Get the free Application for Credit Account - CNZ Office Supply

Show details

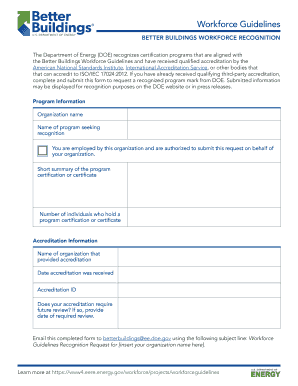

P O Box 259 225 Botany AUCKLAND pH (09) 265 0995 Fax (09)265 0997 Application for Credit Account Nature of Organization: Sole Trader Partnership Limited Company Trust Other Trade Name: Legal Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit account

Edit your application for credit account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for credit account online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for credit account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit account

Point by point instructions on how to fill out an application for a credit account and who needs it:

How to fill out application for credit account:

01

Start by obtaining an application form from the financial institution or creditor offering the credit account. This form can typically be found on their website, at their physical branch, or you can request it to be sent to you.

02

Read and understand the instructions provided with the application form. Pay close attention to any specific requirements or documents that need to be submitted along with the application.

03

Begin filling out the personal information section of the application. This usually includes your full name, contact details, social security number, date of birth, and current address. Make sure to double-check the accuracy of the information before moving forward.

04

Provide your employment information, including your current job title, name of the employer, duration of employment, and monthly or annual income. If you are self-employed, you may need to provide additional documentation such as tax returns or business registration details.

05

Declare any additional sources of income, if applicable. This can include rental income, investments, or any other form of regular income that contributes to your financial situation.

06

Fill in your financial information, including your bank account details, other credit accounts you currently hold, and any outstanding loans or debts you may have. Some applications may also inquire about your monthly expenses to assess your ability to make payments on the credit account.

07

Review the application form thoroughly to ensure all fields are completed accurately and no missing information or errors are present. Providing incomplete or incorrect information may delay the processing of your application.

08

If required, attach any supporting documents that are specified in the application instructions. This may include copies of identification documents, proof of income, or residency verification.

Who needs an application for a credit account:

01

Individuals who are looking to establish a line of credit with a financial institution or creditor.

02

Those who want the convenience of making purchases on credit and paying them off over time rather than in one lump sum.

03

People who are interested in building or improving their credit history by responsibly using credit.

By following these step-by-step instructions, you can successfully complete an application for a credit account and determine if you meet the criteria set by the financial institution or creditor offering the account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is application for credit account?

An application for credit account is a form that individuals or businesses complete to apply for a credit account with a financial institution or credit provider.

Who is required to file application for credit account?

Any individual or business that wishes to obtain a credit account with a financial institution or credit provider is required to file an application for a credit account.

How to fill out application for credit account?

To fill out an application for a credit account, you will need to provide personal or business information, such as your name, contact details, financial history, business details (if applicable), and any other information required by the financial institution or credit provider.

What is the purpose of application for credit account?

The purpose of an application for a credit account is to initiate the process of obtaining a credit account with a financial institution or credit provider. It allows the institution or provider to assess the creditworthiness of the applicant.

What information must be reported on application for credit account?

The information required on an application for a credit account may vary depending on the financial institution or credit provider. However, commonly requested information includes personal or business details, financial history, income, expenses, and any outstanding debts or liabilities.

How can I send application for credit account to be eSigned by others?

Once your application for credit account is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I edit application for credit account on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share application for credit account from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out application for credit account on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your application for credit account, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your application for credit account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.