Get the free Certificate in ACCOUNTING - uma

Show details

This document outlines the requirements for obtaining a Certificate in Accounting at the University of Maine at Augusta, including course prerequisites and credit hours needed for completion.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certificate in accounting

Edit your certificate in accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certificate in accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

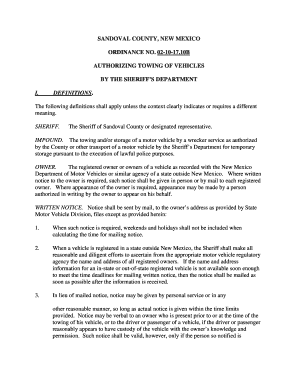

Editing certificate in accounting online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit certificate in accounting. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

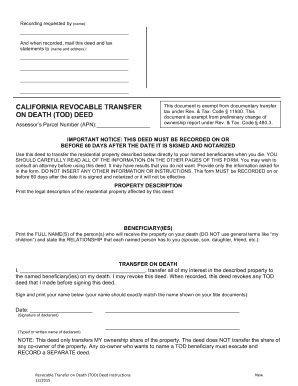

How to fill out certificate in accounting

How to fill out Certificate in ACCOUNTING

01

Gather necessary personal information such as your name, address, and contact details.

02

Obtain any required identification documents or transcripts from your previous education.

03

Review the specific requirements for the Certificate in ACCOUNTING program.

04

Complete the application form provided by the institution offering the certificate.

05

Attach any required documentation, such as proof of prior education or work experience.

06

Pay the application or program fees as instructed.

07

Submit your application by the deadline set by the institution.

08

Prepare for any required interviews or additional assessments, if necessary.

09

Once accepted, register for courses included in the Certificate in ACCOUNTING.

Who needs Certificate in ACCOUNTING?

01

Individuals seeking to enhance their skills in accounting for career advancement.

02

Recent graduates who want to specialize in accounting or finance.

03

Professionals looking to switch careers and enter the accounting field.

04

Business owners who wish to manage their financial records more effectively.

05

Anyone interested in pursuing further education in finance or accounting-related fields.

Fill

form

: Try Risk Free

People Also Ask about

Can I learn accounting in 3 months?

An undergraduate accounting certificate offers a practical pathway to a career in accounting. These nondegree programs can help you qualify as a bookkeeper or accounting clerk, which are vital roles in all types of business organizations.

What accounting certification pays the most?

7 Best Paying Accounting Certificates In 2025 Certified Public Accountant (CPA) A Chartered Financial Analyst (CFA) Chartered Management Accountant (CMA) Certified Auditor of Information Systems (CISA) Certified Fraud Investigator (CFE) Chartered Global Management Accountant (CGMA) Certified Internal Auditor (CIA)

Is a certificate in accounting worth it?

Best accounting certifications Certified Public Accountant. Chartered Global Management Accountant. Certified Management Accountant. Chartered Financial Analyst. Certified Internal Auditor. Certified Fraud Examiner. Certified in Financial Forensics. Certified Information Systems Auditor.

Which certificate is best for an accountant?

Certified Public Accountant (CPA) This professional license demonstrates knowledge of a wide range of accounting functions, including tax preparation, financial statements, financial planning, forensic accounting and internal auditing.

Is an accounting certificate useful?

Furthermore, obtaining an accounting certificate can open doors to various career opportunities. Whether you work in the public sector or private industry or even start your own accounting firm, the skills and knowledge gained from an accounting certificate will apply across various sectors.

What certificate is the best for accounting?

Without the structure of a formal program, progress can be slower and less comprehensive. In three months of consistent self-study (around 10-15 hours per week), you could expect to grasp basic accounting concepts, understand the structure of financial statements, and learn the fundamentals of bookkeeping.

Can I get an accounting job with a certificate?

Those looking to make a career pivot into accounting may be eligible for some entry-level accounting roles with a certificate in accounting alone.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certificate in ACCOUNTING?

A Certificate in Accounting is an educational credential that provides students with foundational knowledge and skills in accounting principles and practices. It typically covers topics such as financial reporting, tax preparation, and bookkeeping.

Who is required to file Certificate in ACCOUNTING?

Individuals who want to formalize their accounting knowledge or pursue a career in accounting are often required to complete a Certificate in Accounting. This may include aspiring accountants, bookkeepers, or those seeking a career change into the accounting field.

How to fill out Certificate in ACCOUNTING?

To fill out a Certificate in Accounting, students typically need to complete required coursework as specified by the granting institution, which may include enrolling in classes, completing assignments, and passing exams. Upon fulfilling the requirements, they can apply for the certificate through the institution's administrative process.

What is the purpose of Certificate in ACCOUNTING?

The purpose of a Certificate in Accounting is to equip individuals with the essential knowledge and skills needed for entry-level accounting positions, to enhance their career prospects, and to provide a foundation for further education in accounting or related fields.

What information must be reported on Certificate in ACCOUNTING?

The information reported on a Certificate in Accounting typically includes the student's name, the institution granting the certificate, completion date, the specific courses taken, and possibly the grades achieved in those courses.

Fill out your certificate in accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certificate In Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.