Get the free INDIRECT TAXES

Show details

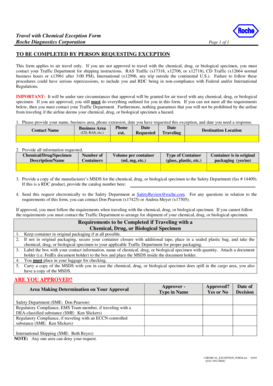

This document outlines an examination focused on indirect taxes, particularly customs, service tax, central excise, and VAT regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign indirect taxes

Edit your indirect taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indirect taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indirect taxes online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit indirect taxes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out indirect taxes

How to fill out INDIRECT TAXES

01

Gather all relevant financial documents and records.

02

Determine the types of indirect taxes applicable to your business (e.g., VAT, GST, sales tax).

03

Calculate the total sales and any applicable taxes for the reporting period.

04

Complete the indirect tax return form provided by the tax authority.

05

Report total sales, tax collected, and any tax exemptions accurately.

06

Review the form for any errors and ensure all information is complete.

07

Submit the completed form by the deadline through the designated method (online or via mail).

08

Keep a copy of the submitted form and all supporting documents for your records.

Who needs INDIRECT TAXES?

01

Businesses that sell goods or services and are required to collect indirect taxes.

02

Entrepreneurs operating in sectors where indirect taxes apply.

03

Companies engaging in international trade with transactions subject to indirect taxes.

04

Individuals making significant purchases subject to indirect taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an indirect tax?

Unlike direct taxes, indirect taxes are levied on goods and services, not individual payers, and collected by the retailer or manufacturer. Sales and Value-Added Taxes (VATs) are two examples of indirect taxes.

Why do some economists criticize indirect taxes?

For consumers, an indirect tax increases the price of the taxed good, which may reduce its affordability and consumption. This could be seen as a negative effect for consumers, as they may have to pay more for the good or switch to alternative products.

What's the difference between direct and indirect?

Direct income is the revenue earn from the sale of goods or services, while indirect income is the revenue earn from non-operating activities, such as interest income, rental income, or gains from the sale of fixed assets.

What is that indirect tax?

An indirect tax is a tax passed off by the government on goods and services. It is collected by the manufacturers or sellers of goods and services from the consumer when they purchase an item or service and then paid to the government. They are often already embedded in the prices of goods and services.

What is the difference between direct and indirect taxes?

Taxes can be either direct or indirect. A direct tax is one that the taxpayer pays directly to the government. These taxes cannot be shifted to any other person or group. An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it.

What is an example of an indirect tax?

Unlike direct taxes, indirect taxes are levied on goods and services, not individual payers, and collected by the retailer or manufacturer. Sales and Value-Added Taxes (VATs) are two examples of indirect taxes.

What's the difference between direct tax and indirect tax?

Taxes can be either direct or indirect. A direct tax is one that the taxpayer pays directly to the government. These taxes cannot be shifted to any other person or group. An indirect tax is one that can be passed on-or shifted-to another person or group by the person or business that owes it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INDIRECT TAXES?

Indirect taxes are taxes that are not directly levied on income but are instead imposed on goods and services. The burden of the tax is passed on to the end consumer in the price of the product.

Who is required to file INDIRECT TAXES?

Entities or individuals that engage in the sale of goods and services subject to indirect tax, such as sales tax or value-added tax (VAT), are typically required to file indirect taxes.

How to fill out INDIRECT TAXES?

To fill out indirect taxes, businesses must gather information on taxable sales, tax collected, tax-exempt sales, and total gross revenue. They then use provided government forms to report this information, ensuring compliance with local regulations.

What is the purpose of INDIRECT TAXES?

The purpose of indirect taxes is to generate revenue for government expenditure and services, regulate consumption, and redistribute wealth effectively within the economy.

What information must be reported on INDIRECT TAXES?

When reporting indirect taxes, entities must provide details such as total sales, taxable and non-taxable sales, the amount of tax collected, exemptions, and tax returns filed for specific periods.

Fill out your indirect taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Indirect Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.