Get the free CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT - unco

Show details

This document outlines the terms and conditions for student employees at UNC to apply for CASE, a payroll deduction plan to help pay their university bills.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit available for student

Edit your credit available for student form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

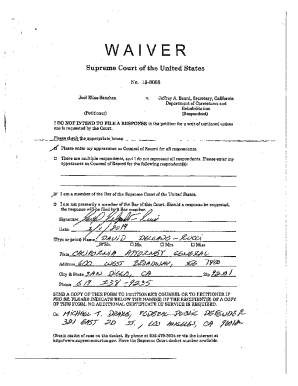

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit available for student form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit available for student online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit available for student. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

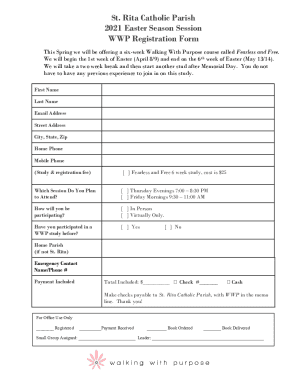

How to fill out credit available for student

How to fill out CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT

01

Obtain the CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT form from the designated office.

02

Read the instructions carefully to understand the eligibility and terms.

03

Fill out your personal details such as name, student ID, and contact information in the provided sections.

04

Indicate the employment position or department you are applying for.

05

Provide the number of credit hours you have completed and your current academic standing.

06

Specify the type of financial aid or scholarship you are receiving, if applicable.

07

Review the agreement to ensure all information is accurate and complete.

08

Sign and date the form at the bottom to certify the information provided.

09

Submit the completed form to the appropriate office or department by the specified deadline.

Who needs CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

01

Students who are currently employed in a work-study program.

02

Students seeking to apply for or renew their financial aid through student employment.

03

Students interested in understanding their credit availability while working part-time on campus.

Fill

form

: Try Risk Free

People Also Ask about

How many times can you qualify for the American Opportunity Credit?

The American Opportunity Education Credit is available to be claimed for a maximum of 4 years per eligible student. This includes the number of times you claimed the Hope Education Credit (which was used for tax years prior to 2009).

Why did I not get the full American Opportunity Credit?

The most likely reason you do not qualify for the American Opportunity Tax Credit is because you are between 18-24 and do not have a tax shown on line 11 of your 1040. In order to be eligible for the refundable portion of the tax credit that would be shown on line 17c, you would have to be over 24.

How do I get full amount of American Opportunity Credit?

To claim the full credit, your MAGI, modified adjusted gross income (See Q&A 13 for MAGI definition) must be $80,000 or less ($160,000 or less for married taxpayers filing jointly).

How do I get the full $2500 American Opportunity Credit?

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential, Be enrolled at least half time for at least one academic period* beginning in the tax year, Not have finished the first four years of higher education at the beginning of the tax year,

What is the American Opportunity Tax Credit up to $2500 per person?

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

What qualifies as education credit?

You pay some or all qualified tuition and related expenses for any of the first 4 years of postsecondary education at an eligible educational institution. You paid qualified expenses for an eligible student (defined below). The eligible student is you, your spouse, or a dependent you claim on your tax return.

How many payments to qualify for student loan forgiveness?

PSLF Process Because you have to make 120 qualifying monthly payments, it will take at least 10 years before you can qualify for PSLF. Important: You must still be working for a qualifying employer at the time you submit your form for forgiveness.

What qualifies you for the American Opportunity Credit?

1. at least half-time in one of the first four years of postsecondary education; 2. for at least one academic period beginning during the relevant tax year; and 3. in a program leading to a degree, certificate, or another recognized educational credential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT is a document that outlines the terms and conditions under which students participating in employment while studying can receive credits toward their tuition or other educational expenses.

Who is required to file CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

Student employees who wish to receive educational credits or financial assistance linked to their employment while enrolled in a program are required to file the CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT.

How to fill out CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

To fill out the CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT, students must provide their personal details, employment information, and any relevant educational program details, ensuring all required signatures and dates are included.

What is the purpose of CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

The purpose of the CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT is to formalize the arrangement between student employees and their institutions regarding the allocation of credits or financial aid in relation to their employment.

What information must be reported on CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT?

The CREDIT AVAILABLE FOR STUDENT EMPLOYEES CASE AGREEMENT must report information such as the student's name, identification number, employment details, the nature of the work, and the corresponding credits or financial benefits being requested.

Fill out your credit available for student online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Available For Student is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.