Get the free MICHIGAN REAL PROPERTY REVIEW - michbar

Show details

This issue of the Michigan Real Property Review features a variety of articles focused on recent developments in real estate law, including topics on recording land contracts, priority claims under

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan real property review

Edit your michigan real property review form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your michigan real property review form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit michigan real property review online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit michigan real property review. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

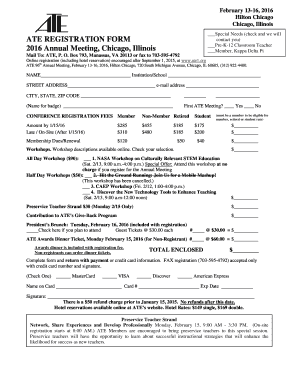

How to fill out michigan real property review

How to fill out MICHIGAN REAL PROPERTY REVIEW

01

Obtain the Michigan Real Property Review form from the appropriate state or local government website.

02

Review the instructions provided with the form carefully.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide details about the property, such as the address, parcel number, and any existing legal descriptions.

05

Indicate the purpose of the review, whether it's for assessment, litigation, or other purposes.

06

Attach any supporting documents or evidence required for the review.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the designated office, either in person or via mail, before the specified deadline.

Who needs MICHIGAN REAL PROPERTY REVIEW?

01

Property owners seeking an assessment of their property value.

02

Realtors and agents representing clients in property transactions.

03

Attorneys involved in real estate litigation or disputes.

04

Government agencies requiring property assessments for tax purposes.

05

Appraisers needing to evaluate property values.

Fill

form

: Try Risk Free

People Also Ask about

What is considered real property in Michigan?

Real property includes land plus the buildings and fixtures permanently attached to it. Real property taxes are assessed on agricultural, commercial, industrial, residential and utility property. Personal property is property that is not permanently affixed to land: e.g., equipment, furniture, tools and computers.

What is defined as real property?

Michigan has some of the highest property tax rates in the country. The Great Lake State's average effective property tax rate is 1.35%, well above the national average of 0.90%.

What is real property in Michigan?

Real property includes land, buildings (including houses), and anything permanently attached to land.

What are real property taxes in Michigan?

Property law in the United States is complex and multifaceted, but these laws pertain specifically to three distinct types of property. Both state and federal laws exist to protect real property, personal property, and intellectual property.

What is defined as real property?

Real property includes not only real estate, such as land, a home, and the geographical features on the property, but also the rights of ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MICHIGAN REAL PROPERTY REVIEW?

The Michigan Real Property Review is a document used to oversee the assessment and taxation of real property in Michigan. It provides a standardized method for reporting property details to ensure accurate evaluations by local taxing authorities.

Who is required to file MICHIGAN REAL PROPERTY REVIEW?

Property owners, businesses, and entities that own, lease, or control real property in Michigan are typically required to file the Michigan Real Property Review to report relevant property information.

How to fill out MICHIGAN REAL PROPERTY REVIEW?

To fill out the Michigan Real Property Review, property owners should provide detailed information about the property, including its legal description, assessed value, property use, and any exemptions being claimed. It is advisable to follow the instructions provided by the local tax authority.

What is the purpose of MICHIGAN REAL PROPERTY REVIEW?

The purpose of the Michigan Real Property Review is to facilitate accurate property assessments and ensure compliance with state property tax laws. It helps local governments assess property values fairly and equitably.

What information must be reported on MICHIGAN REAL PROPERTY REVIEW?

The Michigan Real Property Review requires reporting information such as property identification details (tax code), ownership information, description of the property, location, current use, assessed values, and any exemptions or special circumstances.

Fill out your michigan real property review online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Michigan Real Property Review is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

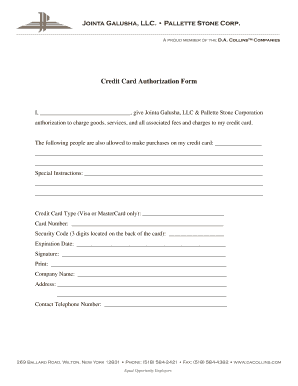

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.