Get the free Short-Term Exchange Financial Statement - vanderbilt

Show details

This form is to be completed by students admitted to Vanderbilt University for a short-term exchange program as non-degree students. It addresses proof of funding, health insurance details, tuition,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short-term exchange financial statement

Edit your short-term exchange financial statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short-term exchange financial statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short-term exchange financial statement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit short-term exchange financial statement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short-term exchange financial statement

How to fill out Short-Term Exchange Financial Statement

01

Begin by downloading the Short-Term Exchange Financial Statement form from the official website.

02

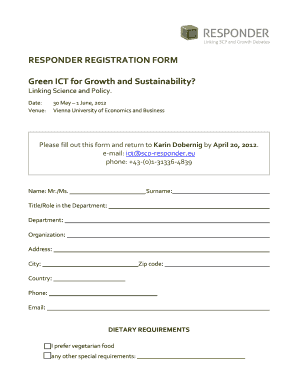

Fill in your personal information at the top, including your name, address, and contact details.

03

Indicate the period of your exchange program in the specified section.

04

Provide details of your financial resources, including bank statements or financial guarantees.

05

Specify any scholarships or grants you have received, if applicable.

06

Ensure that you total your financial resources and clearly articulate how they cover your expenses during the exchange.

07

Sign and date the statement at the bottom to confirm the accuracy of the information provided.

08

Submit the completed statement along with any required supporting documents by the specified deadline.

Who needs Short-Term Exchange Financial Statement?

01

Students participating in a short-term exchange program who need to demonstrate their financial capability.

02

Educational institutions requiring proof of financial support from applicants for processing their exchange application.

Fill

form

: Try Risk Free

People Also Ask about

Where to find short-term debt on financial statements?

Explanation: Short term loans and advances represent funds lent by a company to other parties or advances made for a short duration, typically less than one year, and are classified as current assets on the balance sheet.

Where do short-term loans go on a balance sheet?

Short-term debt, also called current liabilities, is a firm's financial obligations that are expected to be paid off within a year. It is listed under the current liabilities portion of the total liabilities section of a company's balance sheet.

What are short term advances on a balance sheet?

The four primary types of financial statements are: balance sheet, income statement, cash flow statement, and statement of shareholders' equity.

What are short-term borrowings in a balance sheet?

Short-term investments are disclosed as part of a company's current assets on its balance sheet. This is done in a separate account and the accounting of these investments is treated on the assumption that they will mature within one year.

What are short-term advances?

Short-term loans are typically larger amounts repaid over a set period with interest, whereas advances are smaller, short-term funds given quickly and often pre-approved. Loans often require credit checks, while advances can be more flexible but come with higher interest rates.

What financial statement is short term investments?

Recorded in a separate account, and listed in the current assets section of the corporate balance sheet, short-term investments in this context are investments that a company has made that are expected to be converted into cash within one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Short-Term Exchange Financial Statement?

The Short-Term Exchange Financial Statement is a financial document that provides a snapshot of a company's financial position and performance over a short-term period, typically used for interim financial reporting.

Who is required to file Short-Term Exchange Financial Statement?

Companies that are publicly traded or those that are required by regulatory authorities to disclose their financial performance for short periods are typically required to file a Short-Term Exchange Financial Statement.

How to fill out Short-Term Exchange Financial Statement?

To fill out a Short-Term Exchange Financial Statement, companies should gather relevant financial data, complete sections on assets, liabilities, equity, revenues, and expenses, ensuring accuracy and compliance with applicable accounting standards.

What is the purpose of Short-Term Exchange Financial Statement?

The purpose of the Short-Term Exchange Financial Statement is to provide timely financial information to stakeholders, enabling them to assess the company's financial health and performance over a limited timeframe.

What information must be reported on Short-Term Exchange Financial Statement?

The Short-Term Exchange Financial Statement must report information on current assets, current liabilities, shareholder's equity, revenue, expenses, and any other relevant financial data for the reporting period.

Fill out your short-term exchange financial statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short-Term Exchange Financial Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.