Get the free Tax Preparation/Bookkeeping Services Supplemental Application

Show details

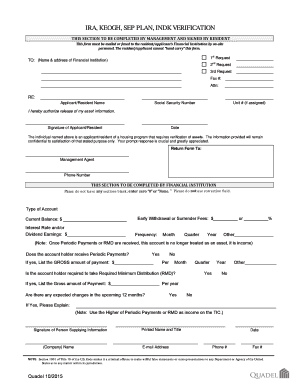

This document is a supplemental application for tax preparation and bookkeeping services, used to collect information from the applicant regarding their services and operations for liability insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax preparationbookkeeping services supplemental

Edit your tax preparationbookkeeping services supplemental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparationbookkeeping services supplemental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax preparationbookkeeping services supplemental online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax preparationbookkeeping services supplemental. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax preparationbookkeeping services supplemental

How to fill out Tax Preparation/Bookkeeping Services Supplemental Application

01

Begin with your personal information: Fill in your name, address, and contact details at the top of the form.

02

Provide your Social Security Number (or Employer Identification Number) as requested.

03

Indicate your filing status (e.g., single, married, head of household) appropriately.

04

List your sources of income: Include details for each source such as wages, self-employment, rental, and any investment income.

05

Detail your expenses and deductions: Record all relevant expenses associated with your taxes, including business expenses, education, healthcare, and others.

06

Complete the section on tax credits: Provide information about any tax credits you are eligible for.

07

Review the compliance questions to confirm your eligibility for services.

08

Sign and date the application before submission.

Who needs Tax Preparation/Bookkeeping Services Supplemental Application?

01

Individuals or businesses who require assistance in preparing their tax returns or managing their bookkeeping.

02

Self-employed individuals looking for professional help to organize their financial records.

03

Small business owners needing to ensure compliance with tax laws and maximize their deductions.

04

Anyone seeking to simplify the tax filing process and avoid common mistakes.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between bookkeeping and tax preparation?

While tax preparers assist businesses in preparing and filing tax returns as well as offering tax advice and guidance, bookkeepers assist businesses in maintaining correct financial records and creating financial reports.

Can a bookkeeper prepare tax returns?

Bookkeepers may work on tax preparation tasks, but they are generally not qualified to file taxes.

Who is not considered a tax preparer?

An official or employee of the IRS performing official duties is not a preparer. A person who provides tax assistance under a Volunteer Income Tax Assistance program established by the IRS is not a preparer to the extent that the return is prepared under the program.

Is a tax preparer the same as a bookkeeper?

Tax preparers ensure taxes are filed accurately and on time while optimizing for tax savings. So in summary, bookkeepers handle day-to-day transactions, and tax preparers focus on tax filing and optimization.

What can bookkeepers not do?

Bookkeepers handle daily financial tasks but cannot perform audits or provide legal interpretations. They do not offer financial or investment advice beyond organising records. Tax filing and strategic tax planning require a certified accountant.

Can a bookkeeper be a tax preparer?

Bookkeepers may work on tax preparation tasks, but they are generally not qualified to file taxes.

How to start a tax preparation and bookkeeping business?

How to Start a Professional Tax Practice Get registered. Register your business with your state. Define your tax practice. Determine your business model. Get tools to streamline tax preparation. Consider which professional tax software is right for your business. Grow your tax business. Market yourself. Learn more. What's next?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Preparation/Bookkeeping Services Supplemental Application?

The Tax Preparation/Bookkeeping Services Supplemental Application is a document used by individuals or businesses to provide additional information regarding their tax preparation and bookkeeping services. It is typically required as part of the licensing or regulatory process for these types of services.

Who is required to file Tax Preparation/Bookkeeping Services Supplemental Application?

Any individual or business offering tax preparation or bookkeeping services may be required to file this supplemental application to meet local, state, or federal regulatory requirements.

How to fill out Tax Preparation/Bookkeeping Services Supplemental Application?

To fill out the Tax Preparation/Bookkeeping Services Supplemental Application, applicants must complete all required sections accurately, providing information about their services, qualifications, and any relevant business practices. It may also require supporting documents to substantiate the information provided.

What is the purpose of Tax Preparation/Bookkeeping Services Supplemental Application?

The purpose of the Tax Preparation/Bookkeeping Services Supplemental Application is to ensure that applicants meet the necessary regulatory requirements and standards for providing tax preparation and bookkeeping services. It helps regulatory bodies assess compliance and qualifications.

What information must be reported on Tax Preparation/Bookkeeping Services Supplemental Application?

Information that must be reported on the Tax Preparation/Bookkeeping Services Supplemental Application typically includes the applicant's business details, types of services offered, educational qualifications, professional licenses, client demographics, and any prior disciplinary actions, if applicable.

Fill out your tax preparationbookkeeping services supplemental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Preparationbookkeeping Services Supplemental is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.