expense Deduction The Consolidated Appropriations Act of 2021 made the 7.5% threshold permanent. You can get your deduction by taking your AGI and multiplying it by 7.5%. If your AGI is $50,000, only qualifying medical expenses over $3,750 can be deducted ($50,000 x 7.5% = $3,750).

What is not deductible as a medical expense?

Other examples of nondeductible medical expenses are nonprescription drugs, doctor prescribed travel for "rest," and expenses for the improvement of your general health such as a weight loss program or health club fees (the weight loss program is deductible if it is to treat a specific disease).

What are IRS qualified medical expenses?

They include the costs of equipment, supplies, and diagnostic devices needed for these purposes. They also include the costs of medicines and drugs that are prescribed by a physician. Medical expenses must be primarily to alleviate or prevent a physical or mental disability or illness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Medical Expenses Worksheet for Financial Aid?

The Medical Expenses Worksheet for Financial Aid is a document used by students and their families to report extraordinary medical expenses that may impact their financial aid eligibility.

Who is required to file Medical Expenses Worksheet for Financial Aid?

Students or their parents who have incurred significant medical expenses that are not covered by insurance and wish to have those expenses considered in their financial aid assessment.

How to fill out Medical Expenses Worksheet for Financial Aid?

To fill out the worksheet, individuals should gather documentation of all relevant medical expenses, including receipts and bills, and complete the form by listing each expense, providing dates and services received.

What is the purpose of Medical Expenses Worksheet for Financial Aid?

The purpose is to provide a detailed account of medical expenses to financial aid offices to potentially adjust the student’s financial aid package based on financial needs.

What information must be reported on Medical Expenses Worksheet for Financial Aid?

The worksheet typically requires details such as the type of medical expenses, amounts paid, dates of service, and any supporting documentation to verify these expenses.

Fill out your medical expenses worksheet for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medical Expenses Worksheet For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.