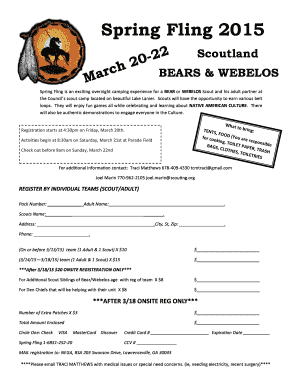

Get the free Sample Reports of Service Tax

Show details

Este documento contiene informes sobre la Computación de Impuestos de Servicio, Pagos de Impuestos de Servicio, Resumen de Crédito de Entrada y E-filing del Informe ST3 para Tally. Proporciona instrucciones

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample reports of service

Edit your sample reports of service form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample reports of service form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample reports of service online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample reports of service. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample reports of service

How to fill out Sample Reports of Service Tax

01

Gather all relevant financial documents related to service transactions.

02

Identify the services provided and their corresponding tax rates.

03

Calculate the total amount of service tax applicable based on the gross receipts.

04

Complete the sample report by filling in details such as tax period, date, and service details.

05

Review the filled sample report for accuracy and completeness.

06

Submit the report to the appropriate tax authorities or relevant department.

Who needs Sample Reports of Service Tax?

01

Businesses providing taxable services who need to document their tax liabilities.

02

Accountants and tax professionals assisting clients with service tax compliance.

03

Companies preparing for tax audits or assessments.

04

Startups needing to establish service tax records for their operations.

Fill

form

: Try Risk Free

People Also Ask about

What is the VAT tax in France?

The standard VAT rate in France is 20%. There are also reduced VAT rates of 10% and 5.5%, and a super-reduced VAT rate of 2.1%. The French super-reduced rate is the lowest in the EU, and includes TV licences, certain pharmaceutical products, certain newspapers and periodicals, and admission to certain cultural events.

What are the rules for service tax?

Service tax is only liable to be paid in case the total value of the service provided during the financial year is more than Rs. 10 Lakhs. If the value of services provided during a financial year is less than 10 Lakhs, it is optional for the service provider to pay service tax or not.

What is the fortune tax in France?

Who pays French wealth tax? IFI applies to taxpayers with real estate assets over €1.3 million. The wealth tax can be applied to anyone who is tax registered in France, including those living abroad who are taxed based on the French property they own. Wealth tax is calculated per household.

What is the tax summary report?

A tax summary report is a summary of all taxes that you have incurred on your expenses and received on invoices in your organization.

What tax do you pay in France?

In France, personal income tax rates range from 0% to 45% (as of 2025), depending on income levels. The tax is calculated on the household's total income using a progressive scale and the family quotient system, which adjusts for dependents and marital status.

How to get a tax compliance report?

Get a tax compliance report You can download a copy of your tax compliance report from your individual online account or business tax account. If you have resident alien status and are leaving the U.S., see how to get a tax clearance document.

What is the gafa tax in France?

The “GAFA” tax, as it was initially abbreviated, is now “GAFAM” and is an income-based tax that primarily affects the most impactful digital services companies with clients worldwide and significant market share.

What are the two taxes in France?

In France there are three categories of taxes on income: the corporate tax, the income tax for individuals and taxes for social purposes (CSG and the CRDS, paid by the households). Taxes paid by employers on wages, namely social contributions, are not considered as taxes by the French central government.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sample Reports of Service Tax?

Sample Reports of Service Tax are standardized documents used to report the collection and payment of service tax by service providers to the tax authorities. They outline the total service tax liability for a specific period.

Who is required to file Sample Reports of Service Tax?

Service providers who are registered under the service tax regime and are liable to pay service tax must file Sample Reports of Service Tax, including individuals, partnerships, and corporations offering taxable services.

How to fill out Sample Reports of Service Tax?

To fill out Sample Reports of Service Tax, the service provider must gather their financial records and service tax collected during the reporting period, calculate the total tax owed, and accurately complete the report forms as required by the tax authority.

What is the purpose of Sample Reports of Service Tax?

The purpose of Sample Reports of Service Tax is to ensure compliance with tax laws, help service providers report their tax liabilities accurately, and facilitate the assessment and collection of service tax by the government.

What information must be reported on Sample Reports of Service Tax?

The information required on Sample Reports of Service Tax typically includes details of the service provider, the total value of taxable services provided, service tax collected, any adjustments or exemptions, and payment details for the tax owed.

Fill out your sample reports of service online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Reports Of Service is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.