Get the free tc 62m schedule j - tax utah

Show details

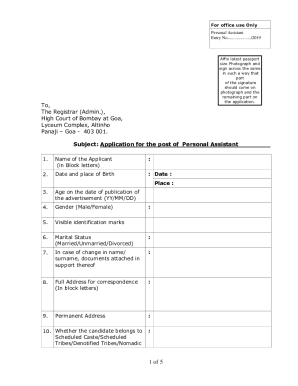

TC-62J Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134 tax.Utah.gov 62131 TC-62M Schedule J Sales of NON-FOOD and PREPARED FOOD from Places Other Than Fixed Utah Locations Print Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tc 62m schedule j

Edit your tc 62m schedule j form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 62m schedule j form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc 62m schedule j online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tc 62m schedule j. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tc 62m schedule j

To fill out TC 62M Schedule J, follow these steps:

01

Start by gathering all the necessary information and documents related to your income, expenses, and deductions. This may include pay stubs, bank statements, receipts, and any other relevant financial records.

02

Begin filling out the schedule by entering your personal information, such as your name, address, and social security number. Make sure to double-check the accuracy of this information to avoid any errors.

03

Move on to the income section of the schedule. Enter all your income sources, including wages, salaries, self-employment earnings, rental income, or any other applicable sources. Provide the required details for each source, such as the amount earned and any withholding taxes.

04

Proceed to the expense section of the schedule. This is where you will list your deductible expenses, such as business expenses, medical expenses, educational expenses, or any other eligible deductions. Make sure to categorize and document each expense accurately.

05

Total all your income and expenses separately, ensuring that you have accurately accounted for each item. Take the time to double-check your calculations to avoid any mistakes.

06

Finally, review the completed TC 62M Schedule J for accuracy and completeness. Make any necessary corrections or additions before submitting it along with your tax return.

Who needs TC 62M Schedule J?

01

Individuals who have a complex financial situation, such as multiple sources of income, various deductions, or significant personal expenses, may need to fill out TC 62M Schedule J. This schedule allows them to provide detailed information regarding their income and expenses, ensuring accurate tax reporting.

02

Self-employed individuals or those who run a business may also need to fill out TC 62M Schedule J. This schedule helps them report their business income and deductible business expenses, facilitating the calculation of their taxable income.

03

Taxpayers who want to maximize their deductions and claim eligible expenses may find TC 62M Schedule J beneficial. By completing this schedule thoroughly, they can ensure that they have accounted for all possible deductions, potentially reducing their overall tax liability.

Fill

form

: Try Risk Free

People Also Ask about

How often do I need to file sales tax in Utah?

Mandatory Monthly Sales Tax Filers Any seller with an annual sales and use tax liability of $50,000 or more must file and pay sales and use tax monthly. The return and payment are due by the last day of the month following each monthly period.

How often do you file sales tax in Utah?

Filing frequency and due dates for Sales Related Taxes are the same as your Utah Sales and Use Taxes.Filing Frequencies and Due Dates. Filing FrequencyDueAnnualJanuary 31QuarterlyApril 30 July 31 October 31 January 31MonthlyJanuary 31 for December February 28 for January Etc.

Does Utah sales tax license expire?

Do you have to renew a Utah sales tax license? The sales tax license is a one-time registration, and no renewals are needed.

What is exempt from sales tax in Utah?

While the Utah sales tax of 4.85% applies to most transactions, there are certain items that may be exempt from taxation.Other tax-exempt items in Utah. CategoryExemption StatusManufacturing and MachineryRaw MaterialsEXEMPTUtilities & FuelEXEMPTMedical Goods and Services16 more rows

What is a TC 62T?

TC-62T, Transient Room Tax.

What is the transient room tax in Utah?

Utah counties may impose a 4.25% TRT tax on the rental of rooms in hotels, motels, inns, trailer courts, campgrounds, tourist homes, and similar accommodations for stays of less than 30 consecutive days. TRT is not imposed on meeting room charges.

What is the accommodation tax in Utah?

Transient Room Tax Utah imposes a statewide tax on temporary lodging of 0.32 percent.

What is Schedule J Utah?

TC-62M Schedule J, Sales of Non-food and Prepared Food from Places Other Than Fixed Utah Locations – State Tax Commission Government Form in Utah – Formalu. Locations.

What is the sales tax rate on cars in Utah?

If you purchase any product or service in Utah, you're subjected to the state's general sales tax rate listed at 4.85 percent. Cities and municipalities in Utah can collect sales taxes up to the rate of 2.1 percent.

How is car tax calculated in Utah?

Utah Sales Tax on Car Purchases: Utah collects a 6.85% state sales tax rate on the purchase of all vehicles. Some dealerships may also charge a dealer documentation fee of 149 dollars. In addition to taxes, car purchases in Utah may be subject to other fees like registration, title, and plate fees.

Does Utah collect sales tax on out of state purchases?

Sales of goods, other than motor vehicles and boats, purchased in Utah and shipped (including drop-shipping) by the seller or their agent to another state are not subject to Utah sales and use taxes.

How do you calculate sales tax on a car in Utah?

The state of Utah applies a tax rate of 6.85% to all car purchases. The total tax on your purchase, however, will take county and local rates into account, which combined can total up to 9.05%. The average total car sales tax in Utah ranges from 6.85% and 8.7%.

How is Utah state income tax calculated?

Utah Income Taxes There is a single, flat rate paid by all income earners: 4.85% of their taxable income. Taxable income is calculated by subtracting all personal exemptions from total income. In Utah, you can claim a personal exemption of $579 for each dependent you claimed on your federal tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tc 62m schedule j?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your tc 62m schedule j to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an eSignature for the tc 62m schedule j in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tc 62m schedule j right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit tc 62m schedule j on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign tc 62m schedule j. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is tc 62m schedule j?

TC 62M Schedule J is a tax form used by individuals or businesses to report information about certain income items.

Who is required to file tc 62m schedule j?

Individuals or businesses that have specific income items, as outlined by the tax authorities, are required to file TC 62M Schedule J.

How to fill out tc 62m schedule j?

To fill out TC 62M Schedule J, you need to gather the necessary information about your income items as specified by the tax authorities. Then, you complete the form by entering the relevant details in the appropriate sections.

What is the purpose of tc 62m schedule j?

The purpose of TC 62M Schedule J is to provide a comprehensive report of certain income items for tax purposes. It helps the tax authorities determine the tax liability of individuals or businesses.

What information must be reported on tc 62m schedule j?

TC 62M Schedule J requires you to report detailed information about specific income items, such as the type of income, amount received, and any applicable deductions or exemptions.

Fill out your tc 62m schedule j online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tc 62m Schedule J is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.