Get the free 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate

Show details

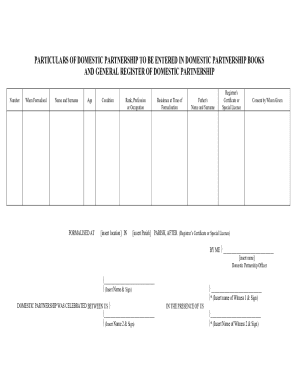

This form is used by residents of Iowa to apply for a reduced tax rate on mobile, manufactured, or modular homes based on household income and age criteria as of December 31, 2011. The application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 iowa mobilemanufacturedmodular home

Edit your 2012 iowa mobilemanufacturedmodular home form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 iowa mobilemanufacturedmodular home form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 iowa mobilemanufacturedmodular home online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 iowa mobilemanufacturedmodular home. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 iowa mobilemanufacturedmodular home

How to fill out 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate

01

Obtain the 2012 Iowa Mobile/Manufactured/Modular Home Owner Application from the relevant state website or local assessor's office.

02

Read the application instructions carefully before beginning.

03

Fill in your personal information including name, address, and contact information at the top of the application.

04

Provide details about the mobile/manufactured/modular home, including the address, year built, and serial number.

05

Indicate the current tax status of the home and previous tax information if applicable.

06

Complete the section that asks for information regarding the owner’s eligibility for the reduced tax rate, including income and family size.

07

Sign and date the application at the designated section.

08

Submit the completed application to your local assessor’s office by the stated deadline.

Who needs 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

01

Homeowners of mobile, manufactured, or modular homes in Iowa who wish to apply for a reduced property tax rate.

02

Individuals who meet specific eligibility criteria related to income, family size, and residency status.

Fill

form

: Try Risk Free

People Also Ask about

Is a mobile home considered real property in Iowa?

1. If a mobile home is placed outside a mobile home park, the home is to be assessed and taxed as real estate. 2. If a manufactured home is placed in a manufactured home community or a mobile home park, the home must be titled and is subject to the manufactured or mobile home square foot tax.

What is the Iowa low income exemption?

Low income exemption Your total income is less than $5,000 and you are claimed as a dependent on another person's Iowa return. You are single and your total income is $9,000 or less and you are not claimed as a dependent on another person's Iowa return.

What is the 65 homestead exemption in Iowa?

In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption. For the assessment year beginning on January 1, 2023, the exemption is for $3,250 of taxable value.

At what age do you stop paying property taxes in Iowa?

Homeowners who are 65 or older AND a qualifying veteran are eligible for both the military exemption and the homestead tax exemption. If you have a spouse who is also over age 65, only one 65 and over homestead exemption is allowed per property. Applications are available on the Iowa Department of Revenue website.

Do you pay sales tax on a mobile home in Iowa?

Manufactured housing is subject only to Iowa use tax and not Iowa sales tax. The sale of manufactured housing in Iowa is defined by the applicable statute as a use of the housing in this state. b. The use tax on manufactured housing is paid by the owner of the housing directly to the appropriate county treasurer.

Do you have to claim a mobile home on taxes?

While buying a manufactured home can be tax-deductible, there are a few limitations to consider. Several factors can influence whether or not you'll be able to claim the home on your tax return, including if: Your manufactured home serves as collateral for your loan. It's used as your primary or secondary residence.

At what age do you stop paying property tax in Iowa?

Homestead Tax Exemption for Claimants 65 Years of Age or Older. In addition to the homestead tax credit, eligible claimants who are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption.

How are mobile homes taxed in Iowa?

Mobile homes are taxed as real estate if sitting outside a park regardless if the mobile home is on a permanent foundation. Property taxes for these are due annually with installments being made in September and in March.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

The 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate is a form used by homeowners of mobile, manufactured, or modular homes in Iowa to apply for a reduction in their property tax assessment.

Who is required to file 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

Homeowners of mobile, manufactured, or modular homes in Iowa who wish to receive a reduced property tax rate are required to file this application.

How to fill out 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

To fill out the application, homeowners should provide detailed information including their name, address, details about the home, and any required documentation to verify eligibility for the reduced tax rate.

What is the purpose of 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

The purpose of this application is to allow eligible homeowners to formally request a reduction in property taxes on their mobile, manufactured, or modular homes, thereby providing financial relief.

What information must be reported on 2012 Iowa Mobile/Manufactured/Modular Home Owner Application for Reduced Tax Rate?

The application must report information such as the homeowner's name, contact information, the address of the mobile/manufactured/modular home, the make and model of the home, and any other relevant details needed to determine eligibility for the tax reduction.

Fill out your 2012 iowa mobilemanufacturedmodular home online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Iowa Mobilemanufacturedmodular Home is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.