Get the free Withdraw of Authorization for Deduction of Organization Dues - umsystem

Show details

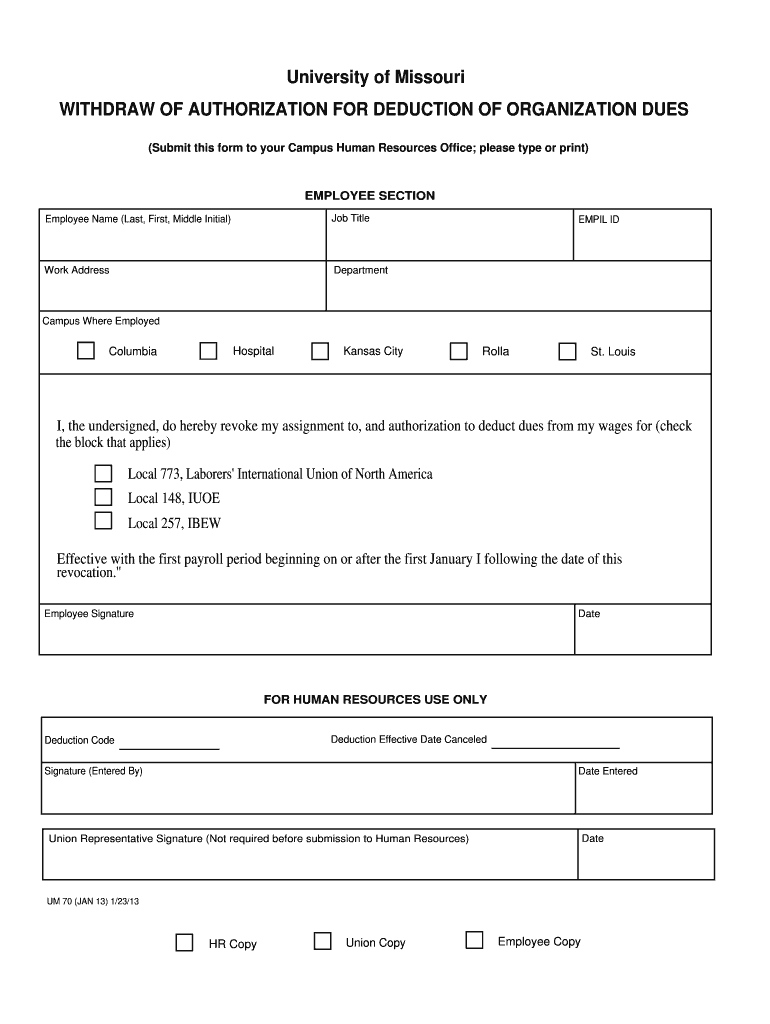

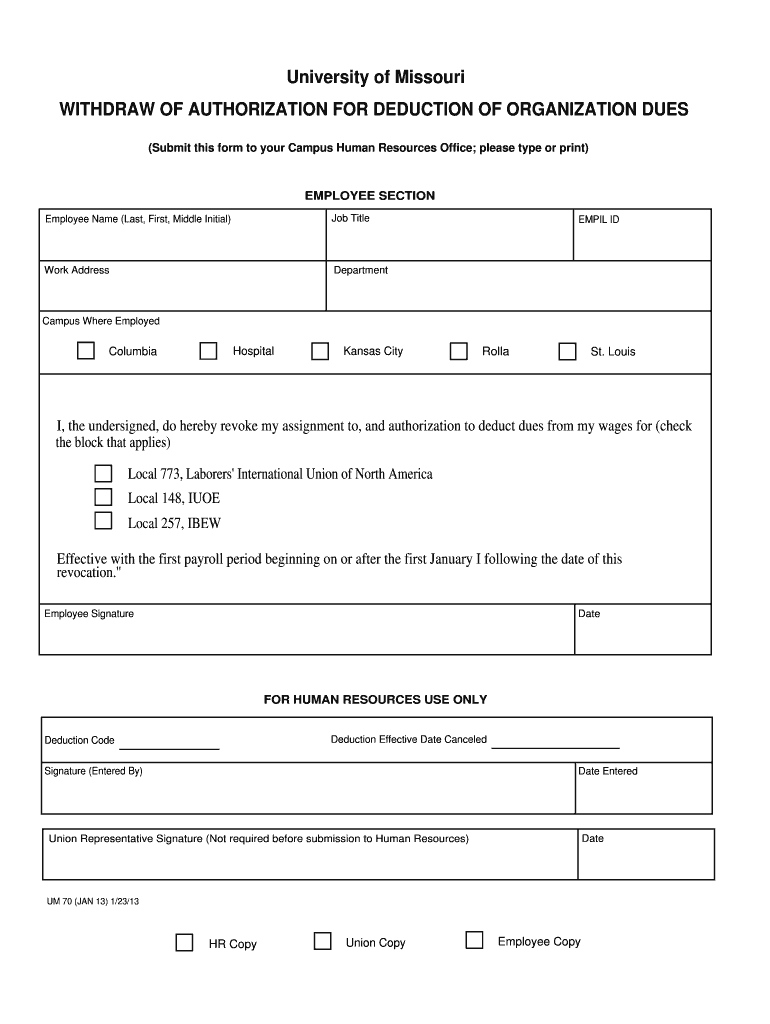

This document is used by employees to revoke their authorization for the deduction of union dues from their wages at the University of Missouri.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign withdraw of authorization for

Edit your withdraw of authorization for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your withdraw of authorization for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing withdraw of authorization for online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit withdraw of authorization for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out withdraw of authorization for

How to fill out Withdraw of Authorization for Deduction of Organization Dues

01

Obtain the Withdraw of Authorization for Deduction of Organization Dues form from your organization or employer.

02

Fill in your personal information, including your name, address, and employee identification number.

03

Provide details of the organization for which the dues are being deducted, including the organization's name and any relevant identification number.

04

Specify the date you wish the withdrawal to take effect.

05

Sign and date the form to confirm your intention to withdraw authorization.

06

Submit the completed form to your payroll department or the designated organization representative.

Who needs Withdraw of Authorization for Deduction of Organization Dues?

01

Employees who wish to stop the automatic deduction of union or organization dues from their paychecks.

02

Members of an organization who have decided to discontinue their membership and no longer want to contribute dues.

Fill

form

: Try Risk Free

People Also Ask about

How to fill out Form 7202?

How to fill out a 7202 form? Start by entering your personal information, including your name, address, and Social Security Number. Detail your employment status and eligible sick and family leave wages. Calculate the credit amount based on your eligible leave. Review the form for accuracy and add your signature.

What USPS form do I need to cancel union dues?

925.11 Form Used Employees use PS Form 1188, Cancellation of Organization Dues from Payroll Withholdings, to cancel dues withholding.

How do I get form 1188 USPS?

Ordering PS Form 1188 Printed copies of PS Form 1188 are available from HRSSC; call 877-477-3273.

How to fill out form 1188?

How to fill out the Standard Form 1188 - Cancellation of Payroll Deductions? Print your name and employee ID. Provide your agency information. State the reason for cancellation. Sign and date the form. Submit the necessary copies to the agency payroll office.

How to stop union dues for federal employees?

You can resign by simply submitting to your union a written letter stating that you are doing so. If you have authorized payroll deduction of your dues, you would also have to notify your employer that you wish to revoke that authorization.

What is an 1187 form?

The 1187 form is used by federal agencies and federal payroll processors to assign membership to the correct employee and initiate withdrawal of bi-weekly membership dues.

How to fill out nalc form 1188?

How to fill out the Standard Form 1188 - Cancellation of Payroll Deductions? Print your name and employee ID. Provide your agency information. State the reason for cancellation. Sign and date the form. Submit the necessary copies to the agency payroll office.

How to fill out Employee Withholding Certificate form?

Here's a five-step guide on how to fill out your W-4. Step 1: Enter your personal information. Step 2: Account for all jobs or spousal income. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Withdraw of Authorization for Deduction of Organization Dues?

The Withdraw of Authorization for Deduction of Organization Dues is a formal request made by a member of an organization to cancel or revoke the authorization previously given for the automatic deduction of membership dues from their paycheck.

Who is required to file Withdraw of Authorization for Deduction of Organization Dues?

Any member of an organization who wishes to discontinue the automatic deduction of dues from their paycheck is required to file a Withdraw of Authorization for Deduction of Organization Dues.

How to fill out Withdraw of Authorization for Deduction of Organization Dues?

To fill out the Withdraw of Authorization for Deduction of Organization Dues, a member should provide their personal information, including name, address, and member ID, specify the organization, indicate that they are withdrawing authorization, and sign and date the document.

What is the purpose of Withdraw of Authorization for Deduction of Organization Dues?

The purpose of the Withdraw of Authorization for Deduction of Organization Dues is to provide a clear and official notice to the organization that the member no longer wishes to have dues deducted automatically, allowing for personal financial control.

What information must be reported on Withdraw of Authorization for Deduction of Organization Dues?

The information that must be reported includes the member's full name, address, member identification number, the name of the organization, the date of withdrawal, and the member's signature.

Fill out your withdraw of authorization for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Withdraw Of Authorization For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.