Get the free tds format pdf

Show details

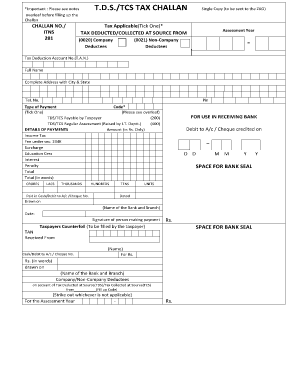

E-Payment From Other Banks Account Allowed 5. TDS challan ITNS 281 In excel amp 6. How to Fill TDS CHALLAN-ITNS 281 7. How To pay Income Tax/Tds Online FAQ 8. Deposit Tax On line Through ATM-Corporation bank 9. Cheque deposited Before due date and cleared after due date 10. How To pay Income Tax/Tds Online FAQ 8. Deposit Tax On line Through ATM-Corporation bank 9. Cheque deposited Before due date and cleared after due date 10. Challan Tender date and Clearing Date 11. Know Challan Details By...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tds format pdf

Edit your tds format pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tds format pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tds format pdf online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tds format pdf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How can I download TDS challan for offline payment?

How to Make TDS Payment Offline Step 1: First Download “Challan 281” from the official website of the Income Tax Department. Step 2: Take a printout of this form. Fill in details such as TAN, your full name, residential address etc. Step 3: Submit your payable TDS amount along with the challan to your nearest bank.

Can we download TDS payment receipt?

TDS challan can only be downloaded at the time of payment. However, the taxpayer can download the challan and check the status through OLTAS or the income tax portal.

How can I download TDS paid receipt?

How to Download TDS Challan? Visit TIN NSDL website. Visit TIN NSDL website. Visit TIN NSDL website. You will be redirected to the 'Challan' page. From here, you can download your required copy of TDS Challan.

How can I download challan from income tax site?

Step 1: Log in to the e-Filing portal with your user ID and password. Step 2: After logging in, select the PAN/Name of the assessee whom you are representing. Step 3: On the Dashboard of the selected assessee, click e-File > e-Pay Tax. You will be taken to the e-Pay Tax page.

How can I download challan from traces?

What is the process to view OLTAS challan status on TRACES? Step#1 Do the OLTAS login at the TRACES website. Enter the requisite user id, PAN/TAN, password, etc. Step#2 Go to Statements or Payments Menu and Click on Challan Status. Step#3 Select CIN or BIN.

How to generate a challan for TDS payment?

Step 1: Log in to the e-Filing portal with your user ID and password. Step 2: On your Dashboard, click e-File > e-Pay Tax. You will be taken to the e-Pay Tax page. Select PAN / TAN of the taxpayer on behalf of whom you want to create a challan form (CRN) and click Continue.

How to download TDS challan receipt from SBI corporate banking?

Printing of Challan Clicking on the corresponding reference number of Tax Payment transaction will display the links to view & print the challan. In case of Corporate Customers the challan can be printed from Tab 'Query by Account' or 'Query by E-cheque' link under 'Reports' tab.

How to download challan 280 receipt?

How to Download TDS Challan? Visit TIN NSDL website. Visit TIN NSDL website. Visit TIN NSDL website. You will be redirected to the 'Challan' page. From here, you can download your required copy of TDS Challan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tds format pdf to be eSigned by others?

When you're ready to share your tds format pdf, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out the tds format pdf form on my smartphone?

Use the pdfFiller mobile app to complete and sign tds format pdf on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How can I fill out tds format pdf on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tds format pdf by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is tds rate chart pdf?

The TDS rate chart PDF is a document that outlines the various tax deduction at source (TDS) rates applicable to different types of income as per Indian tax laws.

Who is required to file tds rate chart pdf?

Entities and individuals who are responsible for deducting TDS, such as employers, banks, and other financial institutions, are required to refer to the TDS rate chart PDF to ensure compliance.

How to fill out tds rate chart pdf?

To fill out the TDS rate chart PDF, one must identify the category of income, corresponding TDS rate, and provide necessary details in the prescribed format as indicated in the document.

What is the purpose of tds rate chart pdf?

The purpose of the TDS rate chart PDF is to provide clear guidelines on the rates of TDS to be deducted on various types of income, aiding taxpayers and deductors in accurate tax calculations.

What information must be reported on tds rate chart pdf?

The TDS rate chart PDF must report the income categories, applicable TDS rates, specific conditions (if any), and the relevant sections of the Income Tax Act.

Fill out your tds format pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tds Format Pdf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.